In-Depth Presentation of the Particl Project (part2)

Here is a non-exhaustive list of DSNs that could be integrated into Particl:

- HTTPs (Privacy:- ( — )

- TOR (Privacy: + + )

- SMSG (Privacy: + + + )

- IPFS (Privacy: + )

- Siacoin (Privacy: + )

- Storj (Privacy: + )

- SafeNetwork (Privacy: + + + )

- This DSN hasn’t been integrated yet or is not production-ready.

As there isn’t really a “best” solution, the Particl platform lets users choose which decentralized storage network they want to use. Some DSNs provide great anonymity characteristics but don’t scale as well as others (such as is the case with SMSG). Some provide great scaling capabilities but are more expensive to use. There is also the fact that some of these DSNs required a native token transfer (Sia, Storj, SafeNetwork), making the integration trickier (but still possible) and possibly less interesting for users. Don’t forget that these DSNs which use a native token either charge the uploader of content or the downloader depending on what storage network is being used.

While DSNs are mostly used by the marketplace application (and the messaging system in the case of SMSG), the agnostic and extensible design has been standardized by the team so that it can be easily be deployed whenever the platform needs to interact with third-party software, once again ensuring that it never gets outpaced by new technologies but embraces them instead. It also has the potential to add use-cases to other blockchain projects (for example, providing a complete and decentralized merchant and escrow system to Siacoin).

Proof-of-stake Consensus Algorithm

From Wikipedia’s proof-of-stake page, “Proof-of-stake (PoS) is a type of algorithm by which a cryptocurrency blockchain network aims to achieve distributed consensus. Unlike proof-of-work (PoW) based cryptocurrencies (such as bitcoin), where the algorithm rewards participants who solve complicated cryptographical puzzles in order to validate transactions and create new blocks (i.e. mining), in PoS-based cryptocurrencies the creator of the next block is chosen in a deterministic (pseudo-random) way, and the chance that an account is chosen depends on its wealth (i.e. the stake)”. Paid at every block, PoS basically financially rewards users for securing the network. It is also much easier to start staking than it is to start mining (as you need to buy a lot of equipment and do some research to understand how it all works), so it could be argued that PoS is a more decentralized and “people-friendly” decentralized consensus algorithm, only requiring users to buy coins, deposit them on their wallet and let it open as often as possible.

Particl uses a pretty recent version of PoS named PoSv3, and has a variable inflation rate that goes as follow:

Year 1: 5%

Year 2: 4%

Year 3: 3%

Year 4+: 2%

Staking As An Investment

Particl’s inflation calendar has been designed this way to support the price during the adoption period by making it quite profitable to stake. Once the marketplace application is more popular and as staking rewards reduce over time, the “burden” of price support should organically transfer from speculators to marketplace users.

One thing that is important to understand about staking rewards is that you are guaranteed to get a 5% interest profit in the first year if 100% of the network’s coins are staking. Staking becomes increasingly more profitable as less and less people stake. This is a direct incentive to get as many nodes staking as possible. However, it is highly unrealistic to think the entire network would be staking as evidenced by Shadowcash’s historical statistics; the percentage of SDCs staking used to oscillate between 35%-50% of the entire network. On Particl, if 50% of the network was to stake their coins, that would mean you could expect an estimated 10% yield on your first year (if you let your wallet open 24/7).

Another interesting dynamic resulting from the way PoS was implemented is that market fees are paid directly to stakers. As explained earlier, the marketplace asks for a small 0.01 PART listing fee every 48 hours to fight spam. That means that as the market gets more activity, it becomes even more profitable for stakers. If it gets popular enough, it could completely nullify the effect of the decreasing inflation rate on staking rewards and possibly even making them bigger in the end. Other fees paid to stakers include regular transaction, CT and RingCT fees. Note that as the platform gets more Dapps other than the marketplace, the fees they generate would generally be sent to stakers.

Could there even be more financial incentives to stake? Yes, there is! As explained earlier, MAD escrows have a timer that forces both participating parties to release the funds before it runs out. This timer can, of course, be extended if both parties agree to, but what if it is not and the escrow runs out of time? All the funds are added to the staking rewards, which in some cases could amount to pretty big bonus rewards!

Staking As A Particl Foundation Self-Funding Strategy

When calculating potential staking rewards, it is important to deduct 10% from the final number. Why? The Particl Foundation didn’t want to simply rely on two funding rounds as they have some very long-term vision for the project, so they had to find a way to get constant funding. A solution they found was to take 10% of daily staking rewards and use those coins to fund the project (hire devs, launch marketing/PR campaigns, etc). If you are familiar with the DASH project, they were the first ones to adopt such a strategy and it could be argued that it is one of the reasons they are doing so well right now.

Economic Dynamics Of Staking

Since it has been first implemented, proof-of-stake has been observed to propose a different set of economic dynamics than proof-of-stake. The major reason why this is so is that stakers don’t actually need to sell their stakes like miners who need to pay for various expenses (electricity, maintenance, temperature management, etc).

In fact, if one was to analyze PoS blockchains, he would notice that most staking nodes actually hoard staking rewards rather than cash them out. Since there is no expense tied to staking, it is actually much more beneficial to re-invest (stake) your newly rewards as that increasingly makes it more profitable as time goes by, a concept named compounded interests.

“Compound interest (or compounding interest) is interest calculated on the initial principal and also on the accumulated interest of previous periods of a deposit or loan. Thought to have originated in 17th-century Italy, compound interest can be thought of as “interest on interest,” and will make a sum grow at a faster rate than simple interest, which is calculated only on the principal amount. The rate at which compound interest accrues depends on the frequency of compounding; the higher the number of compounding periods, the greater the compound interest. Thus, the amount of compound interest accrued on $100 compounded at 10% annually will be lower than that on $100 compounded at 5% semi-annually over the same time period.” (http://www.investopedia.com/terms/c/compoundinterest.asp)

For example, at a 5% reward rate, a staker having 1,000 PARTs would end up the year with 1,050 PARTs. On the second year, his 1,050 PARTs would increase by 4%, leaving the staker with 1092 PARTs. Another staker decides to sell his stake as he receives them, so on the first year, he would have made 50 PARTs of profits. However, because he decided to sell his stakes as he receives them, his second year of staking would only yield him 40 PARTs (1,000 * 0.04). Comparing these two stakers, the first one made a 92 PARTs profits while the second one made 90 PARTs. Note, however, that this example has been simplified for the sake of this presentation. In reality, staking rewards are paid at every block, not every year, so this “build-up” effect that causes stakers to get more PARTs rewards as they re-invest actually happens more quickly, making it even more profitable than in this example.

