VITAL QUESTIONS ABOUT BITCOINS THAT U WERE TOO EMBARRASSED TO ASK{All answered with lots of life changing tips} For all Hardcore Bitcoins /Crypto Lovers/Investores.

Very vital questions about Bitcoin you were too embarrassed to ask…Don’t worry I got your back..

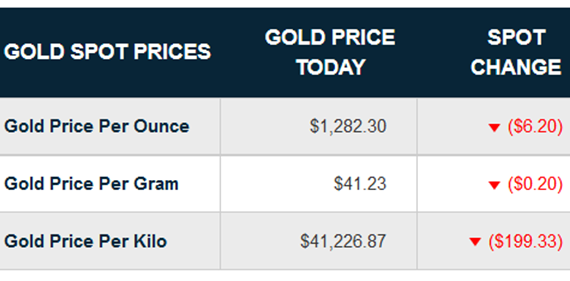

Today, as of now - bitcoin average price at the time of this writing is btc = $4280 is still climbing every minute and Gold is at $1,282.30

credit

Bitcoin price has risen over gold a few times in the past, but now it has gained significant momentum which doesn't seem to be subsiding. And still moving up much more ,

It has shown the quality of being a new class of safe-haven asset.

Tracking price through various leads, it shows a number of transactions growing more than 12-fold in most, if not all, countries with currency problems.

• In Greece - during monetary emergencies - bitcoin price rose significantly

• In Venezuela - the price on the exchange "Local Bitcoins" rose significantly as locals trade with each other in person. Underground networks of Bitcoin mining was the only way some families are able to survive by trading and buying food through amazon.com and having it shipped back to them. Some of these mines were recently discovered and shut down by their military.

• India - the transaction count rose about 10 fold the week that India announced discontinued honoring their highest denomination notes. The price premium also rose over 25%.

• China showed the same percent and portion of rising even though they've worked to reduce corruption in some of the bitcoin exchanges.

• Argentina - the travel industry has made way to accept bitcoin in an effort to attract foreigners to vacation and bitcoin money changers thrive.

• When a country announces restrictions or attempted bans, the trading activities actually increase.

• During the Brexit announcement - the price spiked.

• During the first hours of Trumps announced win - Bitcoin price spiked. It has proven to be a prized uncorrelated asset.

Looking at the above outcomes - is a good trend indicator for use of common people as some locations do not have exchanges so all business must be conducted face-to-face (or phone-to-phone as the case may be).

It seems that Every time there has been a short-term panic in the bitcoin ecology it's not long before the price rebounds as more people realize the utility and benefits of bitcoin continue to outshine the panics and a rush of confident people who understand the technology at a deeper level greedily buy the dips.

