Block66 Review: Next-Gen Mortgages for the Blockchain Age

Overview & Vision

As a species we have witnessed tremendous technological advancement over the past several decades, especially; waves of technological innovation have swept across the globe, each changing the way which humans interact with the world, and with each other. As we advance deeper into the digital age, it is becoming increasingly clear that blockchain is set to become a dominant trend in the 21st century digital landscape- and the innovative technology has already began to penetrate into various industries ripe for disruption. The mortgage industry, however, remains outdated and inefficient, currently running on a system fundamentally built for the paper age long gone.

To add to the complexity of the situation, the market has tightened and fragmented since the bank-induced 2008 financial market crash- greatly limiting opportunities for the average person. Only a truly innovative and cutting-edge utilisation of technology could hope to patch these crippling problems and bridge borrowers and lenders in an ultimately revolutionary manner. This is the grand vision of Block66.

By leveraging blockchain and smart contract technology, Block66 are looking to no less than revolutionise the entire mortgage lending experience from application to issuance. Their vision promises a more accessible, transparent and vastly efficient mortgage lending environment for all actors involved.

But it is a mammoth task, requiring a project based on strong fundamentals, which we will analyse here.

Current Industry Situation

The 2008 financial crash sent economic shockwaves around the globe, and all actors in the space witnessed a sharp shift in the mortgage lending environment for lenders and borrowers alike; the landscape, once dominated by a few major providers in each regional market, has become increasingly fractured and less accessible. Plagued by a mixture of an increasingly outdated core mechanism and the lingering backlash of the financial crash, the mortgage industry overall currently stands in a state of fundamental stagnation and gross inefficiency.

Restrictive Borrower Environment

The post-2008 mortgage market is woefully unaccommodating for the average consumer; the lending criteria of mortgage lenders has necessarily significantly tightened, resulting in a largely inaccessible and unaccommodating to those even who have the capability to finance a mortgage. The statistics from the United States paint a shocking picture, where the median home owner credit score increased from around 700 in 2005 to 732 in 2016 leading to a lending environment in which ultimately, in 2017, an estimated 106 million borrowers with fair and above credit scores were denied adequate service.

Snapshot of top 10 lenders in 2011 and 2016, taken from the Block66 whitepaper: https://block66.io/themes/b66/assets/Block66_Whitepaper_English-update.pdf

Further, the inability of workers such as the staggeringly growing freelancer community, who may not be in a ‘traditional’ form of employment, to receive mortgage financing is testament to the traditional industry’s inability to keep the pace of change.

Fundamental Inefficiencies

From a broader perspective, the mortgage industry is also suffering from a glaring issue at a fundamental level; the very mechanism of arranging and facilitating a mortgage loan is becoming increasingly obsolete, unable- without radical change- to keep pace with today’s rapidly evolving digital world.

The process of attaining a mortgage- an experience which should signify a celebrated milestone in a persons life- is painfully slow, with the average waiting time for a mortgage application process in the US and Canada being 45 days. The need to process mountains of documents, and for multiple fracture parties to repeatedly correspond with one another with minimal attempt at automation results in a highly inefficient mechanism. Adding to the stress and anxiety of the consumer is the fact that the whole process traditionally lacks any degree of transparency.

This is a shocking state of affairs, and one which is presenting a woefully inadequate environment if we wish to have any form of adequately accessible and functional mortgage industry as we progress deeper into the digital age.

Block66’s Solution

Block 66’s innovative use of cutting-edge technology is enabling the transformation of the mortgage lending industry in a way no less than revolutionary.

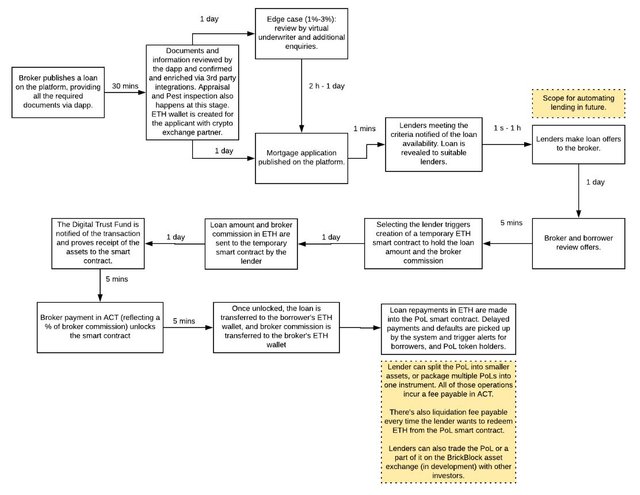

Block66's functional mechanism, taken from the Block66 whitepaper: https://block66.io/themes/b66/assets/Block66_Whitepaper_English-update.pdf

Empowering Lenders and Borrowers via Blockchain

Block66 are initially striving to most vehemently assist those whom the traditional mortgage lending industry has most let down- those in the good/prime credit bands, a vast amount of whom can financially afford a mortgage repayment plan but are still suffering from the lingering effects of the bank-induced 2008 financial crisis. Through the utilisation of blockchain to greatly enhance the mortgage lending space, both borrowers and lenders can now be empowered by new opportunities.

This increased accessibility and flexibility is due to Block66’s ability to seamlessly issue a mortgage as a tokenised asset on the blockchain. The ability of lenders to trade PoL (proof-of-loan) tokens on a purpose-built exchange platform, combined with the ability to divide PoL contracts into smaller loan fractions will increase accessibility and lower the barrier of entry for smaller, previously unserved, investors. Block66 is proposing a truly innovative mechanism which promises to increase the opportunities available to those most unjustly unserved, and beyond.

