Blockchain and Crypto Jobs Market: 2018 Vs. 2019 by the Numbers

Along with Bitcoin (BTC) price growth in 2019 (from $3,400 in February to $12,689 in June), some segments of the labor market related to cryptocurrencies and blockchain have also actively manifested themselves. Demand for lawyers has risen sharply, Facebook is actively hiring and the United States is breaking every record in terms of the number of job offerings. However, the overall picture is rather ambiguous.

Blockchain experts are still in demand, especially in the U.S.

According to a first quarter 2018 report, published by the world's largest freelance network, Upwork, knowledge of blockchain technology came out on top among the specialties for which demand has grown the fastest. And the statistics presented by the international recruiting company Hired showed that global demand for blockchain engineers increased by 517% over the past year.

In 2019, the trend of demand for such specialists hasn’t changed dramatically. The word “blockchain” in the labor market is still in trend — as it was fashionable in the beginning of the 21st century to attribute the word “cloud" to job descriptions. Companies striving to be trendy publish more and more vacancies, and there are still not enough specialists in this field.

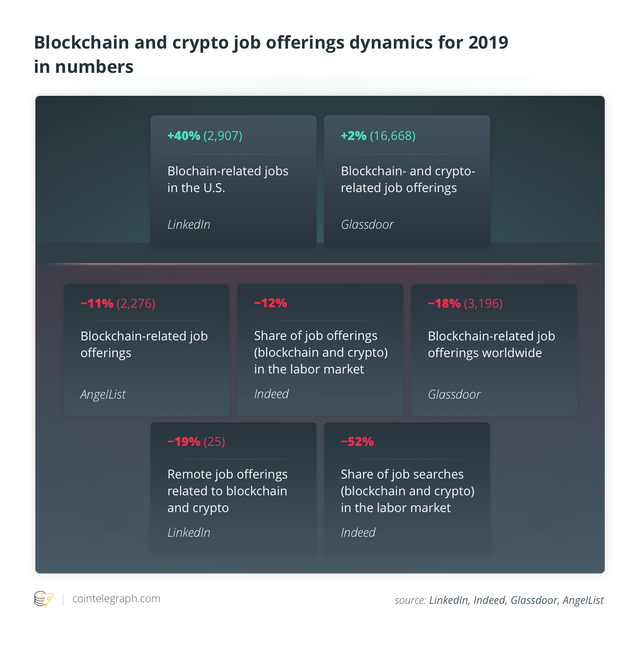

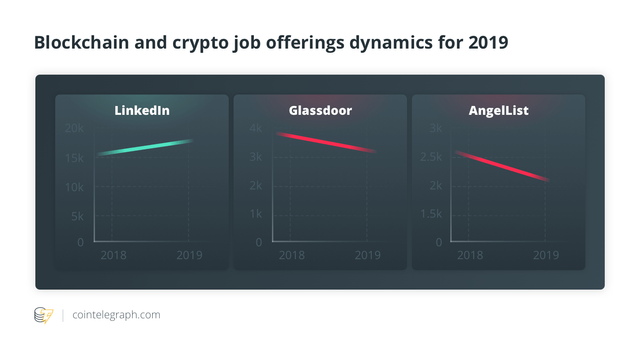

According to the latest data from the international job search site LinkedIn, the total number of vacancies related to blockchain and cryptocurrency hasn’t decreased since December 2018, but has instead increased. In total, as of the end of July 2019, companies have posted 16,668 offers, which is 2% more than last year.

The number of U.S. companies that hire blockchain specialists has grown even more. The U.S. remains the unchallenged leader in the number of such vacancies, and it is also breaking last year’s records in 2019. According to the job search website Glassdoor, as of late July, U.S. firms posted 2,907 job offerings, which is up 40% from 2018. Indeed experts confirm the increased number of blockchain job proposals, referring to an almost twofold increase:

“According to our data, the crypto and blockchain market is far from dead—in fact, it’s still rapidly growing. From February 2018 to February 2019, we saw the share of US job postings related to crypto, blockchain and Bitcoin grow 90%.”

However, if evaluating the share of these vacancies to the total number of offerings in the labor market, it occurs that the share of vacancies that contain the words "blockchain" and “cryptocurrency" has dropped over the last year by 12%, as analysts from Indeed reported to Cointelegraph.

The reduction in the number of offers for blockchain specialists is also confirmed by data from such big recruitment resources as Glassdoor and AngelList, which show a decline of 11% and 18% respectively.

People began to search for blockchain jobs twice less. This trend was identified by Indeed analysts, who shared the comparative statistics with Cointelegraph. According to it, the share of the blockchain- and cryptocurrency-related job searches has declined by 52% over the last year (June 2018-June 2019).

The experts also revealed a direct correlation between Bitcoin price and the number of people looking for this kind of jobs:

“Not only did bitcoin reach an all-time high in December 2017, in February 2019 it had 37% of the value it did compared to the year before. Job seekers responded to the peak in bitcoin pricing with searches for roles related to Bitcoin, crypto and blockchain.”

