First Ever Blockchain Based Marketplace For Trading Insurance: Fidentiax

FidentiaX

xChange With Confidence

Recently availability of those people is more who were choose to sell their insurance policies in the market and make a profit through it.

If you want sell your insurance policy to the third party than policy surrendering to insurer at a lower cost. This is particularly as usual process of the life insurance industry.

Some people might growing older and then realize that they don’t need a life insurance policy. Some of the children’s might be well setup well financially. In this situation, some people offers their insurance policy to buy for more amount than the insurance company pay after surrendering the insurance policy.

But there are some inefficiencies facing by tradable insurance market such as follows:

The lack of awareness

There is no Recognizable Marketplace

Will be dependent on 3rd party

After doing deep introduction FidentiaX will be realized these problems in the insurance market and they make a perfect solution.

The platform FidentiaX is now in the developmental phase of developing and promoting the first marketplace for tradable insurance policies in the world by disrupting the status quo by empowering policyholders withdraw money from insurance policies on the blockchain system. The platform will also be in the process of setting up fidentiaX Open Source Foundation (fSOF) to proliferate the embracing of blockchain system for the insurance sector.

FidentiaX Overview

The platform fidentiaX is promoting First Marketplace in the World for tradable policy of the insurance reaching by leveraging on blockchain technology system.

This is a very innovative and profitable new course of action which enables everyone to sell out their insurance policies for a particularly at high cost than the surrender value which is back to the good supplier, whereas investors or participant could purchase them for getting un-related returns from investment.

CURRENT SITUATION-

In this new era of advance technology where every insurance holders were facing a financial problem which is challenging. Every insured thinks that has no need for the policy when he has taken that policy, he knows the importance of that policy when he needs money to secure his financial position in problems. When he is in that situation the insured has following two solutions: -

1.Here policyholder surrender their policy at original cost which is fixed by the insurer at the time of buying and that time they lost their sum assured. This will change of mind of investor that is policy holders invest in another policy because of their present medical condition or the disadvantageous age terms.

2.90%~95% quantum secure and wholly collateralized loan on their existing policy and an interest rate of 5%~7%p.a. from their insurer.

Limited options are available over here and the lack of awareness also and monitoring have developed the inequitable situation for insurance policyholders.

Mostly Insurance companies suggest that policyholders will be surrendering their policies rather than suggesting trading them into the market.

BUYERS

In the rapidly growth of the advance and technical world, each and every individual will saw the life insurance policy as an investment in asset nowadays.

Not only policyholders but also most of the industries have been also seen the insurance policy as an investment in the property.

However there are some barriers to entered in the market for policyholders, such as higher mortality charges will be charged, which will rise with the age and experience, difficulties in policies sourcing and the transfer process handled manually will make distance from investing in insurance policy.

Inherent Capital Preservation Feature

The total cash value of a policy includes declared and guaranteed returns by the insurers. That is cost is effectively backed and preserved by the insurer of that policy.

Additionally, insurance companies are strictly regulated by the central banks or government entities which have been give guidelines on the requirements which are reserve for insurance organizatons.

Fixed Investment Tenure

Maturity date of any endowment plan is described and allows the portfolio planning and the cash flow management.

Mortality Upside

The policies which were purchased on the secondary market was typically concentrate on the cash price of the insurance policy and didn’t charge as a part of Sum Assured in the event of mortality of the person or life assured of a company. Whereas the Sum Assured will be significantly higher than the cash price.

Eliminating “Setup” Cost Of Insurance

The policy holder (original) who takes the brunt of the setup cost in the starting of the years because of structured of insurance policies. In the first couple of years of the policy the cost of distribution i.e. (underwriting cost,commission payable to agents etc.) is deducted from it.

Liquidity

For immediate liquidity of tradable policies the policies will be resold in the open market or will be surrendered at the insurer of the policy.

Smoothing Of Returns

All the revenue which were earned in good a year will keep as undistributed returns as a reserve which is do not typically declare by Insurance companies. To smoothing out the performance of the underlying funds those reserves will be distributed during a bad year.

OUR SOLUTION

Here the most important thing for the buyer was to buy a insurance policy from a trusted insurer, and this work makes possible in this fidentiaX platform.

The FidentiaX platform is the only itself which is safe marketplace which enables to trade insurance policies. Here the buyer and the seller both were trade safely. The plaform FidentiaX is a ecosystem which is membership-based and it will be focusing on the key stakeholders:

Key Stakeholders

1.Policyholders

This platform will provide a better liquidity alternative to existing policyholders through a fair, transparent, efficient platform which enables the existing policies will tokenize.

2.Buyers

This platform will create a safe marketplace for buyers for promoting tradable policies as a investment portfolio by leveraging on blockchain system. It will be benefitted to policyholder and it will provide transactional secured ecosystem for everyone.

LISTING OF POLICIES FOR TOKENIZATION

1.The acceptable insurance policies database which will consist of Endowment, Universal Life, Whole Life, Investment-Linked, Key-man, Annuity, etc.

2.For more efficient quotation the real-time pricing engine with an automated submission of relevant documents will be provided by this platform.

3.The policyholders who want the option to buy back their policy will have a re-purchase option for within a stipulated timeframe.

4.All the policies on this platform would be tokenized onto the blockchain system.

MARKETPLACE FOR PURCHASE OF TRADABLE POLICIES

1.Tradable policies having availability of marketplace to browsing for purchase.

