The MSME Sector: The What, Why, and How

Companies are springing up in every part of the world monthly, and only a few of those can scale through the market in the long run. If the structure of the business environment had been viable, the hundreds of companies that fold up after a few months wouldn’t have taken that path. But, since the system had been designed in a way to suppress the newbies, and give more opportunities to those that successfully beat through the bearish markets, then the startups might have no chance at all. Hence, we should be expecting the imminent collapse of many Micro, Small, and Medium Enterprises (MSMEs) in the future if nothing is done about the malaise going on in the emerging markets.

The What’s of The MSME Sector

What are the challenges faced by MSMEs/startups? What triggered the problems, and what can be done to address the same?

The challenges facing the emerging markets include but not limited to the inability to decipher the credit score of MSMEscum borrowers that need loans to continue with their operations. In such a case, the lenders (such as the banks) might find it challenging to evaluate the financial standings of such borrowers and the risks of doing business with them. Also, MSMEs have high-interest rates to battle with any time they get favoured to get financial instruments like loans.

On the other hand, potential causes of the challenges include the excessive efforts by established brands to reduce the chances of MSMEs’ growth. They do that by instigating the lenders to increase their interest rates, especially by borrowing higher sums and paying higher interest rates. That is something their counterparts in the emerging markets might not be able to do.

Therefore, if the problems in the emerging markets must be resolved, then both the high-interest rates and the excessive interferences of the established brands have to be stopped. The only way to achieve that is by focusing on the robustness of a decentralized architecture, such as the one presented by the Pngme blockchain platform.

Why Pngme?

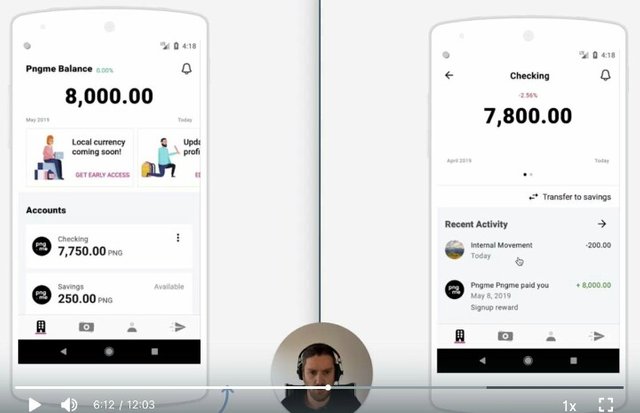

Pngme is needed at this time to resolve many of the challenges rocking the conventional financial market. Worthy of note is that aside from the basis on the blockchain technology, the platform also doubles as a decentralized mobile finance platform where it instituted a marketplace lending structure for businesses.

By using the Pngme platform, MSMEs would, among many other things, derive innovative financial inclusion as opposed to the restrictions in the conventional setting. It would now be possible to get the needed loans directly from the lenders, provided the credit scores of the borrowers are in good shape.

How Possible Can It Be?

With the backing by the blockchain technology, Pngme already has plans in motion to launch a decentralized marketplace lending platform for the seamless matching of the borrowers and the lenders. Also, it has devised a mobile finance platform

that includes all the necessary tools for smooth and hassle-free mobile banking for the emerging markets.

Conclusion

Micro, Small, and Medium Enterprises (MSMEs) can now thank their stars because the innovative financial inclusion courtesy of the Pngmeplatform would go the extra mile to boost the availability of funds for the borrowers (MSMEs) while providing the lenders with in-depth information about the financial standings of the borrowers.

So, if you’re part of the burgeoning MSMEs market or you’re a lender looking for ways to invest and cash out massive returns, you can’t afford to miss the golden opportunity presented by Pngme.

To know more about pngme, please check the links

USEFUL LINKS

Website: https://pngme.com/

Whitepaper: https://docsend.com/view/x4ts5tm

Telegram: https://t.me/pngmecommunity

Twitter: https://twitter.com/pngmemobile

Facebook profile: https://www.facebook.com/pngme

Writers Details

Bitcointalk username: inosend

Bitcointalk profile link: https://bitcointalk.org/index.php?action=profile;u=2439441

Congratulations @anosend! You received a personal award!

You can view your badges on your Steem Board and compare to others on the Steem Ranking

Do not miss the last post from @steemitboard:

Vote for @Steemitboard as a witness to get one more award and increased upvotes!