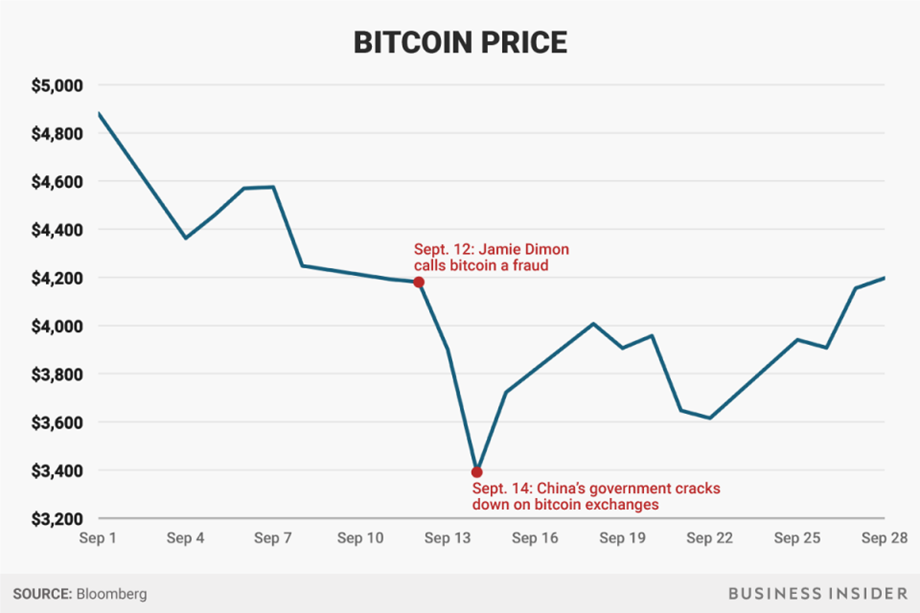

Bitcoin has been pronounced dead more than 127 times as of today not forgetting the jp Morgan chief (Jamie DimonGetty even though he went and bought a DIP after that deceiving statement, China too did their part to discredit bitcoins but in the end what happened?? Bitcoin's price has fully recovered from its recent slump after JPMorgan CEO Jamie Dimon called it a fraud and Chinese regulators cracked down on exchanges.

The cryptocurrency had a drawdown of up to 14% in the 10 days after September 12, when Dimon compared it to the tulip bubble of the 1600s and vowed to fire traders who used it.

Also that week, BTCChina, a major exchange, announced that it would stop all trading on September 30, as regulators moved to contain potential financial risks.

By Thursday, bitcoin had all of the losses. It was up nearly 2% from the lows on the day Dimon spoke, at $4157.31 per coin at 10:28 a.m. ET.

The move illustrates bitcoin's wild volatility; it's gained 331% this year, unheard of for any major currency and most financial assets. It also shows why many Wall Street professionals like Dimon don't see it as a legitimate store of value but as a speculative instrument.

yet it's still alive and looking healthier than ever.

Bitcoin is the Uber of cryptocurrencies: the biggest, baddest and best-known, but not the only one. Add it up to Litecoin, steem,Monero,ethereum and all the others, and the total volume of virtual money floating around the internet, out of the reach of governments and banks, is a whopping $100 billion. That is about as much as the current GDP of Morocco – the 60th-largest economy in the world.

In 2011 - bitcoin was ignored, even though it was the highest performing asset in any class

In 2012 bitcoin was ignored. Even though the price was the highest performing asset in any class

In 2013 bitcoin was laughed at and called a beanie baby and tulip bulb as it was the best performing asset class again.

2014 - it retraced from the massive bubble peak in 2013 of over 8,400%- and it was pronounced dead and fought and laughed at by "I Told You So"

2015 - It was the best performing currency against the USD raising again over 35% and being one of the best asset classes of everything.

2016 - bitcoin again was the best investment of any asset class - and many started to take it seriously

2017 - bitcoin bobs and weaves - fights off bad news, and raises above gold price several times by April. Yet is still owned by a tiny fraction of common people outside of countries experience hyperinflation or government crisis where it is seen as easier to obtain than gold being able to receive it from family and friends around the world at a moment notice.

In just seven years it grew from literally nothing and has been the best performing asset in six out of the last seven years. This resembles paradigm changes of historical proportions throughout history as the type of change Gandi's wisdom through times of revolution.

First, they ignore you.

Then they laugh at you.

Then they fight you.

Then you win.

Why is this? Victor Hugo answers. "Armies cannot stop an idea whose time has come."

Are you still ignoring or laughing?

Most people are amazed by this and they all have been scratching their heads, Shouting and asking each other What's Bitcoin? How do you use it? And why would anyone want to? Read on for answers and directions please

1. What's Bitcoin?

Bitcoin is an online financial network that people use to send payments from one person to another. In many ways, Bitcoin is similar to conventional payment networks like Visa credit cards or Paypal. But Bitcoin is different and far better than those and other payment networks in many important ways.

First, Bitcoin is decentralized. For-profit companies own the Visa and Paypal networks and manage them for the benefit of their respective shareholders. No one owns or controls the Bitcoin network. It has a peer-to-peer structure, with hundreds of computers all over the Internet working together to process Bitcoin transactions.

Bitcoin's decentralized architecture means that it is the world's first completely open financial network {Can you beat that ?}. To create a new financial service in the conventional U.S. banking system, you need to partner with an existing bank and comply with a variety of complex rules. The Bitcoin network has no such restrictions. People don't need anyone's permission or assistance to create new Bitcoin-based financial services.

