Blockchain Sentiment Survey Q2 2017 - sneak preview

COINDESK SURVEY ON BLOCKCHAIN SENTIMENT Q2 2017

I just completed the CoinDesk Research survey on Blockchain Sentiment Survey for Q2 2017. This has been a reliable pulse for those trying to grasp the current state of blockchain. Coindesk aggregates respondent data on: sentiment around bitcoin, ethereum, other cryptocurrencies, ICOs, regulation and distributed ledger technology.

The questions that stood out for me:

--Approximately how frequently do you make digital asset transactions (several times a day/week/month/year or never)?

--How do you feel about the current overall state of bitcoin (extremely negative, negative, positive, extremely positive)?

--What do you compare bitcoin most to? A digital currency OR a digital gold

--I believe “institutional” money will control blockchain ICOs [initial coin offerings] over “retail” investors in the future (highly agree, agree, disagree, highly disagree)

--Do you believe blockchain ICOs should be regulated like securities (highly agree, agree, disagree, highly disagree)?

--Do you believe regulators will attempt to bring ICOs into a regulatory regime (highly agree, agree, disagree, highly disagree)?

--Do you believe the SEC will ever take action against any past ICO (highly agree, agree, disagree, highly disagree)?

--How do you believe regulation will effect the proliferation of digital assets: digital assets will be helped by regulation; digital assets will be hurt by regulation; digital assets cannot practically be regulated

--How much money do you hold in cryptocurrencies (approximate $ value) - From $0 - $1000 to $10,000,000+

TAKEAWAY - MY THOUGHTS

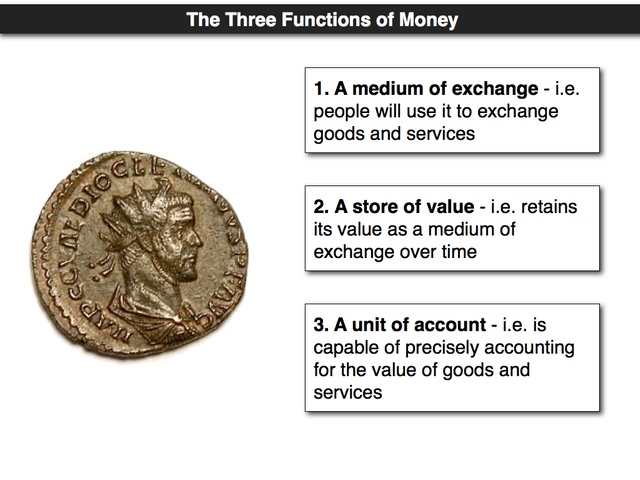

Bitcoin's function as a digital currency has evolved over time. Is the current state oriented towards a store of value --equivalent to digital gold for purposes of hedging against risks in traditional asset classes or a medium of exchange--digital cash to facilitate trades of goods and services. This theme is brought to the fore as Bitcoin faces an imminent protocol upgrade to scale its network capacity. Currently the growth of Bitcoin's market cap appears to be driven more by its attraction as digital gold or an alternative asset in the cryptocurrency portfolio.

There is a risk that investment pools with stakes in initial coin offerings would be skewed towards institutional players rather than retail investors. if that's the case, it may undercut a broader movement towards tech decentralization and community building, which is the original intent of the crowdfunding model and blockchain's potential to transform how economic resources are organized.

The biggest risk for initial coin offerings is the regulatory uncertainty. survey results will quantify how concerned the industry about if and when the Securities and Exchange Commission will issue formal rules or take enforcement actions out of concern for investor protections.

Source: Institute for Ethics and Emerging Technologies

you can get $10 in free Bitcoin by signing up on this exchange using this link

Donations are welcome

BTC: 1NtJHdH7Brx9cx3Ux48ZFdTP3TYPTfHdrw

ETH: 0x3F4e503c18f9B3C0A9f975d7B18aeD1da22D39f5

Congratulations @ddeconomics! You have completed some achievement on Steemit and have been rewarded with new badge(s) :

Click on any badge to view your own Board of Honor on SteemitBoard.

For more information about SteemitBoard, click here

If you no longer want to receive notifications, reply to this comment with the word

STOP