Any exchange selling BCHABC as “BCH” is engaging in an extremely dangerous pump and dump fraud. Here is why.

A

Any Bitcoin fork is a ledger that is updated regularly as new blocks are mined. Each new block updates user balances and allows for transactions and trade. However, for a chain to keep extending in length and new blocks to be added, there must be miners willing to mine the chain. Without new blocks, the chain dies, transactions pile up in what is known as “mempool”, transferring coins becomes impossible, confidence in the chain collapses and the price of the coin heads to zero.

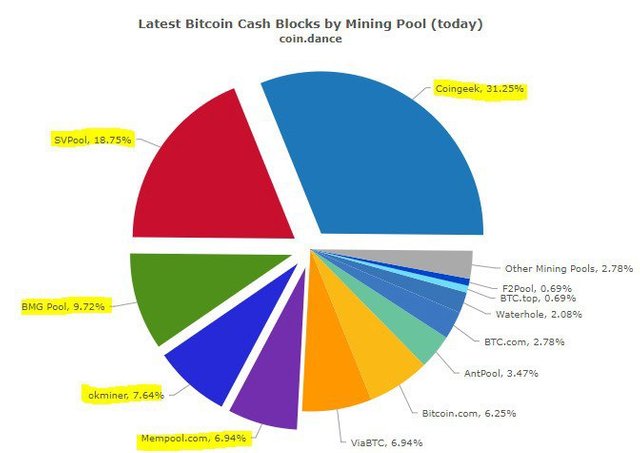

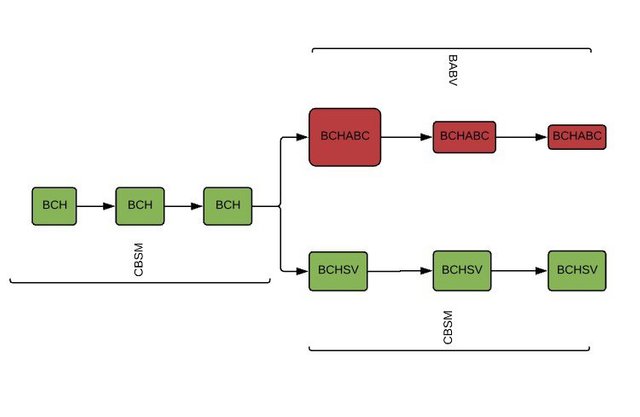

The 15th of November the Bitcoin Cash (BCH) ledger split into 2 forks following different consensus rules. 80% of miners that mined BCH up until the fork moved on to mine with SV consensus rules, this amounted to approximately 4000PH/s in hash. Surprisingly, another 5000PH/s of hash (previously not on BCH) landed on the other arm of the fork to mine with what is known as the ‘ABC’ ruleset.

The first hash war in the history of Bitcoin had just begun.

In the first 24h the ABC hash kept increasing and peaked at around 10000PH/s.

On one side we had pre-fork Bitcoin Cash committed miners that had been serving the entire BCH ecosystem up to the 14th of November. On the other hand, there was abundant fresh hash seemingly willing to switch to and extend the BCH ledger under the new ABC ruleset. While this would have been a positive event if caused by market forces, a deeper look at the source of the ABC hash shows that it is all but desirable.

It was almost 40% more profitable to mine BTC when pro-SV BCH miners were mining BCH.

There is a key distinction between miners mining with SV and the new miners that hopped on to mine with ABC. To understand we must differentiate committed miners, that have proven to mine a given chain even at times when mining other chains is more profitable, from pragmatic miners, who follow profit and switch from chain to chain depending on profitability.

The miners mining with SV since the start of the war are miners that have already proven in the months ahead of the war that that they are committed BCH miners. These are likely to be businesses heavily invested in BCH who profit not so much by selling the coins they mine but by building businesses on top of BCH that give them a competitive edge. No wonder then that among the committed BCH miners we find Coingeek (who owns a football team whose sponsor is «BCH» and is building resorts where all payments are in BCH), BMG (the mining operation of nChain, a Blockchain IP company whose patents are available for free on BCH), SVPool (a pool created for all retail miners that wish to support SV) and Mempool (another mining pool that openly committed to mining SV). We will refer to this group of committed BCH miners as CBSM.