I’ve made a simple Calc file that allows you to easily calculate your staking rewards depending on the number of market listings, the estimated yearly return rate, and your PART balance. It is takes compounded interests into consideration. Please follow this link to be able to download it and then play with it: http://onlyo.co/2uQdLoM

Another interesting economic dynamics proof-of-stake provides is that it generates a coin supply shock on trading markets.

There are two main reasons for this. The first one, as explained above, is that stakers demonstrably prefer hoarding over spending their rewards, creating much less selling pressure on markets. Generally, this would make the coin’s price higher as the supply is reduced while demand stays unaffected. The second reason is directly related to the potential gains a staker can make by simply leaving his computer open. Some people would rather not risk trading their assets, so getting a solid 5–10% investment return under a year can be very appealing, making the coin more in demand. Taking both these dynamics into consideration, it could be said that proof-of-stake increases demand while reducing supply, which generally makes the coin more valuable.

One problem with that, though, is that if not enough people want to sell the currency on the markets (and simply hoard it instead), it can create a kind of liquidity crisis where not enough coins are put for sale. This is far from ideal for speculators with large sums of money who wouldn’t want to accumulate coins on an illiquid market as making a large order could dramatically increase the coin’s price. It is also not a very good marketplace currency as you want to easily be able to buy it at a relatively stable price. To understand why simply ask yourself if it makes sense to have the price increase by 10% just because you made a large PART order to buy a 10,000 USD car on its market. This is not sustainable, so what would be the best way to have a healthy and profitable balance between supply and demand?

Currency-Agnosticism & Proof-of-stake Combo

I believe Particl already has a working solution implemented to balance its staking dynamics with Shapeshift. Remember how I said the market is currency-agnostic and uses Shapeshift to seamlessly exchange other coins into PARTs? Well, it’s not just the marketplace itself, but the entire Particl platform that is so, making it very easy and tempting to actually diversify your portfolio by shape shifting your rewards into other coins. Even though it can be historically demonstrated that stakers would rather keep their rewards than selling them, a proof-of-stake consensus protocol has never been implemented on a currency-agnostic platform.

Everybody says it: diversification is the key to a profitable and healthy portfolio and staying in only one currency is actually pretty risky. What an easy Shapeshift withdrawal option provides is the ability to very easily diversify your rewards. That means you could instantly convert PART rewards into available coins, be it BTC, ETH, DGX (100% gold-backed cryptocurrency, likely to be added to Shapeshift soon) or even USDt (USD-backed cryptocurrency). The concept of being able to be rewarded in any currency of your choice is actually quite novel and powerful, so it could be reasonably expected that this function will be used a lot.

For example, I know that I will personally keep around 50% of my own staking rewards in PARTs and shapeshift the rest into whatever currency I like at a given time. I’m surely not the only one who will use the Shapeshift integration this way…This would make the balance between supply and demand more healthy and has the added benefit of making stakers’ portfolio much more secure through diversification. Just pick a couple of coins you like and increase your bags every day!

Decentralized Voting & Chain Governance

Most cryptocurrencies are designed with full immutability in mind, meaning their state (blockchain data & code) cannot be modified after it is launched (or spent, in the case of a transaction). However, recent events in crypto have shown us that a fully immutable approach to a blockchain perhaps isn’t optimal. In fact, if you are reading this presentation, chances are that you are aware of both the BTC scalability debate deadlock and the past split of the Ethereum chain (ETH & ETC) caused by a contentious hardfork.

In the first case, Bitcoin requires finding a solution to help it scale better in order to allow for more transactions per seconds. There are two popular solutions to fix scalability, one that requires a change to the coin’s protocol (blocksize increase) and one that doesn’t (Segwit implementation). To make things worse, their community is actually split into several groups, mainly the community (traders, holders), devs (Bitcoin Core, Bitcoin Unlimited) and miners. All these groups have their own motives and interests, and that makes coming to a middle-ground and making a decision all can agree extremely hard. Also, because Segwit only requires miners to signal for it, it could be argued that the actual trading/holding community doesn’t have much weight in this whole debate as they can have only a very minimal impact on the signaling.

In the second case, Ethereum community was faced with a tough decision last year when their The DAO smart-contract got hacked and somebody was draining all funds from it. They had the choice to either let the attacker get away with all the funds, or make a modification to the The DAO contract that would have blocked the attack and refunded everyone. The second option, however, required a hardfork and it ended up being quite contentious, causing a chain split (Ethereum and Ethereum Classic). Furthermore, the polling method the Ethereum Foundation choose to use was a bit confusing. They first proposed a “Carbon Vote”, which was a method they quickly implemented to allow people to vote based on the number of coins they were holding. After much criticism, notably from the mining community, they then opted to adopt a more classic method of polling in crypto which is based on miner’s hashing rate (actually almost identical to how Bitcoin is polling its community to implement Segwit or not).

We can easily see what are the main issues with how both scenarios dealt/are dealing with critical decisions. First, simply relying on miner signaling probably isn’t entirely fair to the rest of the community who doesn’t mine. It is true that anyone can use his computer to mine on whatever pool they want based on what decision the pool is taking (what is it signaling for), but not anyone has the knowledge or gear to do it, and whether this can rival with the mining farm’s massive hashing rates is arguable. Also, even though the Ethereum Foundation says it also took the Carbon Vote in consideration when deciding to go for the hardfork, there were a lot of complaints from people saying they actually never heard of it. After all, only a very tiny percentage of the network went ahead and voted, so perhaps it was too complicated for most people or that the word didn’t spread fast and far enough. What makes it worse is that the voting was based on how many coins you were holding, basically making it a 1 coin = 1 vote. While that is not a bad thing in itself, it is relatively easy to game for anyone with deep pockets. An entity with a lot of money could have bought a large sum of coins, put them up for voting, and then dumped then once it’s said and done.

