BitShares Announces The Creation Of A BitShares DEX-Based SEC-Compliant Tokens & Exchange

As the fall solstice approaches, the SEC (United States Securities and Exchange Commission) has been making statements regarding ICOs (Initial Coin Offerings), and has been warning consumers that ICO scams may be abound in the industry. In addition, Jay Clayton, Chairman of the SEC, has articulated his concern that most ICO investors do not fully understand the “substantial risks” associated with initial coin offerings.

Celebrities like Floyd Mayweather and Jamie Foxx may see legal troubles arise by the promotion of tokens sales through ICO’s that may be unregulated and unregistered securities as defined by the Howey test.

China has also cracked down on ICOs, demanding ICOs return money and close.

Chinese officials have also announced that Bitcoin exchanges in the country must close, prompting several to shutter their doors immediately. Regulators and officials have stated that “ peer-to-peer trading would not be tolerated “, and that they would move to not only close exchanges, but also close OTC (over The Counter) trading.

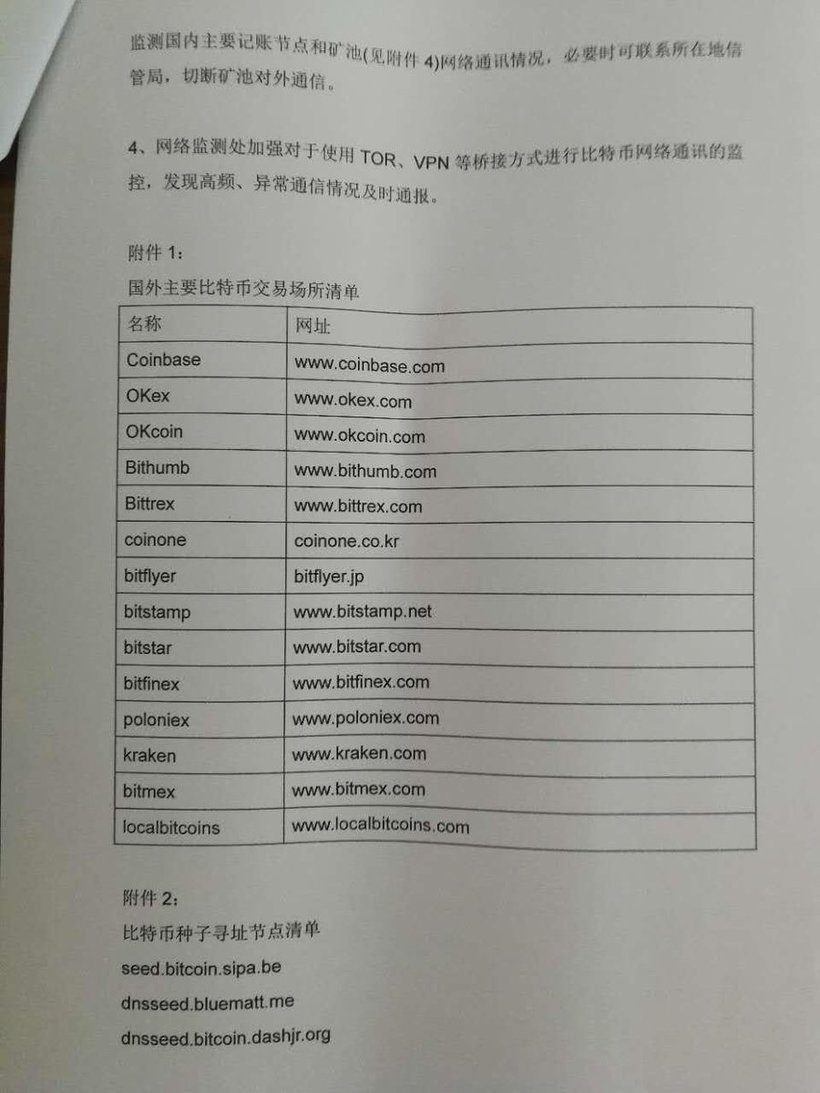

A leaked list was published regarding exchanges outside of China that would be blocked by the Great Firewall of China, and reports have been published regarding regulators banning Chinese bitcoin exchange executives from leaving the country.

List of Cryptocurrency Exchanges outside of China to be blocked leaked.

All of these affect not only the Bitcoin market, but every of cryptocurrency market. Chinese exchanges once accounting for a majority of trading volume, are now trading at only 25% of previous volume and declining.

Traders in China are scrambling, with many wondering where to go to exchange currencies and trade, especially with the regulators and Government officials blocking outside exchanges. The industry as a whole has been discussing the usage of decentralized exchanges to combat regulatory or government oversight, however, there is one exchange that is going a different route. Cryptonomex, the company that created the BitShares DEX, has plans to embrace self-regulation in order to save the industry from itself.