On the other side we have hash that wasn’t mining BCH before the fork, which means that (without looking at it) this is either pragmatic hash that makes money by selling the ABC coins they mine, or hash rented by the people who wanted or believed in the ABC ruleset. However it became clear after the following announcement by Bitcoin.com that a lot of the hash that would mine BCHABC the day of the fork would be stolen hash from Bitcoin.com pool miners

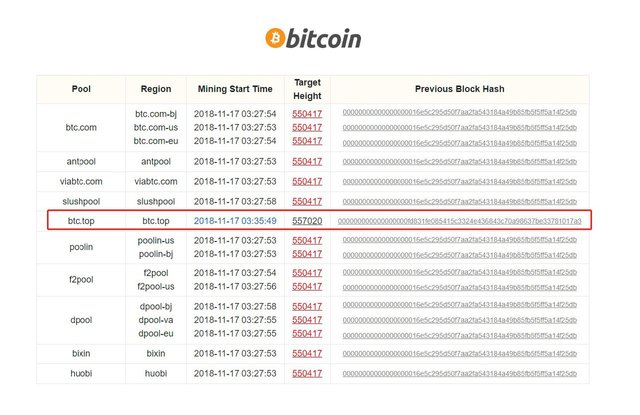

By digging more under the surface it turned out that other pools had also been stealing hash from their customers and pointing it to Bitcoin.com. This included BTC.TOP, Antpool and viaBTC.

We will refer to this hash as BABV. The main property of BABV is that it is extremely unstable hash that mines against the market.

Pool operators bring together miners from all over the globe that point their machines to the pool who provides software and guarantees to mine whatever is most profitable to maximise profit for its customers. BABV is hash coming from machines pointed to the above mentioned pools (Bitcoin.com, viaBTC, Antpool) which are supposed to be mining else, but have been pointed by pool operators to mine BCHABC to signal market strength/demand for BCHABC. However, this is not real demand, the machine owners never asked or consented to mine BCHABC. This is being done behind their back while they are paid as if machines are mining BTC, or whatever is most profitable.

Pointing these machine to mine BCHABC against the market is expensive for pool operators. If no real market demand emerges for BCHABC, the forced hash will go back to BTC and the BCHABC chain will stop progressing because there won’t be enough miners to mine new blocks.

The bottomline here is that BABV does not reflect neither short term nor long term market demand, it is neither committed nor pragmatic hash. It is forced hash.

The question tormenting exchanges these days is which one should get the BCH ticker, the BCHABC chain that is currently longer or the BCHSV chain that is supported by proven committed BCH hash? The right answer is wait it out.

The most reckless thing to do is give it to ABC.

By doing so you are automatically converting your customers’ investment in a stable and sustainable chain like BCH, which has at least 4000PH of committed hash, into a bet on a chain that has at best only around 800–1000PH/s of committed market hash (as proven by hash distribution ahead of the fork) and whose lead right now in terms of length with respect to BCHSV is due exclusively to forced hash. Assigning the ticker based on forced hash is an act of market manipulation, since the new ‘BCH’ holdings are not comparable to the pre-fork BCH holdings which had 3000–4000PH/s of committed hash. Assigning the BCH ticker to ABC is very likely to be followed by a removal of the forced hash, since its only function was to manipulate perception and steal the ticker. Once the forced hash is removed though, the hash support of what would be now referred to as “BCH” by the exchanges that assigned the BCH ticker to BCHABC, would suddenly collapse to 800–1000PH/s from 5000PH. Considering that ABC hash support was 800 when the BCH price was around $500 and that the current BCHABC price is less than $300, such plunge in hash would spiral out of control and lead to a full halt in what these exchanges have labelled as the“BCH” chain. The portfolios of people who held BCH before the fork would now be worth zero while the BCHSV chain keeps being mined.

This death spiral is the most likely scenario for ABC because it relies on BABV, which is extremely unstable hash that can disappear any time if the pool operators cannot afford anymore to subsidise it

So how does ABC save itself? The short answer is that BCHABC is doomed because the only way for BCHABC to be saved is for committed BCH miners (CBSM) to flip on ABC.

CBSM has made it clear that this is not going to happen.

