Bitcoin Soars As Much-Feared Network Split Appears To Be Avoided

Bitcoin and other virtual currencies have rallied this week as growing support for a controversial software update suggests that a long-feared network split might be averted, and the issue settled…at least for now.

“Traders are excited by the prospect of a resolution to the scaling debate, which is why the price has rallied,” Thomas Glucksmann, head of marketing at Hong Kong-based bitcoin exchange Gatecoin, told Bloomberg.

Indeed, bitcoin is up 10% in early trade Tuesday, building on Monday's 20% climb:

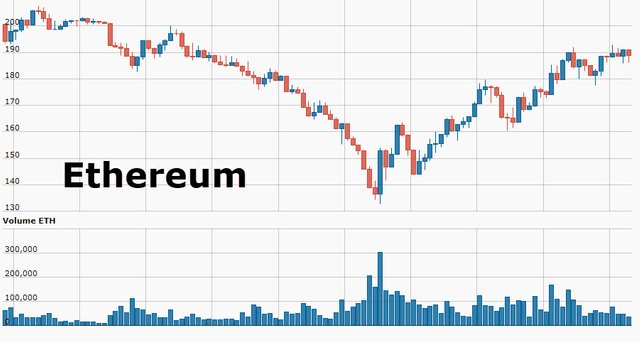

And Ethereum is surging...

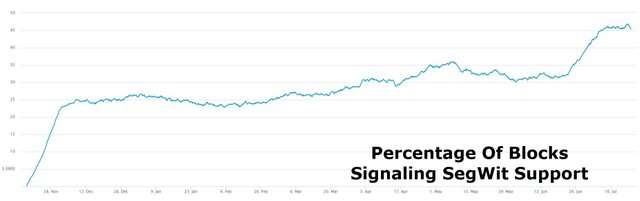

The reason? Bitcoin miners weren't expected to start signaling for Segwit2x until July 21, but some are already moving to show support in advance of another round of software testing, according to CoinDesk. Support topped 45% of hashing power on Tuesday, including AntPool, BitClub, Bixin, BTC.com and BitFury.

However, many professional bitcoin traders believe more pain lies ahead, especially if support for SegWit2x doesn’t move toward the key threshold of 80% adoption – an accomplishment that would avert a network split – as we draw nearer to the Aug. 1 deadline, according to Bloomberg. The only way for bitcoin to avoid a network split is for SegWit support to reach this threshold by or on Aug. 1.

“Despite the progress with SegWit2x, some warned that bitcoin isn’t out of the woods yet. Many Core members still vehemently oppose the software, which they say hasn’t been properly vetted for bugs. Also, not all miners support SegWit2x, which they say is a flawed compromise that doesn’t solve the root scaling problem.

‘This price rally is a bounce, we are very bearish in the near term for a number of reasons,’ said Harry Yeh, managing partner at digital currency dealer Binary Financial, who cites the lack of support from Core developers as one of his biggest worries. ‘Anytime the price rockets up quickly, it will be followed by a strong correction which we are starting to see. We are definitely headed for some turbulent and volatile times in the short term.’”

One trader put it more bluntly: "Shit's getting real, no one is sure what happens after August 1st, so traders are taking profits, squaring positions into the scaling deadline." As Bloomberg explains, the scaling debate began more than two years ago, and has persisted despite several “make or break” deadlines as none of the constantly evolving scaling solutions have garnered a large enough share of support from the mining community to legitimately threaten a network split.

“Bitcoin’s community has been at bitter odds for more than two years about how to solve its scaling problem, which has hampered the cryptocurrency’s growth and allowed rivals like ethereum to steal some of the spotlight. The new software, known as SegWit2x, is seen as a compromise for the two sides of the debate: miners who act as the backbone of the blockchain, and developers known as Core who uphold bitcoin’s bug-free software. While both sides have incentives to reach a consensus, bitcoin’s lack of central authority has made reaching agreement difficult.”

Worries about a network split have even started to rattle national regulators and trade groups. After holding discussions over the possible currency split, the Japan Cryptocurrency Business Association says member exchanges will suspend trading of bitcoin beginning Aug. 1, according to a Bloomberg headline.

A growing number of central banks have warned citizens about the inherent riskiness of investing in unregulated markets like bitcoin and its peers, with the Central Bank of Albania the latest to denounce the cryptocurrency market.

“We appeal to the Albanian public to be mature and responsible in the administration of savings or liquidity they possess. One should orient investments toward financial products and instruments offered by institutions licensed and supervised by the Bank of Albania and the Financial Supervisory Authority.”

Of course, there is an obvious solution here, though it may not be as easy to implement as it sounds: Global regulators could, working with the BIS or some other transnational institution, develop a global regulatory framework, assuaging some of the concerns raised by the SEC in its decisions to reject two proposed bitcoin ETFs. Such a framework might open the door to more officially sanctioned investment products, opening the door to investors who’d like to include bitcoin exposure in their retirement accounts.

Source : http://www.zerohedge.com/news/2017-07-18/bitcoin-rallies-much-feared-network-split-appears-be-avoided

---

Disclaimer : This is not the real Tyler Durden! I read ZeroHedge every day to find the one or two best articles and reformat them for Steemit. I appreciate the upvotes but consider following the account and resteeming the articles that you think deserve attention instead. Thank you!

Head over to ZeroHedge.com for more news about cryptocurrency, politics and the economy.

I read this post earlier today and it seems the reason for the bounce today is the same as the reason for the decline, it just depends on which narrative you want to put stock into. There's simply too much to lose for the miners to not go along segwit2. I think/hope we'll see over 80% adoption before we get to the end of July.

thanks, great post!

Yes the smoke is getting cleared up now and crytocurrencies are on the rise, the charts are looking good again ,, thanks for sharing , this was very helpful

Network split 100% happening on Aug 1. BitcoinCash will fork off using Bitcoin-ABC client and will most likely take majority hashpower with it, making segwit DOA.

https://steemit.com/bitcoin/@ancap47/bitcoin-hf-coin-already-has-started-trading-against-cny-on-viabtc-exchange

https://vote.bitcoin.com/arguments/the-bitcoin-abc-client-and-big-block-fork-bitcoincash-is-a-better-roadmap-than-both-segwit-and-segwit2x

Yep, just hope this trend pull on through to the weekend! I think if it can hold through the weekend we will see great things in the near future.

I think there's a lot more volitity ahead. This is far from over, IMO.

Hope u got some at a discount!

@zer0hedge

Beautiful writeup!Thanks for sharing.

It's from ZeroHedge.com

Wow

I appreciate the Disclaimer, I was wondering. Actually I find this more helpful since you have weeded through the content to pick out interesting stuff. How will we know when it is you writing?