So with these lessons in mind, the Particl team decided to natively implement a voting system on its blockchain that can be used any time a tough decision needs to be taken by any party. Note, however, that this voting system isn’t only used to upgrade the protocol, it can be used by anybody for any reason. It could even be a vendor using the system to poll his customer base about what product they want to be added to the store, for example. They knew the system had to have a couple of key characteristics to be optimal, namely being as decentralized, cheap and limit abuse/fraud as much as possible. So how did they do it?

The Particl voting system is based on staking and is absolutely free. People wanting to vote on a particular matter need to first select their desired voting option and then make their wallet enabled for staking (which has the added benefit of further securing the network). Every time they stake a block, that will count as 1 vote. The entity who first sets up the vote parameters needs to specify to the community for how long the voting period will be open, specified in terms of block numbers (i.e. for a period of 2,500 blocks). This makes it harder to game as a large entity cannot simply buy, vote and dump instantly. They need to hold the coins for X number of blocks and actually secure the network doing so. Additionally, not only is it completely free to vote, it does reward voters with staking rewards, which definitively is an incentive to vote on stuff and not just hold the coins and go with the flow. The in-wallet integration (notably using widgets) also makes it very easy and user-friendly to participate. The only thing that requires a bit of research is that the voting content (description of the vote, pictures, graphs, etc) will be done off-chain, most likely on Github at the beginning. Once IPFS or similar DSNs are implemented, it would then be trivial to also make the voting content in-wallet.

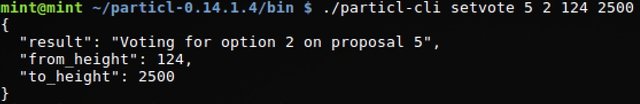

A CLI example of a user voting for option 2 on proposal #5 from block 124 to 2,500

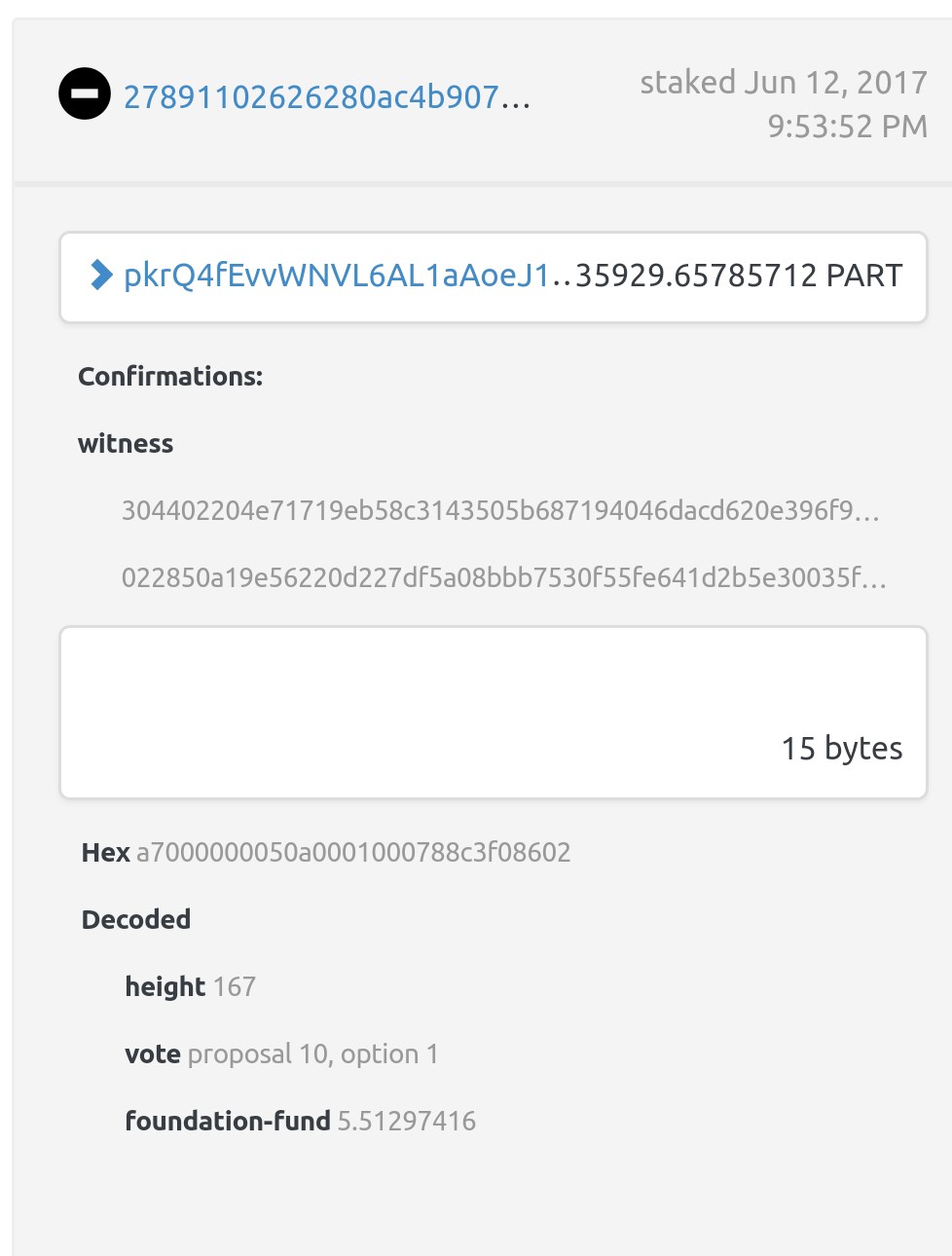

A staked block’s vote result (a staker voted for option 1 on proposal 10 at block #167)

