RE: To Ponzi or Not To Ponzi ===>> A Look Into Bitconnect & the BCC coin

Good post, I "invested" a small amount into Bitconnect to see how it worked and even though I see it working as advertised there is one really important question that sticks out as a red flag and that is the issue you already mentioned with the owner structure being a secret.

That said, there are some things that I have yet to see any review take into consideration. The first is the biggest detail that seems to be ignored and that is the volatility software does not trade BCC. It trades based on the volatility of BTC & dollar. That's a huge difference. If it were trading BCC, I could see this system as being a ponzi or at least broken but by trading on volatility, it gives the system stability. In theory. To understand, let's compare Bitconnect to the Federal Reserve that is printing BCC out of thin air and selling it for BTC. Immediately Bitconnect is making a 100% profit. However as soon as someone lends their BCC, they are gaining twice the value for the term of the loan. This gives Bitconnect leverage to increase the volume the volatility software can trade. The practice is not uncommon in trading but by loaning back to Bitconnect, gives them much needed leverage to buy and sell. This is similar to how traditional banks use money you deposit.

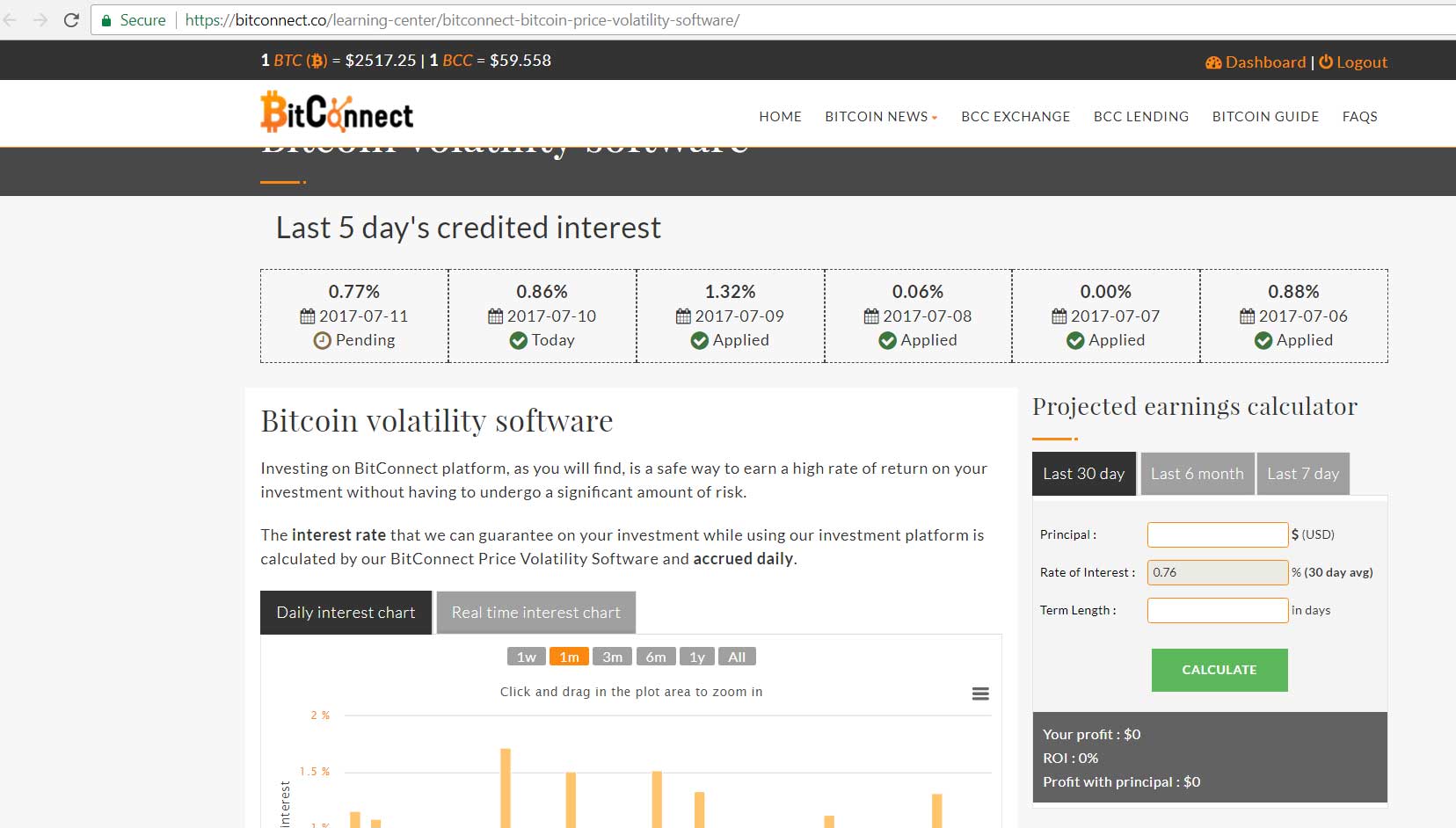

Screenshot form my loan acct:

Here is where it discusses it more: https://bitconnect.co/learning-center/bitconnect-bitcoin-price-volatility-software/

Another detail I see being missed is that although they say " The interest rate that we can guarantee on your investment while using our investment platform is calculated by our BitConnect Price Volatility Software " the truth is there is no actually guarantee of daily interest. I think this statement is worded poorly because it is referring to the interest that have already been calculated in real time for that trading period. Also people are misinterpreting their chart to be the guarantee when it clearly states "up to 40% per month" As you can see from the screenshot I provided of my account, there are days where there is no interest. And unless someone who can prove otherwise, even if you lend $1010 or more, 0% + .1% is still zero. It just so happens that BTC is pretty stable which makes loan investments relatively risk free while their software for tracking volatility has a proven track record. Surely if the company were to tank overnight, just as any company, investors would likely lose their money. So despite it smelling fishy with the "guaranteed interest" that really isn't saying that and the lack of transparency which is a major red flag, there is no actual evidence that they are scamming anyone. To the contrary nobody has said they have lost money. Yet. But then if it were a real ponzi, we wouldn't know about it until people lose their money right? So what are you going to do? Play into your fears until more information comes out? That's for everyone to decide for themselves but people really shouldn't be calling something illegal when there's only indicators not evidence of being a scam.

Research volatility trading for a better understanding.

https://tradingsim.com/blog/how-to-trade-volatility/

https://www.elitetrader.com/et/threads/how-does-volatility-surface-work-in-market-practice.282853/

https://volatilitytradingstrategies.com

https://www.math.nyu.edu/faculty/avellane/harcourt.pdf

With investments, there is always the possibility of losing everything. Especially with investments that are dependent on the fiat system. Educate yourself but don't be paralyzed by fear. Avoid giving into excitement and make investments your comfortable with and can afford to lose.

If you're ready to try Bitconnect for yourself click here. https://bitconnect.co/?ref=Creadis