Companies prefer full-time employees

The number of remote jobs in the field of blockchain technology has significantly decreased — 25 offerings in 2019 against 127 in 2019. Illuminates, a company that is developing a decentralized business relations platform, attributed a similar tendency to demands on candidates, which companies began to increase soon after the number of incompetent specialists started growing in the market. The company told Cointelegraph:

“Even in startups sectors there is decrease of remote jobs, only 29.5% vacancies has tag ‘remote.’ In our opinion this situation is related to unprofessional subcontractors with fake portfolios, problems with partnerships, co-founding relations, unfair clients promises and payments delays, and for sure the problem is always near with area of investments, bubble startups and laundering founders spendings. And it’s not some local problems, each company or founders personally have come across this at least once.”

How much do blockchain specialists earn?

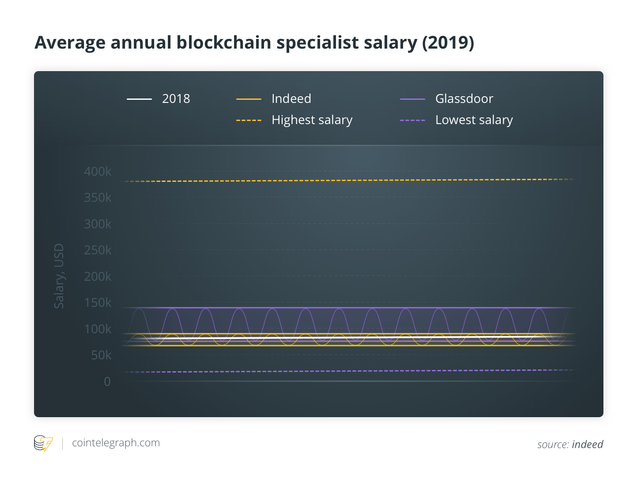

Judging by the consolidated data collected by Glassdoor and Indeed, blockchain specialists have the same salary as in the previous year.

According to Glassdoor, disclosed salaries range from $17,000 all the way up to $271,000 per year. The major pay of job offerings falls within the $81,000 to $144,00 range per year (404 offerings), as TeQatlas analyzed. The salary range according to Indeed was $75,000-$90,000, with an average value of $82,500. In comparison to last year, the average salary for such employees was $84,884, as Glassdoor reported in August 2018.

As can be seen, the salary index in 2019 hasn’t been affected by declining prices or the influx of job seekers from South Asia (India, Nepal, Pakistan, etc.), who offer their services on sites like Upwork for $10-20 per hour. At the same time, the highest rate on average is set by applicants from the U.S. ㅡ $100 per hour and more.

As of July 28, 2019, it is the cheapest to hire a full-stack developer from India. The job seeker offers his/her services for only $3 per hour. The highest price for freelance work in the crypto space goes to intellectual property and cryptocurrency attorneys from the U.S.: $200 per hour.

Researchers at TeqAtlas analyzed open vacancies for blockchain-related jobs for the current year. As it turned out, the highest salaries are still paid in the U.S. ($109,773 on average), a little less is received by specialists in Asia ($98,500), while the average salary of a European employee ($57,500) is 30% lower than that of an American. At the same time, job seekers from other countries may get a higher-paying job by applying for a remote vacancy.

Developer salaries are the same, while the requirements are getting stricter

The major part of the blockchain and cryptocurrency jobs market remains to be focused on developers, and this continues to be the area of most demand. The “U.S Emerging Jobs Report” published by Linkedin back in 2018 shows that demand for blockchain developers has grown 33 times over the previous year.

As of Oct. 23, 2018, the average salary for a blockchain developer was reported to be $127,000, according to Janco Associates, a consulting firm that conducts salary surveys.

Judging by statistics shared by job recruitment firm Hired, the salary for blockchain developers ranges between $67,000 and $155,000 a year, depending on the region.

In early 2019, the situation has changed little. In January, the median annual salary for blockchain developers was $132,000, with the most experienced developers earning $76,000 and upward.

However, six months later, judging by the data from ZipRecruiter as of July 22, 2019, the average annual salary for a blockchain developer in the U.S. has slightly dropped to $126,020 a year. This is 1%-5% less than in the same year. At the same time, if taking a selection of the most popular vacancies posted on the same website, it turns out that in 75% of cases, companies are willing to pay employees $136,000. And this is even more than in 2018.

However, the chance to get “the half-million dollar job,” as it was two years before, seems to be less realistic today, as the analytics show that the average pay range for a blockchain developer varies little (about $19,000). This suggests that, regardless of location, there are not many opportunities for increased pay or advancement, even with several years of experience.

In addition, analysts from Illuminates told Cointelegraph about a large influx of developers from poor regions — such as Nigeria, Pakistan, India and Kenya — who offer “extremely low prices and product quality.” This, according to experts, entails a decrease in demand for third-party developers.

Lawyers much-needed to work with regulators

The demand for legal professionals who specialize in blockchain affairs is constantly growing, and finding such employees is not easy, according to Brian Burlant, managing director of legal recruiting company Major, Lindsey & Africa.

