Investigating the Top 50 Cryptocurrencies, Part 1/50: BitShares

BitShares is the #50 digital token in the world by market cap. What is it, and why is it so popular? In this post, I will explore BitShares and give you a layman’s overview of how it works.

This post is part of a new series where I investigate each of the top 50 coins by marketcap. My goal is to help steem’s userbase become the most knowledgable blockchain community in the world.

Why Investigate the Top 50 Cryptocurrencies?

This series was inspired by a simple twitter exchange I had with @lukestokes. It started with him tweeting this question:

I responded, triggering a short conversation:

Note: I just realized one tweet is missing - before the "/2" tweet from me, I say "I just realized I don't know enough about the top 50 coins to answer that... hm...."

I realized that I know very little about the top 50 digital tokens. I’ve read quite a bit about Bitcoin and Ethereum, and I’m obsessed with steem… but what else is out there? Until I do the research, I can’t speak with any confidence about the space as a whole.

This is why I’m full-time in the blockchain space these days - so I can spend 10 hours a day learning! Bring it on.

Best of all, it’s a chance to share this knowledge. I will investigate each of the top 50 coins, and then I’ll turn it into a detailed blog post where I distill the important info for you. If you read all 50 posts, you’ll have a better knowledge of the crypto space than most people.

We can work together to turn steem into the most knowledgeable cryptocurrency community on the internet. This is a huge opportunity… and in the process, you’ll develop a keen sense of the best ways to invest your time and money.

Disclaimer: I am not an investment expert and will not be providing investment advice. I will teach you about the top 50 coins, and you can do what you want with that info.

BitShares - What is it?

Most steemians know the basic info: BitShares is a decentralized cryptocurrency exchange started by Dan Larimer, the same guy who teamed up with Ned Scott to build steem.

Here are the key features of BitShares:

(1) SmartCoins - Stable Cryptocurrencies Pegged to Real World Assets

A smartcoin is a simple concept for steemians: Steem-Backed Dollars, aka SBD, is our own version of a “smartcoin.” Any digital token that is “pegged” (i.e. designed to match the value of) a real world asset is a smartcoin.

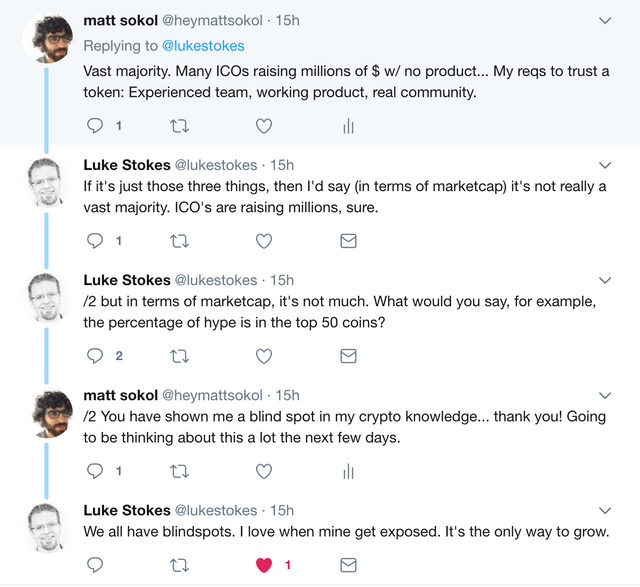

Here’s how BitShares makes their pegged assets stable & safe:

There’s some difficult finance-speak in there. Step #2 is difficult & crucial to understand, it went over my head at first: “(2) The least collateralized short positions are used to settle the position.”

My first question was this: What is a short position?

I’ll defer to the Nebraska Council on Economic Education on this one - here’s their definition: “The Short Position is a technique used when an investor anticipates that the value of a stock will decrease in the short term, perhaps in the next few days or weeks. In a short sell transaction the investor borrows the shares of stock from the investment firm to sell to another investor.” Source

OK - got it. So a person (“John”) borrows tokens from a third party (“Investment Co.”) at a cheap price - for example, at $0.98 per token. They then sell the borrowed stock to another third party (“Mark”) at a higher price - let’s say $1.05 - and hope to buy it back at a discount, then return the stock to the original firm. This leaves them with a profit if it works.

Mark is hoping that he can arbitrage the price - selling at $1.10, for instance - while John is hoping the market will force Mark to sell at a loss, such as $1.00, allowing John to buy back at a profit.