New Technological Possibilities

Aside from providing remarkably increased levels of market accessibility for both lenders and borrowers and a fundamentally secure and efficient transaction network, Block 66’s blockchain-powered ecosystem promises to revolutionise the mortgage industry from its very framework outwards. By automating the mortgage application and facilitation process as far as possible, Block66’s platform will streamline the entire process where possible, and will utilise their team of expert underwriters wherever human consideration or input is necessary.

Blockchain is, of course, borderless and Block66 have notably ambitious and noble long-term plans to expand globally, including into emerging economies where mortgage opportunities are woefully lacking. Addressing this disparity is an opportunity made possible only by the capabilities of blockchain technology and Block66’s innovative marriage of blockchain and mortgage lending, at once providing opportunity to those with none, and enabling the tapping into of previously inaccessible markets for lenders.

Team Analysis

Anybody can write an impressive whitepaper and create a persuasive website; the idea is the easy part, it’s implementing the idea which is difficult. In the Wild West of crypto, ensuring that the team has the experience and capability required is crucial.

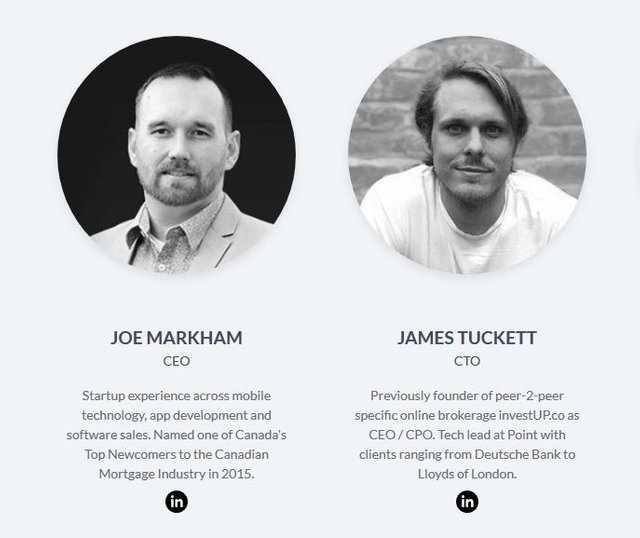

Snapshot of the team, taken from the Block66 website: https://block66.io/

In the case of Block66 I was remarkably impressed with not only the size, but more importantly the calibre of the team. Each team member is relevantly educated and impressive in their own right, which is always reassuring to see. For example, the Block66 CEO Joe Markham has ample and varied startup experience, and impressively was named one of Canada's Top Newcomers to the Canadian Mortgage Industry in 2015.

More about the team can be found on the Block66 website, alongside links to their LinkedIn profiles.

Verdict & Summary

The current mortgage lending industry presents a shockingly inaccessible and inefficient state of affairs, and one which is presenting a woefully inadequate environment if we wish to have any form of adequately accessible and functional mortgage industry as we progress deeper into the digital age and hope to beneficially progress as a species.

Through their innovative use of blockchain and automation technology, Block66 is proposing a truly innovative mechanism which promises to increase the opportunities available to those most unjustly unserved, whilst creating an environment in which the mortgage lending process is more accessible, transparent and vastly more efficient.

The mortgage lending industry is crying out for disruption, and if carried out as envisioned Block66’s innovative blockchain-powered solution could change its very landscape for good, and for the betterment of everyone involved.

I wish Block66 the best of luck for their ongoing token sales, and will certainly be watching with a keen eye as they progress on their journey to revolutionise the mortgage industry.

Block66 is currently in their presale stage, with their main token sale due to begin shortly.

Token sale summary, taken from the Block66 website: https://block66.io/

Have any questions regarding Block66? Join their active community on Telegram where you can discuss anything Block66-related: https://t.me/block66_Official

Learn more at their website, where you can also find their whitepaper if you want to dig in deeper: https://block66.io/

Get connected to Block66 on social media:

Twitter: https://twitter.com/Block66_io

Facebook: https://www.facebook.com/Block66Official

cryptoleonidas

Blockchain Age

Great piece Spartan- been waiting for a project that's finally capable of tokenising mortgages! BIG application in the near future I think!

I agree, if all goes to plan we're going to see a lot of changes coming.

aooooo!! nice pick man keep it up. I am picking up cheap eth while people panicing :)

Glad to hear it @mohanverma the trick on either side of the market cycles is to stay level headed whilst others aren't. Thanks for your support.

Yes interesting. forms the basis of a potential tax dodge depending on the country you are in. Some jurisdictions need to do some updating sharpish.

Definitely! In general the borderless nature of blockchain is going to mean a lot of regulatory change will be needed overall in many areas to keep the pace of change.

Congratulations @cryptospartan! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

Click on the badge to view your Board of Honor.

If you no longer want to receive notifications, reply to this comment with the word

STOPDo not miss the last post from @steemitboard:

This post has received a 4.59 % upvote from @boomerang.

Hard caps are gonna be extremely difficult to reach in this market, to say the least! What's the caps?

12.5m hard cap- says in image above.

Yes $12.5 million is the hard cap, with a soft cap of $3 million.

whats going to happen to ico's if the market keeps going, really worried now! By dumping all their eth theyre really not helping the space right now :/

Stay strong, it's important to remember that the market works in cycles and there is always opportunity to be found regardless of current price! Sometimes the best opportunities can be found in the worst conditions.

any exchanges planned?

Think this is going to be a BIG application of blockchain. I dont kow who's gonna bet there first but I'm watching