PNGME: Decentralized Lending Platform and Mobile Banking Application

Talking about blockchain technology that is applied by several companies or projects to offer their products has been proven to be able to break the intermediary chain which is certainly detrimental to their customers if operations are carried out in the traditional way. In addition, digital transparency and security are guaranteed to make this technology begin to be glimpsed and adopted en masse both individually, companies, and even the government of a country. This has been proven in many business sectors that are able to satisfy their consumers when they implement digital systems by adding blockchain to their platform infrastructure.

This time I will introduce a new ongoing project that focuses on providing credit or loans to MSMEs. We all know that one of the major obstacles faced by MSMEs, both those that have recently been established and those that have been difficult to develop, is the difficulty of access to capital loans. This is because many factors such as their business are still small and finally banks are still hesitant to provide loans, including track record of loans that have not yet been built so that trust from banks or other lending institutions has not been formed as well. Imagine, there are more than 200 million MSMEs around the world who have not been able to access capital loans to develop their business. This is where PNGME offers a solution to the problem. The following is a little review of this project.

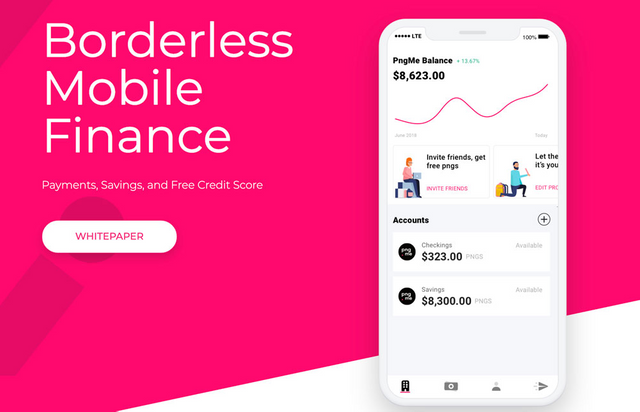

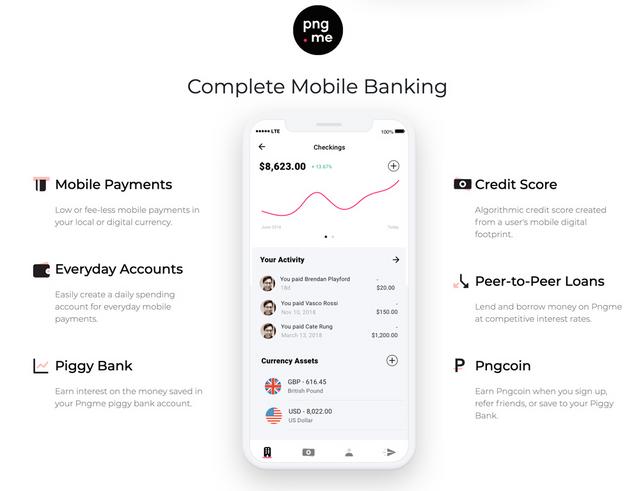

PNGME offers a platform for accessing loans to all MSMEs in the world at lower costs and higher opportunities, as well as digital banking services that can be utilized both personally, companies and even the government. On this platform a digital track record has been prepared for borrowers to set up themselves as an initial valuation and value for investor confidence. In addition, investors can easily invest and provide loans to MSMEs incorporated in this platform. The simplest scheme is for MSMEs to issue digital bonds which will later attract investors to give them credit. Investors can also of course get a higher investment income opportunity with a guarantee of the security of their funds that has been prepared by the team behind this PNGME project. You can also save pngcoin which can generate savings interest like you save at a bank and many other features such as access to cellular payments at low cost, access to borrowing and borrowing activities, credit scores on your account portfolio, to competitive capital markets, etc.

From the little explanation above, I can draw a little conclusion that PNGME has a goal that is able to solve the problems of many MSME companies around the world which of course if this goes well can encourage global economic growth more rapidly. Judging from the features that will be provided, I am convinced that the PNGME project is not a fake project. I personally am not even a MSME industry player, but have been disappointed with a number of similar projects that ended in unsuccessful due to many problems. That means projects with products like this do need to work hard in preparation. I am not a professional investment consultant, so if you are interested in this project, I invite you to continue their research by visiting some of their official links below. may be useful

SEND REGARDS FOR SUCCESS

cyberdg

https://bitcointalk.org/index.php?action=profile;u=1052260

0x225478Ce2388caCD4DB039c0DC6c61AB2E066F89