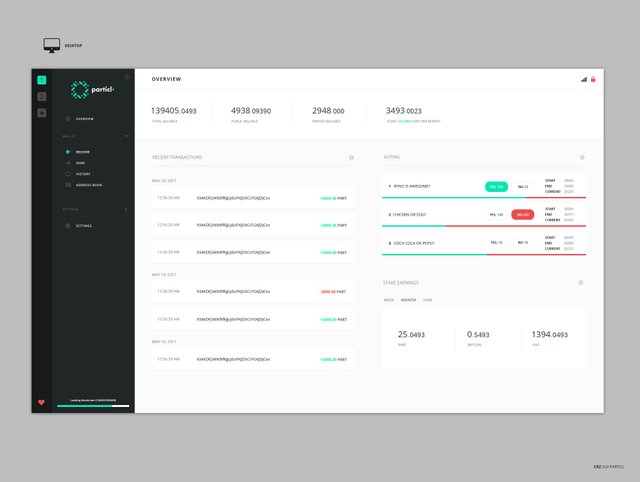

Particl wallet showing voting results displayed in a GUI widget

Decentralized & Anonymous Encrypted Messaging System

“Communication is an essential component of doing business. Modern technology gives us cheap, reliable and effortless methods to communicate with others regardless of physical distance. However, this technology does little to safeguard the content of our messages from the scrutiny of interested observers. We live in an age of constant and ubiquitous surveillance, where it becomes more difficult by the day to retain our privacy. Privacy is paramount when conducting business, the consequences of invasions of privacy can be devastating to both businesses and individuals, whether the attacker is a rival firm, a malicious individual or an overbearing government”. (https://doc.shadowproject.io/#encrypted-messaging)

Particl has its own messaging system, SMSG, used as a DSN to host listings on and “to perform communication between merchant and buyer. All nodes participating in the network store all messages of the past 48 hours, this means anyone in the network could have been the sender or receiver. The benefit of the decentralized topology is that there are no direct ties between the messages and any IP addresses. Nodes must try to decrypt all incoming messages to check if it was destined for them”.

As explained in the Particl whitepaper draft, “A message traveling on the BitMessage network does not include metadata that can reveal who the receiver or sender is. Only the encrypted payload, IV, HMAC and temporary public key are public, the receiver of a message is the only able to decrypt the message and only for them the HMAC will properly verify.

A message traveling on the BitMessage network does not include metadata that can reveal who the receiver or sender is. Only the encrypted payload, IV, HMAC and temporary public key are public, the receiver of a message is the only able to decrypt the message and only for them the HMAC will properly verify.” (https://github.com/particl/whitepaper/blob/master/decentralized-private-marketplace-draft-0.1.pdf)

While there is definitively some area of improvements the team is currently working on, notably concerning dual-key stealth addresses, future and forward secrecy, scalability, blockchain key distribution and RMIDs efficiency, this p2p messaging system offers a safe option for people looking to communicate and host market listings with the highest level of privacy possible.

Native Segwit Implementation

Another sweet feature of the Particl blockchain is that it has a native implementation of Segwit, which I believe is a first in crypto. One small inconvenience with blockchain projects forking their chain to add Segwit is that witness blocks aren’t compatible with blocks prior to the fork. While this is not a critical problem, it sure makes things smoother and easier to have a fully compatible Segwit implementation.

Having segregated witness on Particl gives its blockchain a couple of interesting features. Among many of these, some notable ones are the Lightning Network, transaction malleability vulnerability fixes, and block capacity/size increase.

Lightning Network is a payment channel protocol first proposed by Joseph Poon and Tadge Dryja and now scheduled for implementation on Bitcoin as well as some altcoins. LN gives interesting features to whatever coin decides to implement it such as reduced transaction fees, increased transaction speed, better privacy, and atomic swaps.

As it is becoming more and more likely as time goes by that the Lightning Network will be implemented in various different coins, its atomic swap feature is getting more relevant. Atomic swapping is the ability of an LN-enabled blockchain to be made inter-operable through multi-signature addresses and time-locks with many other LN-enabled blockchains in order to allow trust-less coin exchange between two parties (i.e. Alice can trade 100 LTC to Bob for 1 BTC in a 100% decentralized and counterparty-free fashion). This could even be used to create decentralized multi-coin payment processors or exchanges, effectively spawning a brand new and potentially breakthrough LN-focused ecosystem in which Particl could be part of. It also seems plausible that the Particl platform would eventually leverage this feature to allow trust-less currency exchange on its marketplace as well as other Dapps, effectively replacing Shapeshift with a cheaper and decentralized alternative, even though the team hasn’t made any statement on the matter.