BitShares Announces The Creation Of A BitShares DEX-Based SEC-Compliant Tokens & ExchangeBitShares unofficial spokesman Stan Larimer announced today that “We (BitShares) have a final summer bombshell - a 100% compliant exchange and a growing inventory of security, commodity and other types of tokens that pass SEC scrutiny, built on BitShares, which itself has been deemed a “clean coin” by the Tokens & Exchange Self-Regulating Body”.

The current BitShares DEX (Decentralized Exchange) will of course continue to exist and BitShares members can choose the exchange that suits their needs. The new exchange licensed by Stokens, Inc. and called the Stokens Exchange, will require KYC/AML for membership and only list tokens deemed legal by the SEC and other related global regulating bodies where members reside.

John Gotts, the chairman and founder of Stokens and the TXSRB, engaged more than fifty ex-SEC attorneys, some of whom helped write much of the JOBS Act, Regulation A and other key security laws, to design the framework of the TXSRB and Stokens regarding compliance and licensing with funds and public offerings. The top attorneys on their team gave their take on his analysis of what the token industry needs to “clean up its act.”

Here are a few takeaways from their conversation:

Most ICOs were conducted illegally and now trade illegally. Foundations who try to comply and restart may have to pay fines and return funding.

Stokens and the TXSRB provide the proper methods to create a self-regulating body and a legal site for private companies to raise money from accredited & non-accredited US investors, who may trade the digital representation of their investment (a token or tokens) legally.

They expressed their opinion that Stokens and the TXSRB stand alone in the US and perhaps globally in their legal methods and plans and may get a seat in D.C. on the committee reviewing regulation on crypto investments for the United States Congress. They believe he’s designed the future for crypto investment and trading.

After discussing this extensively, John told me that he “came away feeling that of all the global exchanges, perhaps only Coinbase would not be shut down if/when the SEC decides to act”. John also shared what he learned about what exchanges would have to do to “clean” the exchange operating in the USA:

Immediately delist tokens deemed unregistered securities.

Don’t charge fees for trading without a broker/dealer license.

Don’t charge fees for ICOs based on a percentage of what is raised, equity in the company or any success fee without a broker/dealer license or working as an agent for a broker/dealer.

Don’t allow trading of security tokens without an SEC exchange license.

Complete KYC/AML on all members for anti-money laundering.

Provide auditable transparency – Each exchange must be audited.

Provide educational material on a regular basis in a clear, visible place on any exchange or ICO website or related app explaining the risks of trading tokens and the possibilities of fraud and loss of funds.

Provide clear guidelines to members on best practices for avoiding & reporting theft or fraud.

Provide member wallets and trading with a technically secure exchange.

Embracing the TXSRB and SEC rules, regulations & laws will make the Stokens Exchange (powered by the BitShares Exchange Network) the first and most legally compliant way for a company to successfully secure funding without the chance of a shutdown, lawsuit or investigation. The Stokens Exchange is the future of cryptocurrency fundraising, and it will be built on the BitShares blockchain.

BitShares was designed to support this from the beginning.

BitShares has always provided all the tools and utilities needed to allow users to comply with the regulations and laws that apply to them. These vary widely with token type and jurisdiction, so it must be the responsibility of the individual token issuers and exchanges that build on top of the BitShares platform to ensure that they are fully compliant. The necessary artificial intelligence does not exist for an unmanned blockchain to analyze whether every offering and user has complied with all the relevant rules and constraints.

But BitShares will enforce those rules, including constraining each and every asset to the rules on who can own them and what they can do with them. If you created a token and didn’t tell BitShares the right rules to enforce, you may have broken the law in some jurisdiction.

Since this is complicated and constantly changing, I applaud the efforts of Stokens.com and TXSRB.org to provide a turn-key exchange with the rules built-in for (eventually) every jurisdiction in the world. This brings a whole new level of comfort to those who want to do the right thing, but lack the resources to figure it out on their own.

The TXSRB is currently accepting members to help draft the rules and regulations the industry as a whole should abide by. If you want your voice to be heard in this discussion, please go to TXSRB.org and sign up for more information.

The more I read deeper into this story it seems like Stan Larimer and John Gotts are ahead of the game. However, much of this is imagined and forward-looking without much or any proof that the coins they've chosen are the best and the exchanges in question will go down. Stop, read this story slow many times you will find many holes and issues with the presentation.

Thanks for the fantastic write-up! @tikal

Congratulations @tikal! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Vote for @Steemitboard as a witness to get one more award and increased upvotes!