If you watched The Big Short - this is what the characters in that movie did to get rich.

Source: Wikipedia

The “least collateralized” - in layman’s terms, the people with the worst short positions, are forcefully liquidated whenever someone decides to cash in their SmartCoin for the equivalent pegged value.

None of this matters if you just want to use the currency as a stable token. All of the short and long positions happen behind the scenes, ensuring that average people like you and me can rely on a stable-ish peg. The main use case here is for an e-shop to sell products with the stable token, without worrying about price volatility.

The even deeper details of how SmartCoins work are fascinating, but a bit beyond the scope of this article. All that matters is summed in this quote: “merchants have a financial incentive to advertise BitUSD as the preferred payment mechanism, because they know that $1.00 is the lower bound on what BitUSD is worth.”

One other thing to be aware of: “Privatized SmartCoins.” Users can issue their own smartcoins. This is designed to create pegged assets, for example you can create BitGold, BitSilver, etc - This is NOT a system for creating any kind of token, like what ERC-20 offers - Privatized SmartCoins are much more narrow.

(2) Decentralized Asset Exchange

From the website: “BitShares provides a high-performance decentralized exchange, with all the features you would expect in a trading platform. It can handle the trading volume of the NASDAQ, while settling orders the second you submit them. “

Benefits of a decentralized network:

[2a] - Security: When an exchange is centralized, there is a huge reward (incentive) for people to hack it. One successful hack can earn somebody many millions of dollars… when it’s decentralized, the rewards are much smaller. Even if a hack is successful, it has lower impact on the overall ecosystem.

[2b] - Equal Opportunity - There is no high-frequency trading or “hidden orders” - you don’t need to be physically close to the exchange to gain an advantage, like you do with wall street (every nanosecond counts).

[2c] - Full Reserve - All assets on the exchange are backed with 100% of the asset - no fractional reserve banking.

[2d] - Freedom - No withdraw limits or invasive verification process. You can trade when you want, as much as you want, without revealing private information to a central authority.

[2e] - Low Fees - as the website says, “For a $1000 trade on BitStamp you will pay $5 vs less than $0.01 (Jan 2015) to make the same trade on the BitShares exchange.”

(3) Capable of 100,000 Transactions Per Second

The specifics of this don’t matter for most people. For the layman, it’s simple enough to understand that this technology is scalable. It can handle the transaction traffic of Visa and Mastercard combined.

(4) Recurring & Scheduled Payments

BitShares enables automatic recurring payments, scheduled in advance. This is achieved through users using two accounts: A “Checking” and a “savings” account.

Where do you store your data? Cold storage is important. Source: Upsplash

The savings account holds the majority of the funds, with the keys kept in cold storage (if you are smart about it, anyway). Before putting the keys into cold storage, the user authorizes a certain amount per day to withdraw to the “checking” account - for example, $1,000 per day - and in this way, creates limited risk in the event that the checking account is hacked.

Even if the checking account is completely compromised, the hackers have no access to the majority of the user’s funds, which are safely held in cold storage.

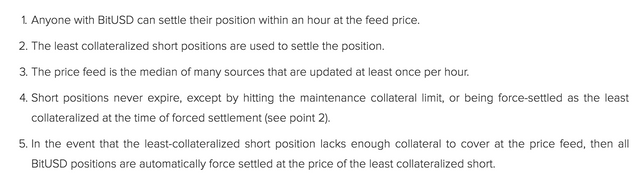

(5) Stakeholder-Approved Project Funding

BitShares started with about $8,000,000 of tokens in its reserve pool - these tokens are issued via stakeholder votes to fund development of the blockchain, paying developers and teams (“Workers”) to improve the protocol.

Source: BitShares website

The reserve pool is replenished through the built-in transaction fees, and ideally will hold its value over time even without any appreciation of the token value.

This is not that far off from how the Steem reward pool works - stakeholders can use their vote power to support users who are contributing to the protocol. The main difference is that steem’s system is inflationary, while bitshares’s is not.

(6) Bitshares uses Delegated Proof of Stake as its Consensus method

The nature of what DPoS is goes beyond the scope of this article - but you can read a bunch more about it over at the BitShares website.

