Satoshi•Fund: 0x ICO Report

The 0x project is developing an open source protocol that should facilitate peer-to-peer trading of ERC20 compatible tokens. Developers can build their decentralized exchanges (DEX) on top of 0x and charge fees for their service. Compared to many existing solutions, 0x can provide higher speed, lower costs and a larger liquidity pool. At the same time, 0x is not the only new DEX solution for trading ERC20 tokens that is being developed at the moment. The 0x token ZRX will be used by traders on the network to pay fees for using DEX applications and in later versions - to vote on the protocol upgrades. The fees are defined by relayers themselves (those who host an off chain order book), but the network growth should increase the competition and moderate the prices. The team will release the first version to the Ethereum mainnet before ICO and the code is already on Github. ICO will last until the $24M in ETH is raised. The team will hold a total of 25% tokens against the 50% sold to ICO participants. 15% constitute a fund for external developers, and the rest goes to early investors and advisors.

About

0x is an open source protocol facilitating trustless exchange of ERC20 tokens on the Ethereum blockchain. 0x can be seen as a building block for developers to build various DEX applications on. Trades will be implemented using Ethereum smart contracts. The 0x protocol can be used for free, except for the standard gas fees, but providers of DEX services will be able to charge transaction fees in ZRX. The development started in October 2016. In May this year the project won the first place in the Proof of Work pitch competition at CoinDesk’s Consensus 2017 conference in New York.

Platform use-cases

- Developers can build exchange applications on top of the platform and earn transaction fees for the trading services they provide to users

- They can use the 0x.js library to interact with the protocol

- Developers are free to choose any fee size, but the expectation is that fees will approach a market equilibrium as network grows

- End users (traders) can exchange ERC20 tokens

- They can trade tokens through a 0x OTC application which is currently released in a testnet mode, charges no transaction fees, but provides no real-time order book, or through any other exchange application that will be built by third party developers using the 0x protocol

- 0x uses the terms “makers” for market participants that generate orders, “takers” for market participants that consume orders and “relayers” for developers who build a decentralized exchange on top of 0x and host and maintain off chain order books and matching engines to match orders of makers and takers

Market

The 0x protocol allows to trade any Ethereum-based assets that comply with the ERC20 token standard. As of July 26, 2017, a total of 4269 ERC20 token contracts are registered on Etherscan, Ethereum blockchain explorer, with new tokens appearing each month. ERC20 is a token standard that is chosen most often by blockchain projects launching their ICO. Given that it is quite easy to create an ERC20 token, this standard is likley to be preferred by those who tokenize traditional securities, currencies and digital goods. This should boost the demand for creating ERC20 tokens further, along with the need to exchange them.

Competitors

Existing exchanges allowing to trade tokenized assets can be divided into centralized and decentralized. 0x fits into the second group except it is not an exchange in itself, but a protocol to build decentralized exchanges (applications) on. If compared to centralized exchanges such as Poloniex, ShapeShift, GDAX etc., 0x is trustless like any decentralized infrastructure and has no central party which controls the funds or which can be hacked. Unlike centralized exchanges, the 0x protocol is free of use, although the developers of exchanges on top of 0x will be free to impose any fees for using the DEX service they provide. At the same time, 0x does not support trading of fiat tokens and is expected to be slower than centralized exchanges.

On existing decentralized exchanges such as Oasis DEX, every new order usually goes through the blockchain. Thus, for each single transaction a network transaction fee is charged and the speed of operations is heavily dependent on block times. In contrast, the 0x protocol allows to operate orders largely off chain as only the order settlement will happen on chain. This should increase the speed of operation and reduce the number of on-chain transactions that incur a fee. Also, the existing exchanges exist autonomously from each other and are not interoperable, while the 0x protocol introduces a different concept - that of a common protocol shared by multiple exchanges. Exchanges on 0x will also share a common liquidity pool, which will be bigger than that of an alone standing exchange.

Among projects in early development stage, the Swap protocol can become a direct competitor. Swap will also serve for trading ERC20 tokens, but instead of using an order book to match makers and takers, Swap will use a purely peer-to-peer approach. An off chain service Indexer will aggregate users based on their intent to trade (buy or sell) specific tokens. When asked, the Indexer will find suitable counterparties. Once a maker finds a suitable taker, they can proceed to off-chain negotiations using another protocol for messaging. The agreement is stored into a smart contract similar to 0x.

Another potential competitor is Omega One. Their whitepaper is a strong and interesting proposition. It is yet another approach to designing a decentralized exchange. Omega will use an automated mechanism that will first match orders in an internal matching engine, and then the unmatched liquidity will be algorithmically derived from the world’s cryptocurrency exchanges. This potentially provides traders on Omega a much larger liquidity pool than on 0x. As to the platform’s tokens, they will provide a membership access and will be used to pay trading fees. The fees will be set by Omega One and defined at the moment of order submission based on a number of parameters. The exact mechanism is not yet described, so at present 0x and Omega cannot be compared in terms of pricing. Omega will initially be developed for ERC20 tokens, but later plans to support tokens issued on other blockchains. Neither Swap nor Omega have scheduled an ICO yet, which gives 0x a first mover advantage.