The fact is that it is very difficult to find specialists who understand what blockchain is and how it is used, especially when it comes to the operation of cryptocurrencies. And now, when companies whose activities are related to digital money have to deal with regulators more and more often, the demand for lawyers has risen sharply.

For example, Coinbase is willing to pay up to $386,000 per year for a role named “Senior Associate General Counsel — Regulatory,” whose responsibility will be “managing the company's relationship with federal regulators, including the SEC and the CFTC.”

Many lawyers who eventually come to the blockchain industry are professionals who have worked with the legal issues of regulating distributed ledger technology (DLT) and cryptocurrencies at the governmental level. And experts who understand how digital assets function and are regulated represent the most value.

Commenting on Burlant’s opinion on the labor opportunities for such specialists, Mary Young, partner of the Zeughauser Group, said that blockchain lawyers have become very popular since December 2017, and when many cryptocurrencies fell in price, many of such specialists quietly left the blockchain sphere for the companies they had worked for before. Similar waves of inflow and outflow of specialists were observed during the dot-com bubble of the 1990s.

Jake Chervinsky, a legal expert, pointed out that legal advocates often take pseudonyms when working on various issues. According to his tweet:

“I recently heard someone refer to the use of a pseudonym as "sketchy." I couldn't disagree more. Pseudonyms are often critical for safety & security and can make the difference between free speech or none at all. If these are fundamental rights, then so too is using a pseudonym.”

This can be explained by the fact that not all lawyers dealing with blockchain and cryptocurrency issues want to disclose their involvement in this kind of business, which means that it becomes harder for recruitment agencies to find them.

The more expensive Bitcoin is, the higher the salaries are

Even if you don’t get promoted, your salary can significantly increase if you get paid for your work in cryptocurrency. For example, specialists who saved their salary of $2,000 dollars in December, January and February would have increased it 3.5 times and turn $6,000 into $21,000.

The popularity of getting paid in cryptocurrency is confirmed by the statistics presented by Bitwage, which provides services to global companies for paying employees in digital currency. It’s reported to currently process $2.5 million in monthly volume for contractors and full-time employees, and the sum of money paid to employees via the service increased from $31 million in 2018 to $50 million in July 2019, according to information the company’s representatives shared with Cointelegraph.

Moreover, several blue-chip companies — including Amazon, Google and Apple — have employees that use Bitwage to automatically convert their cash salaries into cryptocurrencies. Indeed, Bitwage allows ordinary companies and specialists to resort to cryptocurrency payments absolutely legally. In the U.S., companies can even settle payroll taxes, and since January, have also been able to cover such benefits as health insurance.

Giants are hiring

Despite the instability of the crypto market, global companies see great potential in the blockchain technology itself. This year, corporations are breaking records in opening and expanding departments and hiring staff, with new vacancies being mostly related to research and development.

According to AngelList, at the moment, at least 1,500 crypto startups, which have combined raised over $3.7 billion from initial coin offerings, are looking for employees in the U.S. alone.

The most active companies moving in this direction are IBM, Cisco and Accenture — together they account for about 1,000 open vacancies.

The highest wages, whereas, are paid by the companies specializing exclusively in cryptocurrencies and blockchain.Other companies are not only growing, but also actively paying their salaries in cryptocurrency. For example, Kraken exchange claims that it paid salaries in Bitcoin to 250 of its employees in April, while there is a growing demand in getting paid in cryptocurrency:

“Kraken paid 250 salaries in bitcoin in April and more employees are opting for crypto every month.”

At the moment, Kraken has about 800 employees. So, judging by the exchange’s revelation, about 30% of them receive Bitcoin as a payment for their work. Notably, it’s not the only exchange paying in crypto. As reported by Cointelegraph on Dec. 6, 2018, crypto exchange Binance said that at least 90% of its employees were paid in the company's cryptocurrency.

An increasing amount of new blockchain jobs has been recently recorded at Facebook headquarters. On March 25, 2019, it was reported that the social media giant had posted 22 new vacancies over the past month and was actively hiring a lot of specialists for expanding its new blockchain department. These are specialties mainly connected with management and programming.

Blockchain jobs are here to stay

Well, this doesn’t mean blockchain geeks and crypto traders are coming for our jobs, but the labor market is likely to see continued growth in fields related to DLT and digital currency.

However, if the cryptocurrency market falls sharply, the amount of job searches may further decrease, as Tal Vinnik — a content strategist at Indeed Prime, a service that connects tech talent to leading brands and startups — presumes:

“For the first time, the number of jobs per million exceeded the number of searches per million. It could be reasonable to assume that if bitcoin drops dramatically again, a candidate looking for a blockchain role would run into less competition than they would after a large increase. There also does appear to be a skills shortage as enterprise projects have matured over the last three years.”

The same situation may affect the trend of getting paid in cryptocurrency. Overall, Bitcoin payments were popular at one point in time, when the market was down, but after a major rise in price, they may become far less attractive due to the risk of a major fall.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://cointelegraph.com/news/blockchain-and-crypto-jobs-market-2018-vs-2019-by-the-numbers