The second thing that makes the Bitcoin unique is that it comes with its own currency. Paypal and Visa conduct transactions in conventional currencies such as the U.S. dollars which are mush leaser in strength ,value and what have you. The Bitcoin network, however, conducts transactions in a new monetary unit, also called Bitcoin.

2. That seems really weird! And sounds very strange !! Why would anyone use a payment network based on an imaginary currency?

It is weird. Almost everyone who encounters the idea for the first time (including me) has the same reaction: That can't possibly work. But so far the market has proved the skeptics wrong:

The graph above shows that Bitcoin's price has fully recovered from its recent slump after JPMorgan CEO Jamie Dimon called it a fraud and Chinese regulators cracked down on exchanges.

The cryptocurrency had a drawdown of up to 14% in the 10 days after September 12, when Dimon compared it to the tulip bubble of the 1600s and vowed to fire traders who used it.

Also that week, BTCChina, a major exchange, announced that it would stop all trading on September 30, as regulators moved to contain potential financial risks.

By Thursday, bitcoin had all of the losses. It was up nearly 2% from the lows on the day Dimon spoke, at $4157.31 per coin at 10:28 a.m. ET.

The move illustrates bitcoin's wild volatility; it's gained 331% this year, unheard of for any major currency and most financial assets. It also shows why many Wall Street professionals like Dimon don't see it as a legitimate store of value but as a speculative instrument, But still bitcoin is still as strong as ever.

credit

the price of one Bitcoin since the start of 2011, when the currency began to adopt mainstream attention. The price has been extraordinarily volatile --But there's also been an unmistakable upward trend. Notice in the chart ,It shows the currency's value rising from around $1 at the start of 2011 to above $4000 today and still climbing very high . There are about 12,446,725 bitcoins in existence, so the Bitcoin "money supply" is now worth above $41 billion.

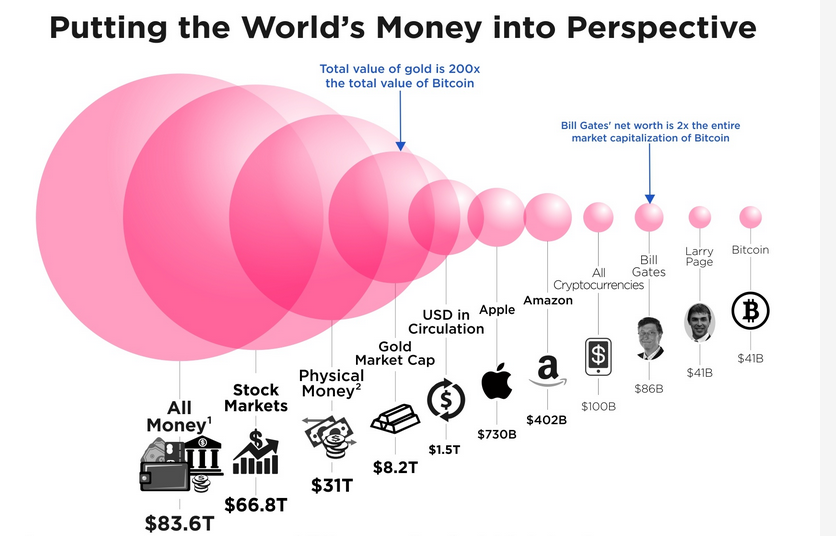

As you see on this head-spinning graph below, the total amount of money in the world is $84 trillion. But that includes money in the bank. In physical coins and notes, the total global money supply is only $31 trillion. See the problem? Hence the rise of Bitcoin and other cryptocurrencies. Bitcoin is the cryptocurrency that refuses to die. Its demise has been predicted numerous times, and one expert calculated that its value is eighteen times more volatile than the U.S. dollar. Yet the virtual money keeps going from strength to strength.

Bitcoin has captured the imagination of venture capitalists. A startup called Bitpay,

credit

An Atlanta-based bitcoin merchant processor BitPay has officially raised $30m in Series A funding in the largest-ever financing round for a bitcoin company.