Technology

- 0x is an open source protocol (code on Github) built using Ethereum smart contracts; it is application-agnostic and is intended for DApp developers who wish to build a decentralized exchange for trading ERC20 compliant tokens

- On later stages, the 0x token holders will be able to upgrade the protocol via a decentralized governance mechanism; upgrading implies changing the underlying smart contracts and will be needed to catch up with the changes in the evolving Ethereum ecosystem

- Trade orders will be relayed off the blockchain and will only the returned on chain for settling the order which reduces the volume of transactions processed on chain

- Executing a trade will go as follows (see whitepaper, p.5, for more detail):

- An order maker creates an order to exchange token A for token B and sign it with their private keys

- A maker broadcasts the order off chain; she/he can use 0x OTC DApp if trading with known counterparties or use a relay service on the platform to approach all potential takers

- When a taker accepts the order, it is written down in a smart contract

- The DEX contract verifies a set of parameters and transfers tokens between the two parties at the specified exchange rate

- The protocol development will go in two major steps: version 1 will be released to Ethereum mainnet prior to ICO and version 2 with a much broader array of features will follow up later

- Version 1 core functionality includes the following:

- A system of smart contracts that facilitate the decentralized exchange of ERC20 tokens; developers can build exchanges on top of 0x and start earning fees, while end users can begin trading tokens; the core tools included are listed below

- 0x OTC (currently on Kovan testnet) will be an open and free-to-use browser-based web application for over-the-counter trading of ERC20 tokens between known counterparties. Users can generate, inspect and fill orders that adhere to 0x message format. Order makers must manually share their orders with a known counterparty via email or broadcast their orders across their social networks. The app will not host and maintain a real-time order book, it will merely allow users to leverage the message format. No transaction fees will apply (partially cited from the Development Roadmap)

- 0x.js is a javascript library built on top of web3.js that provides an API for developers to interact with and listen to 0x smart contracts

- Token Registry: will allow users to verify ERC20 token addresses and exchange rates before executing a trade. The registry should serve as a trusted reference containing a list of all ERC20 tokens with associated metadata for each token, such as name, symbol, contract address, and the number of decimals. To ensure the trustworthiness of the data, the registry will be subject to oversight; in the first version it will be carried out by ZRX token holders, but for now only the 0x team will be able to do that. The oversight includes adding/modifying/removing tokens from the registry. The mechanism of oversight by token holders is still an area of research

- Other functionality that is planned for later releases includes among other:

- Decentralized Governance: web application for users that allows stakeholders to generate, inspect and vote on proposed updates to the protocol using the 0x platform token ZRX (for more information on Token see below); initially, a simple multi-signature contract will be used for decentralized governance until a more sophisticated DAO is developed; some more detail is available in this Github repo, but this tool is still an area of research

- Trade Explorer: an explorer for the 0x protocol similar to Etherscan.io for the Ethereum blockchain; the explorer will compile and present to users data related to trading activity on 0x such as trading statistics and history associated with each ERC20 token, Relayer (entities that maintain and host real-time order-books) and dApp, with individual addresses and performance leaderboards

Economics and token

- 0x uses own token ZRX (ERC20 compatible)

- ZRX will have a fixed supply with no inflation mechanism

- ZRX value is two-fold:

- Makers and takers of orders will pay a fee to relayers using ZRX tokens, that is, they will pay for the ability to broadcast their order to potential makers

- The 0x protocol itself does not charge transaction fees, except for the standard gas fees related to any processing on the Ethereum network, but it does support the transaction fee functionality

- Relayers will be free to decide whether they wish to charge fees for their service and what size the fee will be; this should incentivize them to join the network as a relayer

- The more trading activity is generated, the more transaction fees are earned by relayers

- The expectation is that as more relayers join the network, the competition will grow and the fees will approach an efficient economic equilibrium

- ZRX token holders will be able to participate in decentralized governance over protocol upgrades

- ZRX will allow its holders to vote on protocol upgrades whereby the voting weight will be proportional to the share of tokens one holds; the detailed voting mechanism is not yet developed

- Makers and takers of orders will pay a fee to relayers using ZRX tokens, that is, they will pay for the ability to broadcast their order to potential makers

Company

0x foundation is a non-profit behind the 0x project registered in Delaware, U.S.

The project has received backing from several large investment firms: Pantera Capital, Polychain Capital, Jen Advisors and Blockchain Capital. The early funding amount is not disclosed.

Team

The current team is 6 people: CEO and CTO who are also the two co-founders, two engineers, a Director of Operations and a designer. The two engineers have solid Github record. Amir Bandeali, 0x co-founder and CTO, has background in finance and trading. 0x CEO and co-founder Will Warren has background in mechanical and structural engineering and applied physics. According to bios on the website, both have been engaged in smart contract research and development lately. Basing on the information openly available, 0x is their first product on blockchain.

Advisors and partners

The team’s four advisors are founders/key employees at Coinbase, Augur, Polychain Capital and Pantera Capital.

