Burned tokens, rewards, and inflation summary August 13, 2022 - Estimated beneficiary burn since May 29: 56,855 STEEM

Steemit launched the #burnsteem25 initiative on May 22, and the corresponding rewards started being delivered to @null on May 29. Here is the next weekly update with PowerBI charts to visualize the burned token-related statistics since that date.

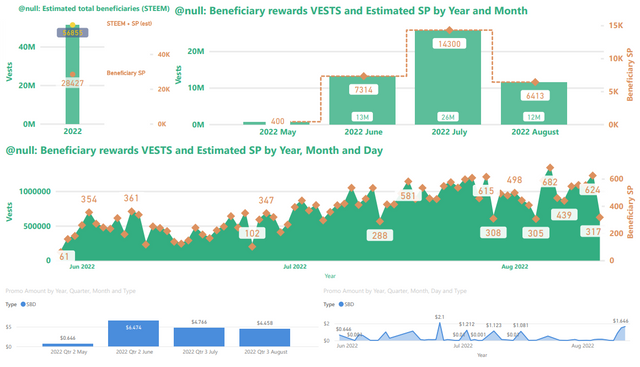

Slide 1: Burn amounts in beneficiary rewards and transfers to @null.

With 682 SP burned on August 6 and 625 SP burned yesterday (August 12), the two highest days on record fell in the last seven days. Today's total is 317 SP, with about 7 hours left in the day. Roughly 7,490 SP were burned throughout the week. This week, I broke the SBD transfers to @null down into two visualizations - one is monthly and one is daily.

Top-left: This image shows the number of VESTS along with the estimated numbers of SP and ( SP + STEEM ) beneficiary rewards that have been burned since May 29. This is where the headline number comes from.

Top-right: This shows the VESTS and the estimated SP beneficiary rewards burned per month.

Middle: This shows the daily VESTS and the estimated SP beneficiary rewards that have been burned.

In all three of the above charts, VESTS are shown against the left axis, SP and STEEM are shown against the right.

Bottom: SBD transfers to @null. As readers are likely aware, SBD transfers to @null can get a post added to the /promoted page. The visualization on the left shows the breakdown by month. The one on the right shows the daily record.

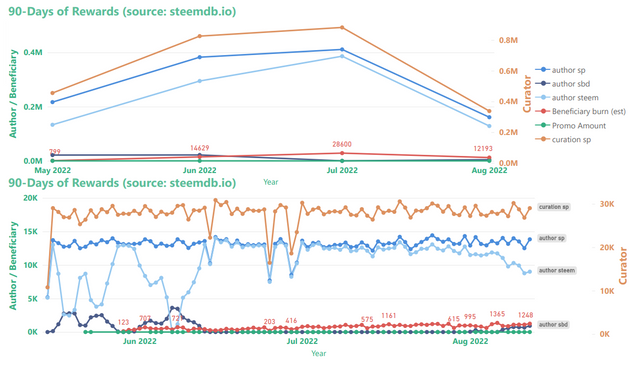

Slide 2: Rewards summary

Curator rewards use the scale on the right, author and beneficiary rewards use the scale on the left. Thus, curation rewards appear to be scaled down relative to author & beneficiary rewards. Beneficiary rewards for @null in this chart (red) have been adjusted in order to account for both SP and liquid rewards. The top graph shows the monthly aggregations, and the bottom graph shows daily totals.

Noteworthy this week is that SBD printing has resumed, which we can see in the decline of STEEM going to authors and also in the increase in SBDs.

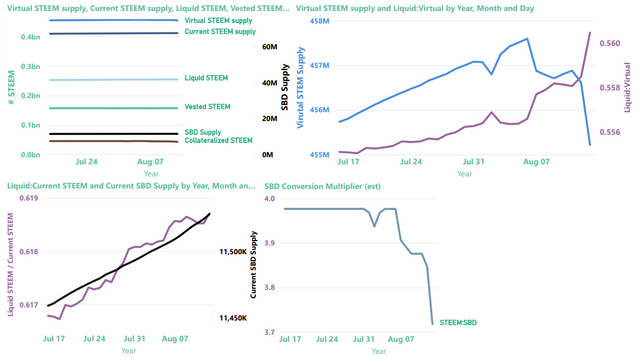

Slide 3: STEEM & SBD Supply as well as vested (i.e. staked or "powered up") STEEM

Noteworthy: As a result of STEEM's rising price, the virtual supply switched to deflationary on August 6. This can be seen in the top-right visualization. If you squint hard enough, you can even make out the dip in virtual supply and collateralized STEEM in the top-left visualization. Also, the bottom-right graph shows that the blockchain's internal SBD conversion rate dropped sharply as the STEEM price rose.