The round was led by Index Ventures, and included Yahoo founder Jerry Yang's AME Cloud Ventures, Felicis Ventures, PayPal founder Peter Thiel's Founders Fund, Horizons Ventures, RRE Ventures, Virgin Galactic's Sir Richard Branson and TTV Capital.

As part of the deal, Index Ventures' Jan Hammer and noted bitcoin ecosystem investor Jimmy Furland will join BitPay’s Board of Directors.. Coinbase, a startup that helps consumers buy and sell bitcoins, has raised more than $5 million. And last month, a Bitcoin startup called Circle raised more than $9 million. Not forgetting Blockchain, a bitcoin wallet start-up, has raised more than $40 million led by venture capital firm Lakestar, Google's investment arm GV, and billionaire Richard Branson, the company said on Thursday.

The investment comes at a time of rising interest in cryptocurrencies, especially bitcoin, which recently hit a record high and has seen a massive rally since the start of the year.

Blockchain has created a bitcoin wallet which is essentially a piece of software to store the digital currency and carry out transactions with other users.

The money will be used to expand the team further and invest in more research and development, Blockchain CEO Peter Smith, told CNBC on Thursday. In addition, the start-up is looking to open new offices in different countries to expand.

credit

Bloomberg | Getty Images

Peter Smith, chief executive officer of Blockchain Ltd.

Smith said that the recent rally in bitcoin has caused high demand for Blockchain's wallet product, and the funding will help to meet that.

"We are really focused on scaling to meet the record demand we are getting in the market," Smithsaid at an interview.

3. This just sounds like a bubble. Do people use the currency for anything besides speculation?

I just mentioned Bitpay. It provides a good sign of Bitcoin's growing popularity for "real" transactions.

Bitpay works with a wide variety of merchants. Some sell online services like Web hosting or virtual private networks. Others sell jewelry and electronics. There are even restaurants and cupcake shops that sell their wares for bitcoins.

And yes, Bitcoin has significant illicit uses. Programs like Satoshi Dice allow people to gamble online. Until recently, a Web site called Silk Road helped dealers sell millions of dollars of illicit drugs.

It's hardly unusual for new payment technologies to attract illicit use. Pornography was a big draw for both the first VCRs and the early consumer Internet. New payment technologies often attract criminals looking for new ways to move their funds without government scrutiny.

Another application for bitcoins that is expected to become more important in the future is international payments. Right now, wiring money internationally involves slow, expensive and inconvenient services like Western Union. Bitcoin is international, and its fees can be much lower than conventional wire transfer services. There's still work to be done to make such a system affordable and user-friendly. But it has the potential to disrupt the international payment industry.

for us to appreciate this blog more here is Price Chart - This

https://bitcoincharts.com/markets/chart displays the last trade price for bitcoin (BTC) against a number of currencies and

credit

ranks the exchanges by 30-day volume. Advanced charting capability is provided here. The price depth chart of BTC/USD on the MtGox exchange is usually the best indication of overall market price.

4. Who created Bitcoin?

No one knows for sure. The currency was created by a person who identified himself as "Satoshi Nakamoto." While the name sounds Japanese, Bitcoin's creator never provided any personal details. He collaborated with other early Bitcoin fans through online forums but never met with other members of the Bitcoin community face to face. Then, starting in 2010 he gradually reduced his involvement in the currency's development. His last known communication came in 2011.

We don't know who Satoshi Nakamoto is, but we do know that if he ever surfaces, he will be an extremely wealthy man. Millions of bitcoins were created in the currency's first two years, and Satoshi likely owns hundreds of thousands of them. At today's prices, he would be a millionaire many times over.

Before leaving the scene, Nakamoto passed his torch to a mild-mannered developer named Gavin Andressen, who is currently the project's lead developer. Andressen now works under the auspices of the Bitcoin Foundation, the closest thing the anarchic Bitcoin community has to an official public face.