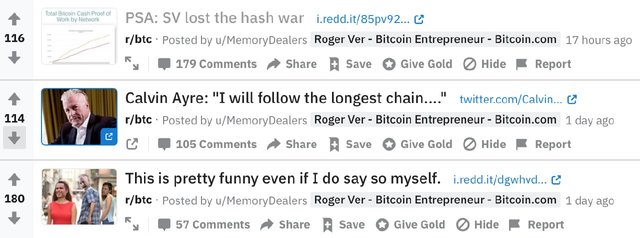

ABC sponsors like Roger Ver and Jihan Wu, on the other hand, have shown a lot of weakness by trying to claim victory after 48h into the war and by trying to exert social pressure on committed BCH miners to give up SV and to flip on ABC. What ABC sponsors desperately need at this point is some big miner willing to mine ABC so that they won’t have to subsidise it anymore. This makes Calvin Ayre, the biggest industrial miner in the cryptosphere, a perfect fit.

No surprise then that Roger Ver’s recent social media outings have been targeted at Ayre and have culminated with today’s video where Ver tells Ayre that they can subsidise BCHABC with 4000PH for a decade if necessary.

On other social fronts Roger Ver has been resorting to aggressive censorship in his own subreddit r/btc, where he refused to list “SV” in the sidebar and since the hash war started went so far as to ban people for posting SV price memes like this one. r/btc censorship has also been applied regularly since August 2018, when it first became clear that a hash war was inevitable. Anyone who sided or supported SV would start suffering personal attacks and would be included in what a user denounced as public enemy lists where everyone listed was declared to be a “paid shill” without any proof other than the fact that they supported SV. People close to Roger Ver such as the lead moderator of r/btc David Shares were caught working behind the scenes to discredit with personal attacks anyone who supported SV and going so far as attacking Ryan X Charles, creator of Yours and Money Button. In today’s video Ryan refutes David’s theory by disclosing that he received $1M from Bitmain and only $500k in funding from nChain for his startup Yours.

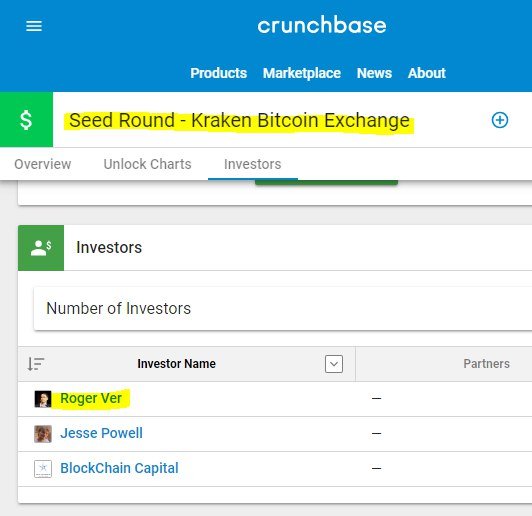

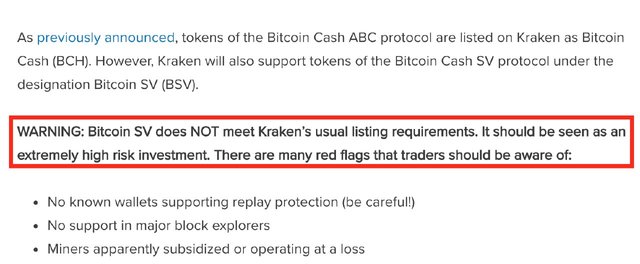

Another point where ABC sponsors have been trying to exert pressure are exchanges. Although BCHABC is the chain currently mined with forced hash, Kraken, an exchange that is known to be close to Roger Ver, today issued this alarming statement in an attempt to further manipulate market perception of the Bitcoin Cash fork.

Kraken has also been openly lobbying for ABC on social media where it has issued controversial tweets and even gone so far as to threaten BCHSV holders of losing funds in case the BCHABC chain is re-orged (something that happens when a chain dies).

The take home message, if you came so far, is to steer clear of exchanges that try to sell ABC as “BCH” as ABC is extremely unstable and not comparable to your BCH holdings. In fact all stable BCH miners are committed to mining BCH with the SV protocol and consider ABC an attack on BCH.

If you found this post informative please share it with others and subscribe to r/BitcoinCashSV, the new Bitcoin community created 3 days ago at the onset of the hashwar in response to the aggressive censorship in r/btc. Any mention of r/BitcoinCashSV in r/btc will get your comments automatically removed for “spam/scam/malware”.

Edit: r/btc mods have recently removed r/bitcoincashSV from automod (so comments with bitcoincashSV in them do not get automatically removed anymore).

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://archive.is/YULsd