The top-left image provides a summary view of current and virtual STEEM supply, current SBD supply, liquid and vested STEEM, and the amount of STEEM reserved as collateral for paying off SBDs.

| Note |

|---|

Collateralized STEEM and current SBD supply actually represent the same value expressed in terms of STEEM or SBDs, respectively. They're aligned differently on the graph because they use different axes. |

The top-right graphic now contains a zoom-in on "virtual STEEM Supply" (left axis) and the ratio of liquid STEEM / virutal STEEM supply (right axis). As we learned, here, virtual STEEM supply is heavily influenced by price, so with STEEM prices down, it's not surprising to find the virtual STEEM supply increasing. The up-side of this is that it's now possible to burn more collateralized STEEM per SBD with post promotion.

The bottom-left visualization now contains the ratio of liquid STEEM / current STEEM supply (left axis) and a zoom-in on Current SBD supply (right axis)

The chart on the bottom right shows the value of SBDs in terms of STEEM, according to the blockchain conversion rate, not external markets. This is the inverse of the blockchain's: internal price (which is different from the actual feed median, for reasons that I don't currently understand).

Now, here are some more details about each of the values

| Parameter | Axis (left/right) | Meaning | Comments |

|---|---|---|---|

| SBD Supply | right | Number of SBDs in circulation | Equivalent in value to collateralized STEEM |

| Collateralized STEEM | left | Number of STEEM needed to pay off all SBD debt | Equivalent in value to SBD Supply |

| Vested STEEM | left | Number of STEEM staked as STEEMPOWER | |

| Liquid STEEM | left | Number of STEEM that's not staked or needed for SBD collateral | Calculated as (Current STEEM supply - Vested STEEM) |

| Current STEEM supply | left | Number of STEEM in circulation | |

| Virtual STEEM supply | left | Number of STEEM in existence |

Thanks for reading!

For previous updates, see:

- Burned tokens, rewards, and inflation summary August 6, 2022 - Estimated beneficiary burn since May 29: 49,365 STEEM

- Burned tokens, rewards, and inflation summary July 30, 2022 - Estimated beneficiary burn since May 29: 42,556 STEEM

- Burned tokens, rewards, and inflation summary July 23, 2022 - Estimated beneficiary burn since May 29: 35,497 STEEM

- Burned tokens, rewards, and inflation summary July 16, 2022 - Estimated beneficiary burn since May 29: 28,408 STEEM

- Burned tokens, rewards, and inflation summary July 9, 2022 - Estimated beneficiary burn since May 29: 22,185 STEEM

- Burned tokens, rewards, and inflation summary July 2, 2022 - Estimated beneficiary burn since May 29: 15,312 STEEM

- Burned tokens, rewards, and inflation summary June 25, 2022 - Estimated beneficiary burn since May 29: 12,412 STEEM

- Burned tokens, rewards, and inflation summary June 18, 2022 - Estimated beneficiary burn since May 29: 8,994 STEEM

- Burned tokens, rewards, and inflation summary June 11, 2022 - Estimated beneficiary burn since May 29: 6,492 STEEM

Pixabay license, source

Reminder

Visit the /promoted page and #burnsteem25 to support the inflation-fighters who are helping to enable decentralized regulation of Steem token supply growth.

I suspect the amounts will go up a bit more in the near future. Therefore, I think it is currently a good decision to add the daily view.

It's interesting to hear that SBD is being produced again, which means we will be receiving SBD again as payment.

The #bursteem volunteer action that is increasingly being carried out by many steemians certainly encourages the growth of steem prices. Hopefully #burnsteem will continue to be supported by stakeholders.

Thank you for sharing this information on an ongoing basis.

The price of cryptocurrencies has been increasing, even the price of steem and sbd, the truth is that this market is too manipulated, so I prefer to continue saving and accumulating

The burning mechanism will add value to steem. We should work on formulas to make this more useful.