2.The key criteria on which the filter were based are (amount, tenure, yield at maturity etc.)

CUSTODIAN SERVICES

1.To provide custodian services and hold the policy in a trust structure all the buyers could engage here.

- Facilitate annual premium payment.

3.The policy Members who purchase policies through the market were able to choose between engage fidentiaX and transferring the purchased policy to their name or to hold by realizing the cost.

PORTFOLIO BUILDER

To build and customize a portfolio for tradable insurance policies fidentiaX will facilitate professional services for validation, sourcing and to transfer of the policies the Portfolio Builder will bespoke those services for buyers.

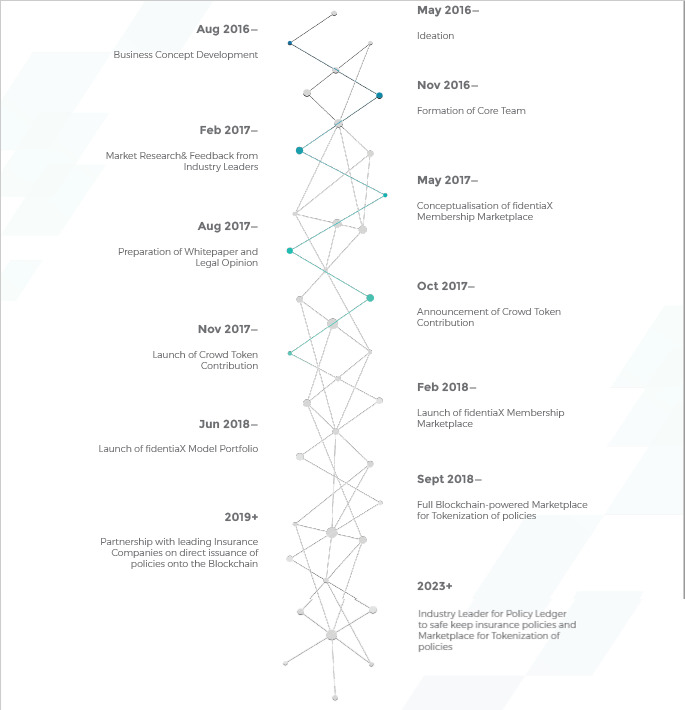

Roadmap

The FidentiaX Token Sale:

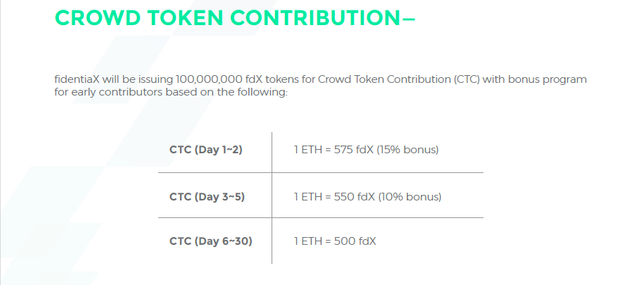

The three different types of Tokens will use by the FidentiaX platform :

1.The Crowd Token Contribution of (Ethereum, Blockchain) - fdX

2.The Currency Representation Tokens – (eBTC, eJPY, eETH, eUSD, eMYR, eEUR, eSGD, eKRW etc)

3.The Platform Unified Tokens – ISX

Through the crowdsale the fdX tokens were made available. Where there is an aggregate of 100 million fdX tokens which are available from the deal.

1 ETH = 500 fdX throughout the deal, rather than that rewards which are available from day 1st to 5th .

On October 16 they announced token sale. There are some other important dates you have to see for FidentiaX

On October 20: Start of private contribution round i.e.(pre-sale)

On November 5: End of round of private contribution

On November 6: The start of public contribution round (crowdsale)

On December 5: End of public contribution round

All of you could participate in the token sale by simply signing up at https://token.fidentiax.com/

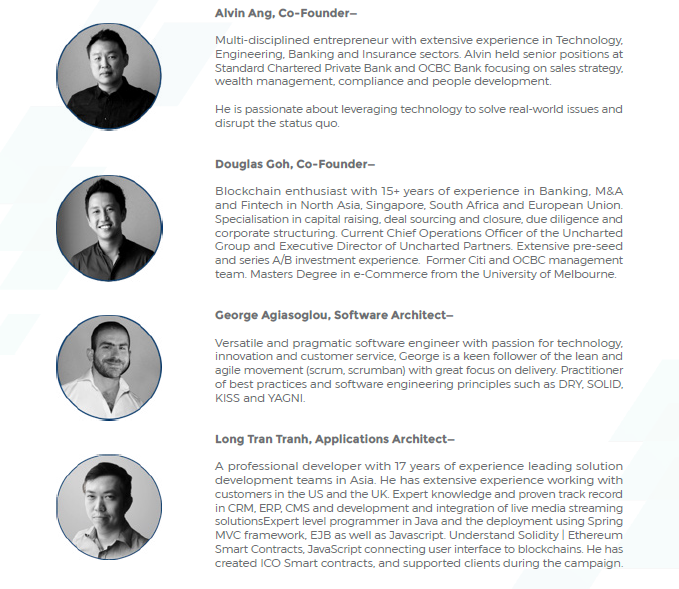

Team

For More Information Please Visit

For Upcoming ICOs Please follow

@royrodgers has voted on behalf of @minnowpond. If you would like to recieve upvotes from minnowponds team on all your posts, simply FOLLOW @minnowpond.