Industry-leading & User-friendly Graphical Wallet

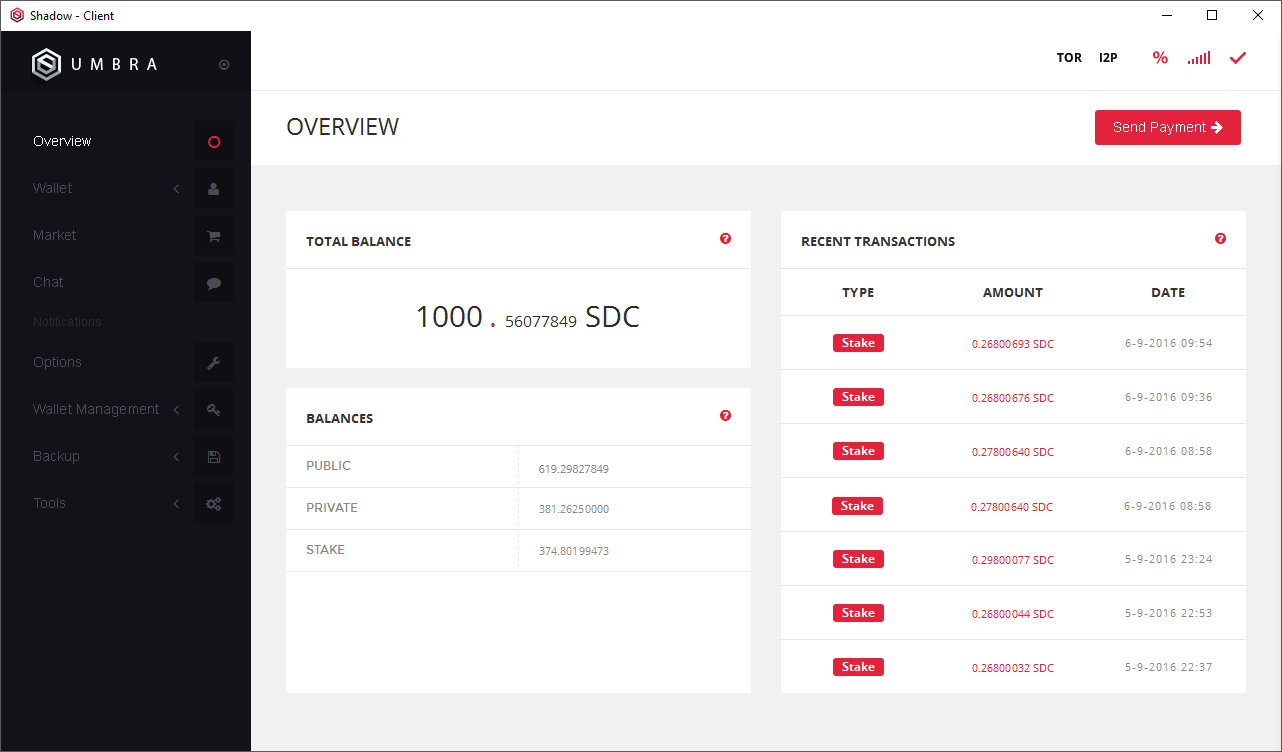

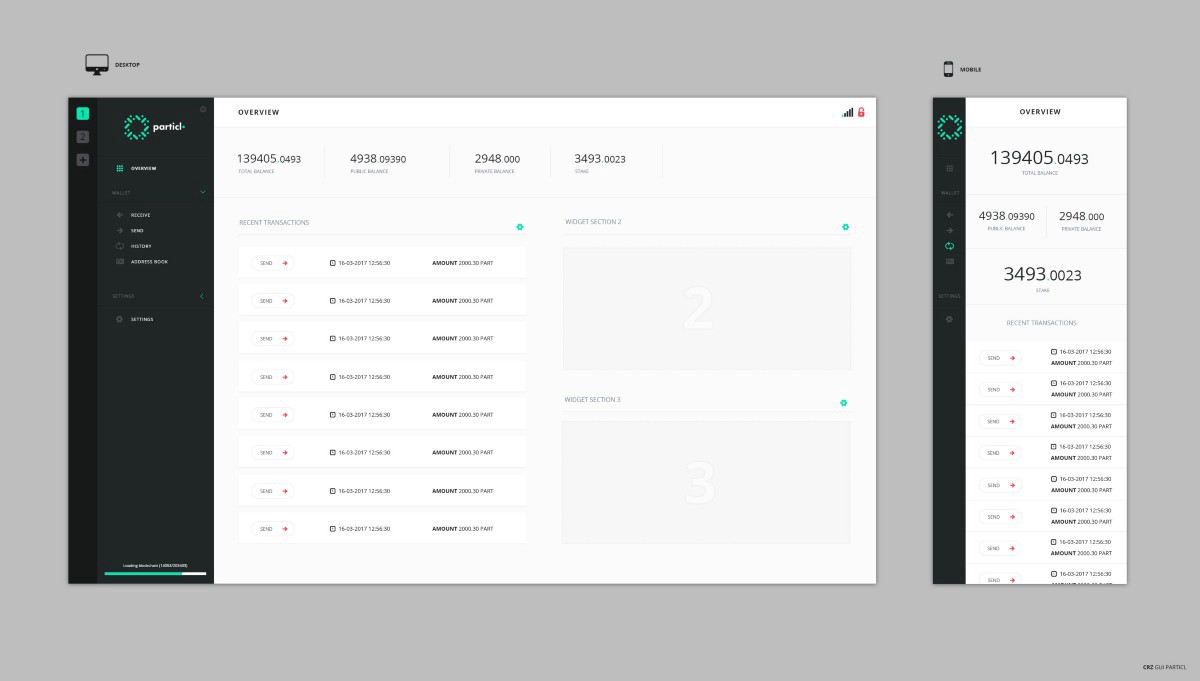

All the aforementioned Particl features wouldn’t be as exciting if they weren’t supported by a user-friendly and eye-appealing wallet. Not everyone wants to use terminal-based wallets and even fewer people know how to. Fortunately, the Particl team has some of the best graphical designer and UI/UX devs in the crypto scene, as evidenced by their previous work on Shadowcash’s Umbra wallet built using HTML5.

Graphical designed of SDC’s Umbra wallet, Particl’s prototype released in 2016

This time, the team has taken their GUI work to the next level! Started from scratch, the Particl wallet is built using the open-source project Electron (https://electron.atom.io/) and AngularJS (https://angular.io/) as its main framework, the Particl wallet does away with the QtWebKit engine on which is created all the crypto Qt wallets to make it more secure, beautiful and flexible. At this stage of adoption, it is very important for a blockchain project eyeing the mainstream to have its platform as easy to use as possible. Indeed, Particl’s end-game is to make almost everything related to crypto work seamlessly in the background while offering users a very intuitive experience not more complicated than using web-based marketplaces such as Amazon, eBay, etc. A web portal (a website where one could use the Particl marketplace without even downloading the wallet and blockchain) is even planned for later, though the team is currently focusing on first releasing the market.

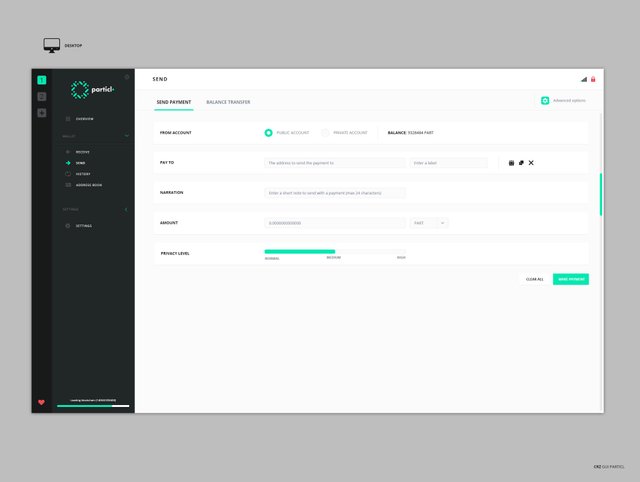

Particl’s “Send” page

Security-wise, Electron offers substantial improvements over QtWebKit because of how rendered processes are sandboxed leveraging Chromium’s rendering engine. “A sandbox, in computer security, is a security mechanism in which a separate, restricted environment is created and in which certain functions are prohibited” (https://www.techopedia.com/definition/27682/sandbox-computer-security). In Particl’s context, it means that if an attacker was to exploit a vulnerability within a Chromium rendered process, the damage would severely be limited to this very process and could not spread to other processes due to the engine’s sandbox.

