Bitcoin Blows Through $4000 As Asian Demand Soars

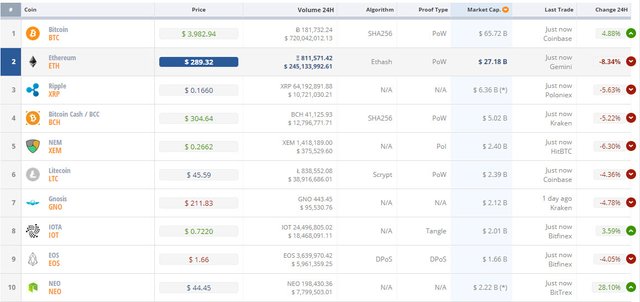

While many of the largest cryptocurrencies are fading modestly this morning, Bitcoin is holding on to dramatic gains which saw the largest virtual currency spike to as high as $4190 as Yen, Yuan, and Won trading activity dominated volumes.

Bitcoin Cash remains in 4th place overall by market cap but Bitcoin is the only currency higher among the top 5 this morning.

Soaring past $4000...

As CoinTelegraph reports, the trading of Bitcoin in Japanese yen has accounted for almost 46 percent of total trade volume worldwide. The trading of Bitcoin in US dollar accounted for around 25 percent, while the trading of Bitcoin in South Korean won and Chinese yuan accounted for approximately 12 percent each.

Additionally, anticipated demand is being priced in after VanEck filed for an 'active strategy' Bitcoin ETF:

The Fund seeks to achieve its investment objective by investing, under normal circumstances, in U.S. exchange-traded bitcoin-linked derivative instruments ("Bitcoin Instruments") and pooled investment vehicles and exchange-traded products that provide exposure to bitcoin (together with Bitcoin Instruments, "Bitcoin Investments").

The Fund is an actively managed exchange-traded fund ("ETF") and should not be confused with one that is designed to track the performance of a specified index.

The Fund's strategy seeks to provide total return by actively managing the Fund's investments in Bitcoin Investments.

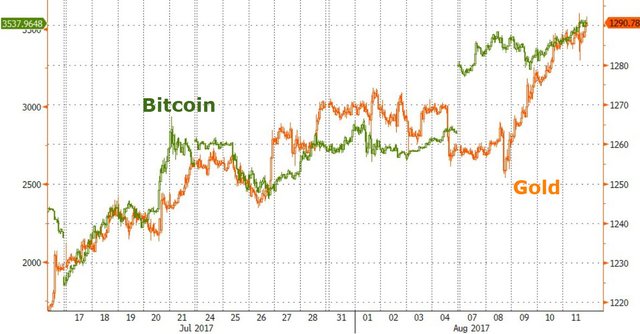

Bitcoin’s solid performance in early August reflected that of gold’s amidst the selloff in stocks and bonds around the world due to the growing apprehensions over North Korea’s nuclear threat.

And the latest moves this weekend in the crypto world suggest gold will open well north of $1300 tonight.

Source : http://www.zerohedge.com/news/2017-08-13/bitcoin-blows-through-4000-asian-demand-soars

Disclaimer : This is not the real Tyler Durden! I read ZeroHedge every day to find the one or two best articles and reformat them for Steemit. I appreciate the upvotes but consider following the account and resteeming the articles that you think deserve attention instead. Thank you! Head over to ZeroHedge.com for more news about cryptocurrency, politics and the economy.

Good article and when I saw the surge in BTC I attributed it to Asian demand, akin to when the Shanghai exchange first opened for metals. I was a more than a little surprised to see this as almost an exclusively BTC rally, leaving the alts in the dust, but I see what transpired. Asian monies almost exclusively poured into BTC and NEO.

Japanese exchanges don't charge trading fees, so there's no way to know if the volume is fake or not. This was also the case with the major Chinese exchanges until the PBoC forced them to charge fees.

I would say it's Korean investors that had a major role in the recent rally. Bithumb's BTC/KRW volume is 11.68 percent of global turnover.

Could BTC also start to show a gold-like "safe heaven" status regarding NK current threat?

Great share. I was wondering what was driving up the price so rapidly this weekend.

Bitcoin was predicted to hit $5k then $10k so it's on track.

I think that there will be a healthy correction before it goes up further.

I beleive so too.

GOOD POST KEEP HE GOOD WORK

for me the major reason who push bitcoin to reach all time new high price is the fear from a 3 world war

Bitcoin 핵심 개발 팀의 확장 솔루션 인 Segregated Witness (SegWit)의 잠금 기능에 의해 확립 된 상승 추세에 힘 입어 비트 코인 (bitcoin)이 4,168 달러라는 새로운 사상 최고가를 달성했습니다.

8 월 초, BIP (Bitcoin Improvement Proposal) 141의 잠금 기능을 통해 SegWit의 활성화가 본질적으로 마무리되었습니다. 그 결과 SegWit의 활성화 기간이 초기화되었으며 다양한 데이터 분석 플랫폼에 따라 SegWit이 onAugust22를 활성화 할 것으로 예상됩니다 .

Goldman Sachs와 JP Morgan과 같은 기관 투자자들의 요구가 증가함에 따라 SegWit에 의해 결정된 비트 코인 가격의 상승세가 이어졌습니다. 금주 초 미국의 904 억 달러 투자 은행 재벌 인 Goldman Sachs는 투자자, 고객 및 포트폴리오 담당자를 격려했습니다. bitcoin에 대한 시장의 신뢰를 고려하여 bitcoin 및 cryptocurrencies에 대한 투자를 고려하십시오

great thanks for the post

Thanks for sharing

Hoping Ethereum is on it's way to an all time high as well.