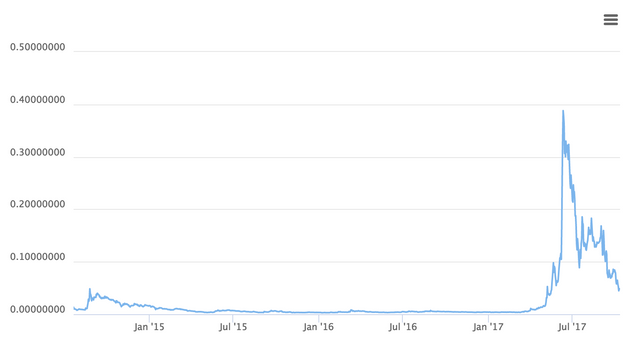

Price History of BitShares

The price has been mostly steady, with one huge spike in July that has been correcting downwards ever since. Bitshares is very affordable, just ~5 cents per token. Pretty easy to hold a few of these if you want!

https://www.coingecko.com/en/price_charts/bitshares/usd

Current Controversy

Bittrex recently announced that they are delisting Bitshares in the near future.

There isn’t a lot of clear information about this decision. All we know is that BitShares has supposedly reached out to Bittrex to try and avoid the delisting. Some users are speculating that this is because BitShares is a direct competitor to all centralized exchanges.

We will see how this plays out in the long run… I suspect that delisting BitShares may be a huge mistake. It’ll force people to engage with BitShares directly, rather than through a centralized exchange, and in the process it could actually educate users about how useful a decentralized exchange is.

In other words - when you can’t use Bittrex to access BitShares, you may realize you don’t need to use Bittrex… you’ll wonder why you ever used it in the first place.

My Thoughts About BitShares

BitShares is well known in Steem-land, thanks to the fact that both projects were started by the legendary Dan Larimer.

The more I read about BitShares, the more excited I get. The blockchain is elegant and seems to really work. The incentives make sense and the security seems robust.

I love the overall goal of the project - to provide a secure and decentralized exchange that anybody can use. If BitShares succeeds in becoming the most popular cryptocurrency exchange in the world, it could be a huge victory for the blockchain space.

I’ll be exploring BitShares more in the near future, because it seems like one of the best ways to exchange cryptocurrency. If I discover more useful info for crypto-enthusiasts here on steem, I’ll share it on my steem blog, so stay tuned.

What Do You Think About BitShares?

What experiences have you had with BitShares so far? What are your biggest criticisms of the service?

Superb post, thank you, and I look forward to the next 49!

Bitshares is easily the most undervalued token on the market measured by any metric - utility, adoption, development, track record, security, speed, scalability, funding, good news, new features, community etc. etc. Compared to the other tokens on the Top 50 list BTS should easily be in the Top 10, or imho, Top 5. But it's No. 50. Why?

My theory is pretty simple. Most of the Top 50 are shitcoins with no product, limited user base and poor development. But they keep popping out of nowhere and running up the CMC list. Someone is pumping millions and millions into shitcoins that do not provide any rational basis for investment.

This pumping is happening on exchanges. Coins get listed, they get bought like crazy, and then sold like crazy to the FOMO investors.

So we have exchanges that are listing shitcoins and someone on the exchanges who is pumping shitcoins to insane valuations and then someone on exchanges who is selling to greater fools.

So now go read about USDT. Follow the money, as they say. :)

Do you think that part of the reason it's undervalued is that BitShares is more challenging to use than a traditional, centralized exchange?

I'm pretty experienced with cryptocurrency and even for me it's taking a little bit of time to poke around and understand the system... it seems plausible that crypto newbies without financial experience would have a hard time with it.

As far as shitcoins in the top 50 are concerned - I look forward to finding and revealing them all 😈

I'll go and read about USDT... sounds good to me 🙂

Hi John,

I know from previous posts that you also buy Eos as well as BTS. I bought my first tranche of Eos yesterday on Kraken and transferred to the Bitshares DEX. But is there something I need to do re registering the tokens?

Would appreciate any guidance.

Thanks

great article. I have been interested in stacking some bitshares for a while now. I love the concept and the product seems sound. My only concern over use is that every time I’ve checked, coins seem to trade at a premium (ie they are more expensive on bitshares than other exchanges). I haven’t looked in detail at many coins over a long period, just an observation.

BTS DEX just needs to get the volume up to increase liquidity. Otherwise large buy and sell walls develop. I would think it is an arbitrage opportunity for someone, and will work itself out once more people become comfortable with the poor user interface of the dex. I've got to think they are pouring major development into the user interface behind the scenes to make it more intuitive and the price discrepancies will be lessened.

I hope you are right. I’ll try and take another look this weekend. Can I open an account, transfer Btc in and sell it for bitshares? I assume so but thought I’d check.