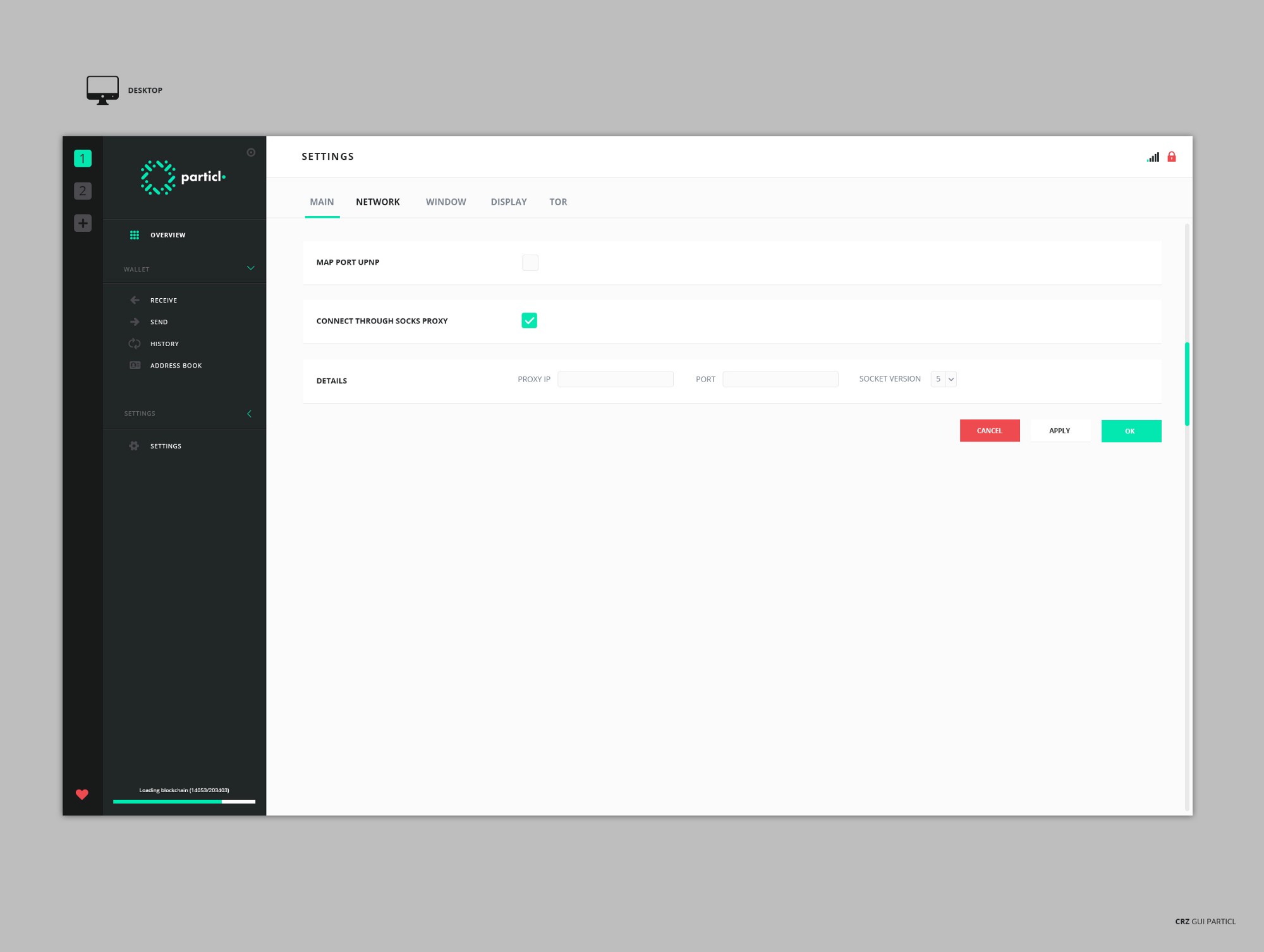

On the aesthetics side, the interface is made much more appealing than the famous Qt engine. Written entirely in HTML, CSS, and Angular, it is much more interactive than any crypto wallet currently released and is designed with a “modular” approach to it. Indeed, the wallet supports the use of many widgets which can be selected by the user depending on what information they want to quickly be able to glance at. They display much useful information about the wallet in a neat visual fashion, and users can very easily customize how their wallet looks by adding/removing whatever widget they want. Elements they can display include (but are not limited to) staking data, voting data, transaction history, marketplace data, network data, etc. As they are basically only visual representation of blockchain/p2p data, it is very easy to add more of them. It will be very interesting to see what the community comes up with in terms of useful widgets they can code and add to Particl. Also, as the project advances in time and new Particl Dapps are created, using widgets will lead to very different and personalized experiences from person to person depending on what is their main reason to use the Particl wallet (staking investment, shopping, holding, gambling on a Particl Dapp, etc).

Particl wallet widgets overview & responsive capability

Particl’s “Receive” page

Particl’s “Settings” page

For more screenshots of the Particl wallet, you can either visit this link of GUI progress screenshots (http://imgur.com/a/AwNSX, posted on May 22nd, so may be outdated) or simply go ahead and participate in testnet #4 which is the first iteration of Particl testnet to include a GUI version.

Wallet Installer

Another useful feature the GUI wallet will have is an installer that automatically pops up the first time a user launches the wallet and offers to set up lots of stuff such as wallet file importation, privacy sliders (a user can choose how much privacy he needs to set up DSNs), tor installation, etc. Again, as the project grows, a lot can be added to the installer to make it even more useful and render the experience as user-friendly and customizable as possible.

