REMIIT is a decentralized platform that unites enterprises and private users for money transfers based on the principles of openness and trust

The platform works on reference as the occupation of the blockchain network of server with the customs of the decentralized with the transparency as offering modest on systematical template as clients to manage collateral relation with different members within the network from abroad as following use on scheme with the details of reference to complete of tasks with the money transmission on qualification of the framework to follows of dtandard requirements as providing valid on smart contracts to work on customs with the medium of finance as managing scheme on accounting with the works as the business of personal company.

REMIIT, THE GLOBALIZATION CATALYST.

There are numerous obstacles between nations which have been lowered and the global communications of people and goods have become more appropriate. More to its development of the internet which has improved or increased in number of overseas remittance and payment. The obstacles between users are still high and transparency continues to be an accordant or prolong problem.

Overseas remittance transaction are slow and ineffective due to their limitations in scalability and expendability.

Moreover, the emergence of an exchange rate when discussing global finances are changing in as different countries have different political and economic interests. The fees for foreign currency exchange among financial institutions varies and participants have paid more than necessary for exchange fees. There have been various innovative trials, attempts, initiatives to curb inefficient structures through technologies based on the blockchain. The “Genesis” generation blockchain was transparent security oriented through the distributed ledger technology but the second generation blockchain [ such as ETHEREUM ] the core technology deals with smart contracts & scalability. Enhanced and growth block capacity and speed handling which has been consistently brought is already widely known as technology that will be first applied to overseas payments and remittance business.

Remiit platform then aims to be a revolutionary initiative as a catalyst for development of a more efficient & innovative structures for overseas remittance and payment and provide these various services in each and every country.

PROBLEM

The current overseas remittance and payment methods have a substantial varieties of problems. The major problems raised by the overseas remittance are the expensive fees and slow transaction speeds. A lot of institution or companies have each suggested various solutions against these expenses. Remiit looks at these issues from this standpoint:

There are numerous reoccurring overseas payment issues in the huge scale of overseas remittances market, which is observed by “issues related to trade & use”.

Remiit looks at the problems in terms of reliability [security], cost effectiveness[commission & efficiency] & infrastructure[ right to have various services & market scalability].

1.RELIABILITY & SECURITY ISSUES; Nobody wish to invest /trade in something they cannot trust. Reliability therefore is an important element in overseas remittance. Anyone sending money overseas needs another oversea business operator which can be trusted. This huge problems gives away for individuals & business to go through the SWIFT networking. SWIFT network is both time consuming and expensive for participating individuals and financial institutions.

2.Hacking has become a serious threat to security. SWIFT network has caused a steadily increase in the amount based in actual remittance.

3.Trust is relevant in the establishment of business alliances between money transfer operators and verification of this trust requires a wonder deal of time and effort. KYC/AML is intended to verify the reliability of multilateral such as “ Individual-Company-MTO” in overseas transactions. Currently, the verification which is required to go through every time you use it, is too complicated & difficult. Monopolistic system has made it difficult to have transparency in overseas transactions and very few organizations/ institutions are worth of trust.

COST EFFECTIVENESS [ Commission & Efficiency] ISSUES; In the centralized financial systems, fees are raised only because of its market is monopolized by this limited number of players. Here, cost effectiveness implies not only reasonable pricing but also efficiency. SWIFT network, increases commissions for overseas remittances. Overseas remittance business are also less cost-effective technological investments for security also result in high cost. This leads to be inefficient structure where all related cost goes back to the remittance participants.

INFRASTRUCTURE ISSUE; consumers have the right to be supplied with various forms of services. To provide such variety of services, we need to move from the monopolized and centralized systems, the overseas remittance or settlement is likely to expand further.

Every user wish to have an effective and faster overseas remittance and payment service but there is still a lack of infrastructure where the service can be compared and selected against its competitors.

The above-mentioned problem in transparency conceals the market, hindering infrastructure development. Overseas remittance and payments are locked in a non-transparent environment.

The stated problems above shows they are neither a separate nor an independent problem. Exclusively, Remiit recognizes that all the problems seen in oversea remittance and payments are largely attributed to “ what happens when we send or receive something”

THE SOLUTION; THE REMIIT ECO-SYSTEM

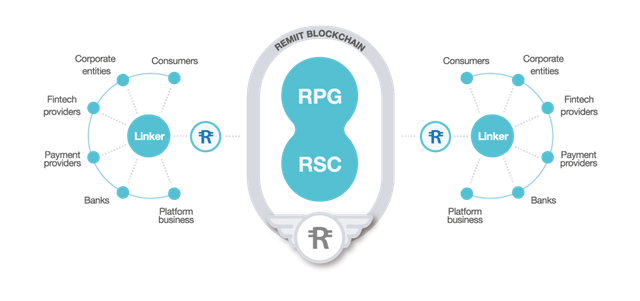

Remiit brings to the community a new innovative perspective way in the business of transaction; thus the Remiit own Ecosystem based on blockchain technology.