Yup, you can do that. I haven't exexcuted any trades yet within the bitshares interface, but it looks like that would be easy to do.

You do it through blocktrade feature on Bitshares exchange

I’ve checked it out but blocktrades seem to be considerably more expensive than polo. I hate to use polo after previous experiences but I have opted to ladder in on polo with regular withdrawals to my desktop wallet!

NICE!

its nearly a 10% difference so well worth shopping around

You weren't kidding! I love that a short little twitter conversation is leading to what looks to be a really great series!

BitShares invented DPoS by the way :)

I've used it a couple of times, it didn't seem complicated.

But, the interface is really shitty. If they want to attract more users, they should really work out something more eye-candish. Despite all the features, people get hooked on the visuals. And this is where BTS is failing.

Yeah, you're right, the interface is pretty rough right now. Hopefully they can improve on it soon.. I heard some rumors about an update on October 15th.

Hey Matt, maybe you can think of a way to solve my dilemma. I have quite a few bucks in Bitshares sitting in my Bittrex account. I opened up a Bitshares wallet 8 days ago and tried to transfer the funds. All the protocols were quite easy to follow. Bittrex came back with an invalid withdrawal code. e-mail communication with them enlightened me to something along the lines of my new Bitshares address isn't verified by the blockchain. Now, how the !#% do you do that if you can't deposit into the wallet? I tried again today ( a week ltr and still no go).....

i'm kind of old school and don't want to keep opening endless accounts.

Any suggestions? Any chance you could put a Bitshare into my account if you have a Bitshare wallet? I'll send you back 10 times the amount if this is easy for you to do.....

My Bitshare wallet address is:

andr-wm-rkm-s-c

Thanks in advance and no pro if this is a no can do on your end.

The account is coming up for me as "unknown account" - are you positive that's the right username?

I just searched and it doesn't look like that account was created, I would give it another shot.

Okay, maybe you have to put a number in the account name but even so, the Bitshares wallet says the account is verified. In the wallet, it says you can open another account. Do you think that is the way to go about doing it? Thanks, guys!

Have you tried creating another account with the same username? I don't think your exists because I can't search it. You can try using openledger or the downloaded bitshares client to make an account aswell

It seems the first account I tried to open is some kind of phantom account. Damn! Anyway, deleted off my computer. The link you provided is linking my account to the blockchain now. The dummy account didn't do that. Hopefully, this works!

Thanks!

Sorry to bother you guys! More details. I'm using a Mac and there was a warning not to. Trying to sync anyway. About 2-hours so far. I can see the blocks counting upward. They are not stuck. I remember going to this page previously but then went to the other one.

When I signed up for the previous one it didn't generate a password which I thought was odd. And then it automatically 'synced' and said I was good to go! We now know that was some kind of phantom page. Weird....The wallet looks exactly like this one. Who knows! Tough being a Luddite these days:D

Are you sure you didn't get phished? I was given a password as soon as I created my account.

I'm not sure of anything, matt! I know the first one was a dmg download. It all worked quite well other than the weirdness of having to write my own password.

On this try, from trexicons link there is no download, sign up right from the browser, and this morning it is still trying to link to the blockchain. I assume that that is not right and something is wrong. Apologies for bothering you with this.

DUuuuuuuuuuuuuuuuuuuuuude. You're a machine! Starting the journey here but excited to follow the list. Thanks for putting these together.

You know it! Thanks for checking it out @healingvibes.

Awesome job! I just have one small note

Actually, you are guaranteed to receive $0.99 worth of BTS, not $1.00. On the other hand, you basically never need to use force settlement because you can sell it on the market for better price.

Ok, I think that makes sense. That quote you're responding to is actually straight from the bitshares website, perhaps they were oversimplifying the concept.

They are not oversimplifying, it changed couple of months ago.

Gotcha.

I believe one of this days, BTS price will hit $10 mark. Since, it's big older brother of steem and EOS and fully decentralized. Now while BTS is in dip, buy and hodl is the best we can do.

$10 seems pretty far off, considering that it is only at $0.04 right now.

I had similar thoughts on BitShares, but couldn't help thinking that the whole atomic swap phenomenon could prove very negative for the project (and similar projects).

I was thinking that atomic swaps would be helpful in that folks could exchange altcoins directly to/from BTS without a gateway. Atomic swaps should work on the BitShares blockchain as well, right?