Future Features

Even though Particl will already offer quite an impressive set of features on day 1, the team has much more goodies planned for the future.

One of them is a mobile wallet with ALL desktop features enabled, including messaging and marketplace shopping. The only aspect the team is not sure wants to integrate to its mobile wallet is staking since it has a couple of drawbacks (potentially high number of unstable nodes due to bad phone signal reception, battery draining, possible security vulnerabilities, etc). Of course, the dev team sure has some aces up its sleeves but for now, all the focus is on releasing the marketplace in the first place.

Fiat gateways are also high on the list of priorities. While a solid crypto marketplace could find its niche within the crypto world, it would be much more difficult to go mainstream if it didn’t support integrated fiat deposits and withdrawals. In a way, this is already covered through the Shapeshift integration using Tether (USDt), but more options are always appreciated. The team is considering many partnerships with fiat gateways, for example, Changelly which allows the use of credit cards as a funding method or using exchange API keys to integrate fiat pairs into the wallet.

Another future feature of the project is to establish web portals on which people can access some (or all) functions included in the desktop wallet. The end-game here is to allow people to shop on the marketplace using a website and without having to download the wallet and the entire blockchain. This would make it much easier for regular, non-crypto people to use and is one of the things that could greatly help Particl have a shot at becoming mainstream.

The team is also looking to integrate more DSNs through partnerships (Siacoin, SafeNetwork, IPFS, etc) and others method of network routing such as i2p. This is of course with the goal to provide users with a vast array of choices to suit their security needs and budget (as DSNs can vary in fee pricing).

Competition

With all that being said, it is now time to look at who are Particl’s competitors. After all, the crypto world is now an extremely competitive space and it could lead to several BETA vs VHS or blu-ray vs HD DVD situations where many projects would compete in the same sector until one becomes big enough to stomp its competitors out of business. Hopefully for Particl, it has one huge advantage in the fact that it actually competes in several sectors, dramatically increasing its exposure and chances of success. Please note that the following paragraphs will contain a lot of subjective opinions on why I believe Particl is a serious competitor in many industries, so take it with a grain of salt and come up with your own conclusions.

As A Currency

Particl definitively meets the criteria to be considered a competition in the payment currency sector of crypto. Not only does it possess all the same features as Bitcoin and other similar currencies, it literally hosts a decentralized marketplace on its wallet on which its native currency is used to trade goods and services. This is a use-case that very few currencies can claim to have, but it doesn’t stop there.

This currency also is a major competition in the field of privacy coins where Monero, Zcash (and similar ZK SNARKS coins) and DASH and furiously battling. Just as in the payment currency sector, Particl doesn’t need to shy away here at all. It does possess a similar (and arguably better) implementation of Monero’s privacy tech, RingCT, and even adds Lightning Network + CT on top of it a very impressive privacy combo (RingCT + CT + LN combo). This should be very interesting for a lot of people and projects that wanted to easily add a RingCT coin to their platform (i.e. Jaxx wallet).

As A Marketplace

Another obvious crypto sector in which Particl is a serious competitors is marketplaces. This space has a limited number of competitors such as OpenBazaar, Syscoin and Bitify. Personally, as an investor, my subjective opinion is that decentralized marketplaces are going to become a big thing in the years to come. This is why I research these projects a lot, and my conclusion is that Particl has the most potential as a market through its user-friendliness and the many features detailed throughout this presentation. Its two main competitor, OpenBazaar and Syscoin, do have some interesting features but I believe they will not outperform Particl in terms of both popularity and investment returns.

In the case of OpenBazaar, it is simply not possible to invest in it and while it charges no fee, it’s user experience is years away from any kind of mass adoption and has a p2p approach I am not too fond. It also offers poor privacy and security parameters and should not be relied on by vendors looking for the ultimate privacy experience. What I find to be the most annoying about OB, though, is that a vendor needs to host his shop on a computer/server and leave it open at all time. Failing that, the listing is put offline and the vendor cannot make any sale. It is possible to host your shop on a third-party server to make it more reliable in terms of up-time, but that is taking the control out of your hands and a security risk as well as going against the decentralization principle of the crypto world. OpenBazaar plans to launch a second version of their marketplace using IPFS which would allegedly eliminate the need to have a computer open at all time, but that does imply that they will need to introduce a fee structure to their platform.

With Syscoin, there are other problems that I see as well. The first one is that the user-experience is simply horrible and the wallet itself is not eye-appealing at all. Their solution for this was to create BlockMarket, a more user-friendly but closed-source interface interacting with the Syscoin blockchain. While it is definitively better looking than its Syscoin backend, it is still years away from any kind of mass adoption and its look would most likely turn off anyone that is not involved in crypto. What worries me the most about Blockmarket, however, is that it is basically a glorified centralized marketplace. In fact, The Blockchain Foundry (the company who developed BlockMarket) has total control over what content is hosted on its market. It can ban users and delete/censor listings at will, which lead me to wonder why one would even use the platform as it actually doesn’t provide much that centralized marketplaces such as Amazon and eBay don’t. It also doesn’t provide the set of privacy tools Particl offers, making it a no-go for any vendor looking for high levels of privacy. Also, purely as an investment, I believe Syscoin to not be as worth it as Particl because people can use other currencies on BlockMarket without having to touch Syscoin wat all. This is also the case with Particl, however the latter automatically converts all other currencies into its native coin (PART) in order for a market order to be possible, so even though a user buys something with Bitcoin, it ends up being a Particl transaction, generating demand. It also should be noted that Particl is PoS while Syscoin is PoW, and I believe the proof-of-stake protocol is more fitted for a marketplace as it allows a lot of great features such as decentralized market governance and market fee earnings. Lastly, another problem I see with Syscoin is that should it become very popular, it would have some serious troubles with scalability as all market data are stored directly on-chain (contrary to Particl which stores data off-chain on DSNs).

Though it may seem that I am hating on the other projects, really I am not. I do believe this kind of industry can and will have enough place for more than one marketplace. After all, we have Etsy, eBay, Amazon, Craigslist and Alibaba all co-existing and sharing the same space, but with each one having its niche features and appeal to different audiences. There is nothing indicating that this could not be the case in the crypto world as well. Here, Particl definitively is the most secure and private solution, and this is what excites me the most as a privacy enthusiast.