The entities 0x refers to as “partners” on the website are projects that wish to integrate with 0x. They are Augur, Maker, Aragon, ChronoBank, Melonport, district0x, dharma, ANX. They all require a liquid exchange for their operations that 0x should be able to provide.

ICO

- Starts on August 15th, 2017, 15:00 GMT and will last until the hard cap of $24M in ETH is reached, but no longer than 96 hours

- A mandatory registration to participate in ICO is held throughout August 9-12

- No pre-sale was held, but the project already received backing from a group of large investors

- Token offered for sale: 0x Token (ZRX)

- Issued on the Ethereum blockchain, ERC20 compatible

- A total of 1 billion ZRX tokens will be issued, 500M ZRX (50%) will be sold

- 0x protocol will be used during ICO

- Cap for individual contributions:

- Will be determined prior to ICO based on the total number of registrants for ICO

- For the first 24 hours of ICO, the individual cap will be fixed so that each registrant will have a guaranteed participation during this period

- Max individual cap will increase each day until max cap of $24M in ETH is reached

- In case any ZRX will not be sold after 96 hours, they will be retained by the 0x team

- For more details on that check this blog post

- Contributions accepted in ETH

- Token price for ICO: number of tokens sold / amount raised in ETH

- Bonus staging: no

- Liquidity: immediately after ICO

- ICO instructions on how to register and contribute: to be released in early August

- ICO webpage: https://0xproject.com/token

- Terms of Sale: not yet available

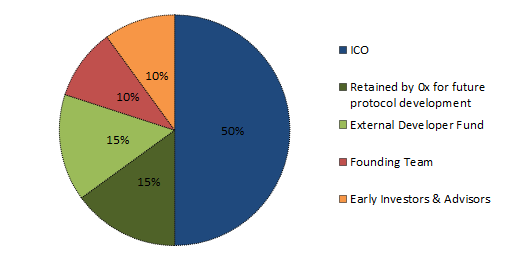

Token distribution

- Total token supply: 1,000,000,000 ZRX, fixed

- Retained by 0x for future development

- Used to finance future development at the protocol layer

- Includes token compensation packages for future team members and capital to the team’s operations beyond the first 5 years (the first five years of operations should be covered by the amount raised at ICO)

- External developer fund

- Used to finance future development at the application layer

- Providing capital to selected high potential projects and teams that attempt to grow the 0x ecosystem; investing in strategic partnerships, hackathon prizes and community development activities

- Founding team

- Founding team’s allocation will vest over a four year vesting schedule with a one year cliff; 25% will be released each subsequent year in monthly installments

Use of proceeds

The team says to spend the entire funds raised on the 0x future development.

Summary

- The protocol targets a growing market as the number of ERC20 tokens is constantly increasing along with the need to exchange them

- Keeping the order book off-chain will allow 0x compete with the existing DEX in speed and costs and 0x users should benefit from a larger liquidity pool; however, among projects in an early development stage, there are a few that offer interesting alternative solutions

- The protocol charges no fees of its own, but relayers who host off chain order books will be able to charge fees in 0x tokens for their service; the price tag has no limit and can initially be pretty high, but as more relayers join the network it is expected to approach an equilibrium

- The team has written lots of code in less than a year, the first version will be released to the mainnet before ICO and will even be used in the token sale

- Next to transaction fees ZRX will also be used to vote on the protocol upgrades, but the decentralized governance part is still an area of research

- Pre-registration for ICO is mandatory; before ICO; individual contributions will be capped and the cap will double each day of ICO until the hard cap of $24M in ETH is reached

- The targeted $24M should cover the first five years of development

- ICO participants get 50% of tokens and another 15% will be used as a fund for external developers; the factual token share held by the team is 25%; early investors and advisors get another 10%

Useful links

For more details on the project check the project’s website,whitepaper or join their Slack.

For other useful links, check the project’s profile on Cyber•Fund.

Satoshi•Fund — blockchain investment company that invests only in blockchain assets since 2014.

So funny, i just finished an article about DEX and highlighted 0X there as well. Check it out if you like: https://steemit.com/bitcoin/@attalis/liquidity-over-safety-why-it-has-to-be-a-trade-off-for-now

I like your post by the way, will follow you have upvoted as it is very well structured and informative. Looking forward to the next post!

I'm bullish on 0x project. Their partnerships look great: Ethfinex, District0x, Augur and Melonport. Also their innovative approach to ICO is totally biased towards small investors. Here you have my thoughts about it:

https://steemit.com/cryptocurrency/@fejcon/why-0x-project-is-a-heaven-for-small-investors#@fejcon/re-iamcrypto-re-fejcon-why-0x-project-is-a-heaven-for-small-investors-20170810t171450737z

Interesting article. Good to see I'm not the only one who thinks like this. Icos have zero obligations to their token holders, they can just run away at any time they want. That's why we have to do very proper research before we invest in them. I found this great website: https://www.coincheckup.com This site lets you check investment stats, And does a complete background analysis for every single coin. That's tradable on the market.