5. Where do bitcoins come from?

In a conventional financial system, new money is created by a central bank, such as the Federal Reserve. But the Bitcoin network doesn't have a central bank. So the system needed an alternative mechanism for introducing currency into circulation.

Bitcoin's designer solved this problem in a clever way. As I said above, hundreds of computers scattered around the Internet work together to process Bitcoin transactions. These computers are called "miners," and Bitcoin's transaction-clearing process is called "mining." It's called that because every 10 minutes, on average, a Bitcoin miner wins a computational race and gets a prize, These prizes provide a strong incentive for more people to join in Bitcoin's transaction-clearing process, helping the currency to remain decentralized.

This reward declines on a fixed schedule: Every four years the reward falls by half. So, from 2009 to 2012, it was 50 BTC, now it's 25 BTC, and so forth. If you do the math, you'll find that there will never be more than 21 million bitcoins in circulation. Right now, there are almost 12plus million bitcoins in circulation, so the Bitcoin money supply will never be more than twice its current size.

6. Isn't that a huge problem? I learned in economics class that deflation can cause economic problems.

It's true that deflation has traditionally been associated with economic problems, but there's little reason to think this will be a problem for Bitcoin. That's because deflation is only a problem if it is what economists call a "unit of account" for a nation's economic system.

Right now in the United States, salaries, mortgage payments, rents and other long-term financial commitments are priced in U.S. dollars. As a result, if the value of the dollar rises unexpectedly, these "sticky prices" can cause severe economic distortions. Unable to cut wages, employers have trouble making payrolls. Unable to renegotiate their debts, homeowners have trouble making their mortgage payments. Tenants get stuck with rents they can't afford. The result is a recession.

Hardly anyone uses Bitcoin as a unit of account. You'd be insane to sign a contract promising to repay a loan of 100 BTC in 10 years or to take a job where your salary was priced in bitcoins. Even the Bitcoin Foundation, which pays its employees in bitcoins, still sets its employees' salaries in dollars, converting employees' dollar-based salaries into the corresponding number of bitcoins on each payday. As a result, fluctuations in the value of bitcoins don't cause the kinds of economic disruptions that fluctuations in the value of traditional currencies do.

7. How do I get bitcoins?

One option is to mine them yourself, but that's not a good choice for beginners. For everyone else, your best bet is to purchase them with a conventional currency. Web sites known as exchanges will let you trade bitcoins for conventional currencies with other users. Even more convenient are companies like Coinbase, which will withdraw cash from your bank account and convert it to bitcoins at the current exchange rate. A few Bitcoin ATMs are popping up, which will directly trade paper money for Bitcoins. Here's a video of someone using a Bitcoin ATM in Vancouver:

credit

And if you like you can bus me for real genuine platforms where you can grow and earn your bitcoins with peace of mind

Let me show you my dash board in on those lovely platforms.

8. Okay, I bought some Bitcoins. Now what?

Next you'll need a place to store them. Bitcoins are stored in "wallets," which in this case are just files that contain encryption keys, or secret codes that allow you to transfer your bitcoins to other people. There are several options. One is to store them yourself using one of the Bitcoin programs available for Mac, PC and Android.

Another option is to entrust them to a third-party Web site known as a "online wallet."

A third option is what's known as a "paper wallet," where you print out your encryption keys and store them in a safe place, such as a safe deposit box.

Each has risks. If you choose to store your bitcoins yourself, then you could lose them to a hacker, a hard drive crash or a lost mobile device. But if you choose to use a third party, you need to worry about that third party swindling you or becoming bankrupt. The Bitcoin market is largely unregulated, so there are few legal protections if you happen to choose the wrong online wallet service. Paper wallets avoid the pitfalls of other methods, but they're tricky to set up correctly, and of course you're out of luck if you lose the piece of paper.

In Conclusion:

If you getting ready to jump on the Bitcoin bandwagon?

If you feel like you don’t know how to get started,and you still need more assistance you’ve come to the right place...

Over the years, a handful of clever (or just lucky) investors has managed to make millions from the world’s first digital currency.

In fact, if you'd invested $100 in Bitcoin in 2010, your investment would be worth over $75 million today.

