DAGT: The Digital Asset Credit Platform Built on Blockchain Technology

Blockchain technology has been known worldwide. The blockchain technology is adopted by different companies, organizations, and institutions for different purposes: educational, financial, healthcare etc.

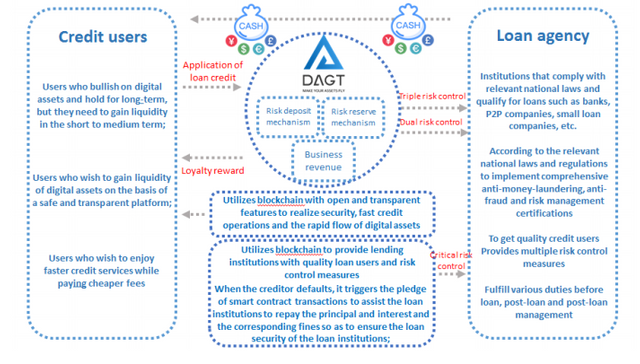

DAGT is one of the platforms which is built on blockchain technology. The objective of this platform is helping the digital assets (in this case cryptocurrencies) holders to manage, or specifically, to increase their digital assets by leveraging it for credit and loans.

Background of The Project

There is nothing wrong with our existing credit and loans providers such as banks, traditional credit and loans agencies, and other financial institutions. They only have weaknesses: the inefficient procedures, customers’ privacy, and high operational costs. All of the weaknesses impact on the less number of credit users.

For example, the lenders are forced to judge whether a person will be a potential user or not only based on his credibility and qualifications. How they do that? By asking for sensitive personal data, proof of income and assets, tax certificates etc. Not to mention the high costs spent to fulfil the requirements. The procedure is too cumbersome for the potential credit users. That’s why DAGT with its blockchain technology creates a new system for both of lenders and credit users.

DAGT Ecosystem

By using blockchain technology, DAGT will eliminate the unnecessary procedures of the current credit and loans system. DAGT will create a simpler, efficient, and less expensive operations. Still, at the same time still ensure the trust, transparency and security of its credit model.

By joining the DAGT platform, loan agencies are able to use credit loan data provided by the platform as the basic information to help them during the credit review process. The provided resources will help to reduce the operating costs and shorten the time needed. It impacts on the lower amount of credit costs for the credit users. The simpler procedures will promote more demand for credit and loans.

DAGT Operations Model

As the proofs of its vision to create a simpler, transparent and secure credit model, there are only 4 steps of DAGT credit process. The first one is the users need to register and apply for loan credit qualifications, next, users are required to send the digital assets to wallet by using the smart contract. After that, letters of credit are created, now the loan institutions are having cooperation with DAGT. Then loans are ready to be distributed to banks and later to the borrowers.

DAGT Token Information

This time the DAGT platform is inviting us to join and support its revolutionary credit model by participating in its ICO. The DAGT platform has its own token called DAGT, with total supply 100 Million DAGTs.

Make sure that you have read the DAGT whitepaper. At least you are highly recommended to read at important parts like the notice, advantages and market analysis, founding team and risks. You may also contact the DAGT team at http://www.dagt.io/, or by following its social media accounts such as on facebook, twitter, telegram, youtube or on its other accounts which are mentioned on its whitepaper.

Links:

Website

Whitepaper

ANN Thread

Facebook

Twitter

Telegram

Author:

Ashadiya_

ETH Address: 0xf6C481e9bf059DB0a38b876Ab893D11e31C338E3

Hi LOVE YOUR POST MAN!!! LIKE MY POST TOO!!!!! HERE IS THE LINK: https://steemit.com/bots/@abusereports/last-minute-upvote-list-2018-05-02

Hi LOVE YOUR POST MAN!!! LIKE MY POST TOO!!!!! HERE IS THE LINK: https://steemit.com/bots/@abusereports/last-minute-upvote-list-2018-05-02

Hi LOVE YOUR POST MAN!!! LIKE MY POST TOO!!!!! HERE IS THE LINK: https://steemit.com/bots/@abusereports/last-minute-upvote-list-2018-05-02