We should also not forget about centralized, well-established marketplaces such as Amazon and eBay. These giants sure do have a huge share of the global market and have some really great features decentralized marketplace can probably not even dream offering (at least for now), but they do have negatives that decentralized solutions can do better. Please refer to the previous “Target Users” section of this presentation, or read my previous article on this very subject by following this link: https://decentralize.today/who-is-going-to-use-particls-decentralized-anonymous-market-and-why-is-it-so-badly-needed-7eb79cc8b9ad

I believe that decentralized marketplaces can compete with centralized ones in these aspects:

-Controversial & potentially illegal goods & services

-Perceived gray area businesses

-Unfairly blocked businesses

-People looking for better protection of personal/corporate data & documents

-Taxation resistance & revolts

-People from the unbanked world where banks and e-commerce websites are not present

-Much lower fees than centralized counterparts

-Any crypto user looking to shop with his favorite coin

As A Dapp Platform

Even though the competition with Dapp platforms such as Ethereum, Stratis, Lisk or Tezos in not as direct as Particl competition in the marketplace sector, it is still a platform on which more “Dapps” than the marketplace will be built. It is very important to understand that we are not talking about smart-contract Dapps here, but rather hard-coded decentralized applications. To give you an idea, a year or so ago, an SDC community member had started working on a dice Dapp that allowed people to gamble directly on the SDC wallet. The project was abandoned and the community member disappeared, but that gives a good idea of what kind of Dapps Particl could host. The use of DSNs open up a lot of possibilities, I wouldn’t be surprised if we ended getting decentralized Netflix/Youtube/Music Stores powered by DSNs such as IPFS or Siacoin.

The main difference with Ethereum in terms of Dapp is that Ethereum is more like an operating system similar to Linux where users are given full liberty to code any smart-contract with its native programming language (Solidity), whereas Particl is more like a WeChat-style application on which apps (not smart-contracts) can be added to. To get a better idea, Paul Schmitzer, Particl’s communication manager, floated the idea that Particl could one day have its own “app store” from which users could install whatever decentralized application they want to have on their Particl wallet. It is worth noted that Particl Dapps are probably going to be much more scalable than smart-contract platforms as they would work using DSNs (SMSG is not immensely scalable, but IPFS, Siacoin or SafeNetwork are).

Conclusion & Personal Comments

For all the reasons and features mentioned during this presentation, I believe Particl is one of the most under-rated and undervalued projects of the crypto space at the moment. Its impressive set of privacy tools, its highly profitable staking reward schedule, and its highly scalable marketplace/Dapp ecosystem makes it extremely likely that Particl will become a popular and widely used crypto-currency in a not so distant future. Another thing that I really like about it is that it is building an entire ecosystem rather than being a simple “feature coin” (a coin that mostly does ONE thing well). Not only does having a working ecosystem around your coin makes it more resilient to being outdated by newer technologies, it also creates a real demand for it rather than just deriving its value from trade speculation. This ecosystem is supported by a 5% (which will most likely turn into 10%) yearly investment return, on which is added market/Dapps/Txs fees and busted escrow funds.

Let’s crunch some numbers. If one would buy 25,000$ worth of PARTs at 25$, it would give him a total of 1,000 PARTs. If he were to stake his entire balance, he would be guaranteed 5% yearly, paid every day. The actual more likely number would probably be 8–10%, so let’s round it up to 9%. This staker would make around 0.25 PARTs per day (1,000 x 0.09 / 365 = 0.24657), or about 6.16$. At the end of a full year, considering no PARTs were spent, he would have an estimated balance of around 1090 PARTs, a 9% increase valued at around 2,250$ profits. The actual formula to estimate staking profits per day is as follow: Balance x estimated yearly % returns / 365 x PART price

That amount, however, is assuming that no transaction happens in the marketplace and that no one makes any transaction on the blockchain since no transaction fees are added into the formula. To calculate how many additional PARTs one would from the marketplace fees, it is possible to use this formula:

(Estimated number of marketplace listings x 0.01 x 0.5) / 100 x (PART balance x 100 / Particl total circulating supply)

If the marketplace was to host 50,000 listings, the staker in the example above would receive an additional 0.3 PART a day, or 11.93 PARTs a year. At 25$ per coin, that would earn him additional 298.20$ per year for a total of 2,548.20$.

Again, there are some missing numbers that are harder to calculate such as daily transaction fees and busted escrow funds, so it is almost certain that the actual staking profits the staker in this example would make in real life would be bigger. It is also not taking into consideration the future Particl Dapps that will end up generating fees as well, making staking rewards even larger. I really do believe these interesting figure could propel Particl in the top 10 cryptocurrencies.

Please visit this link to download a spreadsheet I’ve made that will help you calculating your staking revenues taking compounding, Particl Foundation donation and market fees into consideration: http://onlyo.co/2uQdLoM

The only major problem I see with the currency itself is that it could eventually have scalability problems similar to Bitcoin and Ethereum during popular ICOs. Yes, the project will soon get Lightning Network once it is ready, but it is likely that it would be mostly useful for micro-transactions rather than ALL types of transactions. Besides, RingCT transactions cannot be processed through LN and are certainly NOT lightweight in terms of what space they use within a block. Even though I have heard from one solid and reliable source that the team does have plans and methods they are exploring that could potentially make its currency scalable similar to DASH’s levels, nothing has been publicly revealed (or even hinted at), so it shouldn’t be taken into consideration until this is publicly discussed. However, if Particl should ever have currency scalability problems, it would actually be a pretty good problem as that means the platform would already be quite popular and its coin very valuable. Note that there is a distinction to make between currency scalability and market scalability, the latter being already successfully dealt with.

This concludes this Particl presentation. Don’t forget that any piece of opinion expressed in this presentation is purely subjective and that this document does not constitute an investment advice in any way. I am also not a Particl team member and have not been paid to produce this post. However, I do own some PARTs as an investment.

You're a brilliant man! I like your posts!

@anatolii

Nice Job!

Keep the good work up!

Thanks for sharing