That sum has most people shaking their heads with regret or disbelief. But these gains actually happened. Thousands of people have built homes and lives on them and are still building and ranting many others out.

That said, many people are just now starting to ask questions about Bitcoin.

My team wants to help answer those questions. That’s why we put together the free report: “A Beginner's Guide to Bitcoin.”

This report shows you how to invest in Bitcoin the right platforms to head to with real proof of earnings ,apart from the dash board i placed in this blog, and it also provides you with invaluable research on how Bitcoin functions and what its role may look like in the future.

This information could help you make an informed decision about whether or not Bitcoin (or digital currency in general) is right for you.

In your free report, you receive:

The name of real platforms that pays for real with a very active link to roll with .

The history of Bitcoin.

An in-depth analysis of how Bitcoin functions in our global economy.

Access to further resources explaining digital currency investing.

As you may have noticed, the digital currency market is picking up speed. This means that if you want to start investing, now is a great time to start getting educated about it.

You can’t afford to wait. And you don’t want to miss this groundbreaking opportunity. This online report is in high demand, and digital copies are limited. Get yours and start investing today!

feel free to reach me through these channels....

For your Enquires contact

@chuxlouis

© Coindeskbitcoin

WhatsApp: +2348037188995

[email protected]

credit

Success Is Deliberate dear steemains

#MillionairesMindset

KINDLY

UPVOTE

RESTEEM

AND

COMMENT

Follow @chuxlouis

This post was resteemed by @steemitrobot!

Good Luck!

The @steemitrobot users are a small but growing community.

Check out the other resteemed posts in steemitrobot's feed.

Some of them are truly great. Please upvote this comment for helping me grow.

More blessings ..

Resteemed to over 4700 followers and 100% upvoted. Thank you for using my service!

Read here how the new bot from Berlin works.

@resteem.bot

this article is too good and helpful

I am happy it was helpful to u ,just followed u now,more blessings to u.

Thank you for the info. I hope to hop on the bitcoin wagon soon. Cheers

I am glad you liked it if u can just let me know when you are set so i show you the real deal ,more blessings to you @trixi88

That would be great thanks again. Cheers.

you are always welcome,i am right here waiting for your signal.

Congratulations @chuxlouis, this post is the tenth most rewarded post (based on pending payouts) in the last 12 hours written by a Newbie account holder (accounts that hold between 0.01 and 0.1 Mega Vests). The total number of posts by newbie account holders during this period was 1648 and the total pending payments to posts in this category was $1124.41. To see the full list of highest paid posts across all accounts categories, click here.

If you do not wish to receive these messages in future, please reply stop to this comment.

Wow thanx a lot @bitgeek...i Will try and do much better so I be first in ur list

This is great, u just have me answers to a few questions I had in my head

Thanx a lot boss,I glad it was of good use to you boss,resteem is allowed and thanx a lot for ur upvote sir .

@chuxlouis got you a $8.49 (4.0%) @minnowbooster upgoat, nice! (Image: pixabay.com)

Want a boost? Click here to read more about @minnowbooster!

The @OriginalWorks bot has determined this post by @chuxlouis to be original material and upvoted it!

To call @OriginalWorks, simply reply to any post with @originalworks or !originalworks in your message!

To enter this post into the daily RESTEEM contest, upvote this comment! The user with the most upvotes on their @OriginalWorks comment will win!

For more information, Click Here!

Special thanks to @reggaemuffin for being a supporter! Vote him as a witness to help make Steemit a better place!

Thanx a lot @ originalworks

This post recieved an upvote from minnowpond. If you would like to recieve upvotes from minnowpond on all your posts, simply FOLLOW @minnowpond

well written blog - i found you on #cof resteem and am now following and upvoting - rock on

Lovely @daydream4rock thanx a lot ,hope u will resteem just followed u now as do stay and always remain blessed more blessings .

This post was resteemed by @resteembot!

Good Luck!

Curious? Check out:

The @resteembot users are a small but growing community.

Check out the other resteemed posts in resteembot's feed.

Some of them are truly great.