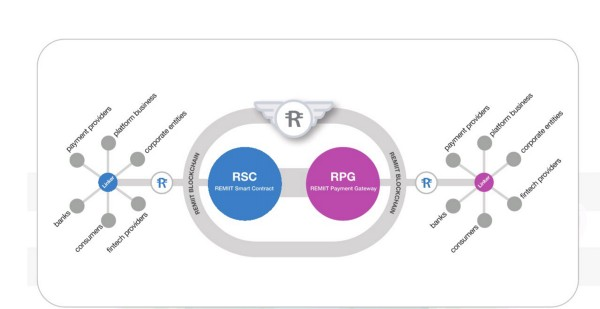

Foreign exchange for remittance process lies at the bosom of overseas remittance or payment. Therefore, Remiit has designed the Remiit Smart Contract [RSC] to make the process scale efficiently. Each participant of in the Remiit Ecosystem are placed at the center of the business relationship.

To do this the Remiit, “RSC” with Remiit Payment Gateway Protocol [RPGP] have combined to expand to “payment through the remittance platform.

With these basic infrastructure available in the Remiit ecosystem, each partaker can create various ways or channels to overcome existing problem. Limitations on previous foreign exchanges ecosystem will be overcome by various channels, the market will expand and the business will grow.

Remiit offers a low cost commission to business participants in oversea remittance at various levels as well as “RSC” which will help connect to the extended network. “RSC” provides specific interface to various participants in remittance or payment process to leverage smart contract in a more organic way. “RSC” -based business expansion is the fundamental core and first step in the Remiit ecosystem. If the oversea remittance process is effectively intensified with “RSC” and insurance of the Remi Token, the Remiit ecosystem will be able to expand the entire business up to the payment infrastructure. “RPGP” has therefore been designed as a protocol to organically link “RSC” that covers payment transactions. Through “RPGP”, participants and payment providers in related business can explore overseas business by linking to “RSC”. This great opportunity gives “RSC” participants the freedom and reliability to open new business opportunities beyond the existing remittance services.

PARTICIPANTS

Payment Providers

Banks

Fintech Provider

Platform Businesses

Consumer

Corporate Entities

REMIIT COMPONENTS

- Remiit Smart Contract

ü RSC Store[Linker Matching System]

ü RSC Communication Channel

ü Reputation System

Remiit Payment Gateway Protocol

Remiit Token

Remiit Service

ü Remit Linker Protocol

ü KYC/AML Solution

ü Remiit Wallet

2018 Q3

Private-sale

Pre-sale

2018 Q4

Crowd-sale

KYC/AML

2019 Q1

Remiit Smart Contract MVP.

Wallet MVP.

2019 Q2

Remiit DEX MVP

2019 Q3

Remiit Linker Protocol SDK.

Remiit Applications.

Partnership with main linkers.

2019 Q4

RSC Launch

Remiit Wallet Launch

Remiit DEX For Main Linkers Lauch.

2020 Q2

Remiit DEX Expansion

2020 Q3

Remiit Payment Gateway Protocol MVP

2020 Q4

Partnership With Main Payment Providers.

2021 Q2

RPGP Launch.

Service Expansion.

Partnership For The Future Ecosystem.

STEVIE AN……….CEO

BluepanNet Founder

LOGAN HONG………CTO

BluepanNet CTO

RYAN MOON……….CXO

BluepanNet CXO

Neospring, Fintech CIO

JAY JUNG………CFO

MSC/Ph.D In Financial Engineering

DANNY KIM………GLOBAL REMITTANCE MANAGER.

YUCHAO LI……..BUSINESS DEVELOPMENT

MANAGER.

HANG SLIN……MARKETING & PR MANAGER

VIBEO ADVISOR

AIESEC IN KOREA

REMY LOBUS…..REMITTANCE ASSISTANT MANAGER

BluepanNet Remittance Manager

FREEND CHOI….SOFTWARE MANAGER

BluepanNet Software Manager

HUNTER SLIN….BLOCKCHAIN ENGINEER

BluepanNet Global Operation Manager

ARUP GHOSH…..BLOCKCHAIN ENGINEER

Research Publications

JOEY LEE……..BLOCKCHAIN ENGINEER

BluepanNet Software Engineer

LINKS:

WEBSITE: https://remiit.io/

TELEGRAM: https://t.me/remiit

WHITEPAPER: https://remiit.io/static/remiit/images/whitepaper_REMIIT_Eng.pdf