Which exchange has best volume robot in bear market

"How much is the flow of centralized exchanges true? How much is robotic trading? Is there price manipulation? Whether to provide convenient speculation for external hot money... These allegations have always existed, but there is no public evidence to confirm or deny them.

There are many internal problems in the exchange. It has been an open secret in the digital money market that the stock exchanges combined with bankers crashed.

In order to create the illusion of user influx, robots hanging up sales orders and brushing data back and forth have become a common tactic in many exchanges. It seems that the volume of transactions is so large, in fact, a large part of them are false transactions, not transactions of real users. The more rubbish the currency, the greater the proportion of data brushing.

"How much is the flow of centralized exchanges true? How much is robotic trading? Is there price manipulation? Whether to provide convenient speculation for external hot money... These allegations have always existed, but there is no public evidence to confirm or deny them.

TThere are many internal problems in the exchange. It has been an open secret in the digital money market that the stock exchanges combined with bankers crashed.

In order to create the illusion of user influx, robots hanging up sales orders and brushing data back and forth have become a common tactic in many exchanges. It seems that the volume of transactions is so large, in fact, a large part of them are false transactions, not transactions of real users. The more rubbish the currency, the greater the proportion of data brushing.

There are always such posts in the forums: "Now it's all exchange robots trading data. It's too pitfalls." When you want to ship large quantities of goods, you find that you can't make a deal. The purchase price is always a little lower than your sales order.

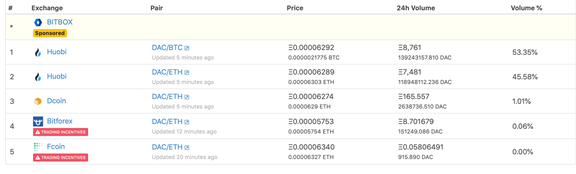

Let's look at a set of diagrams. Take DAC/ETH as an example. The currency is currently on four exchanges, including Fcoin, Huobi, Dcoin and Bitforex.

Among them, Huobi account for the largest share, reaching nearly 99%. Screenshots of a 15-minute chart of the market data, the rise is quite stable, can be said to be the textbook version of the "horizontal plate oscillation", this wave of operation is very disturbing.

Look at Dcoin(www.dcoin.com), which accounts for 1.01% of the stock exchange. According to the data, it is a new Swiss exchange. It was founded in 2018. Although it did not report much hope, the result is very encouraging. It intercepted some of the trading quotations. Comparing with Huobi, the trend is still very real. Pass! uuuuuuuuu A small safflower is to be rewarded.

The remaining two exchanges account for a lower proportion, and Fcoin accounts for 0% of the total, so don't bother to take a look at Bitforex! Lets witness the wonderful... Moment. Emmmm, this robot is afraid of rusting.

There are a lot of users in the exchanges. The larger the turnover of the exchanges, the more new users come to them. Everyone wants a share. A bull market stirred up thousands of waves, countless small exchanges one after another, no data? Make it! No users? Make it! No project? Grab it! Pigs can fly at draught. In a twinkling of an eye, the cold winter came and fled. The rest was waiting for a fire to burn in the winter before spring: the robot hired itself and the volunteer hooked.

According to data from CoinMarketCap on April 12, OKEx, Binance and Huobi ranked second, third and fourth in the 24-hour Bitcoin trading volume on the global exchanges. As China's top three digital currency exchanges in 2017. After the ICO ban was promulgated by the government on September 4, 2017, they either went to sea or transformed. In the digital money world, exchanges are the largest centre. Centralized exchanges are facing more transformation and standardization. To truly carry forward the spirit of block chain, the currency circle has a long way to go.