Blockchain & Sustainability

A new hype is about to get started in the blockchain arena. This time it’s around sustainability or ESG (Environment, Social and Governance). One of the new terms is ReFi, which stands for regenerative finance and aims for a financial system that places sustainability over financial gain. It’s true, blockchain can play a significant role in promoting sustainability by improving transparency, accountability, and efficiency in various industries and sectors.

Conversations about blockchain & sustainability also often divert to the negative energy effects of bitcoin mining. However, this underestimates the complexity of the blockchain universe. Not all blockchains require energy-intensive mining and even if the consensus methodology requires a lot of energy, then it’s not necessarily wasted. Beyond bitcoin, as a decentralized currency, blockchain opens a number of use cases that are not possible with centralized databases. Therefore, in reality, blockchain might be a sustainability enabler. In order to become more sustainable, we will partly need to rely on blockchain technology.

What projects are there?

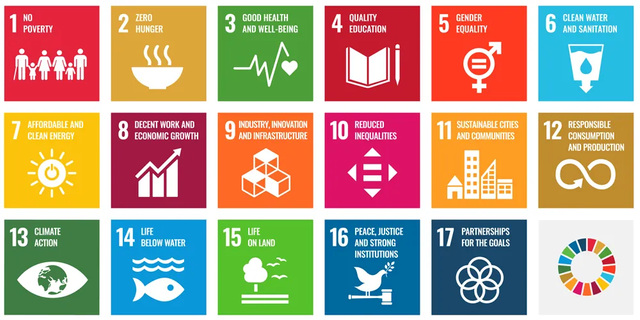

Let’s directly get into a few real examples. There are 2 websites that can be recommended for inspiration on what blockchain can contribute to sustainability. The first is positiveblockchain.io, which is a platform that provides information about projects that use blockchain for good. They maintain a database with currently 1230 projects in it. The database shows the name, description, location, year of creation, and website. There’s also a column that shows if the project is active (currently 576 inactive) and an indicator of which blockchain is used. Very interesting is that each project is associated with one or several SDGs (Sustainable development goals) as defined by the United Nations. If a project contributes to healthcare, then it shows number 3. Unfortunately, there’s no review of the projects, which means that the list most likely contains a mix of high- and low-quality projects.

The second website is cryptoaltruism.org, which is a platform that provides articles, infographics, and podcasts about altruistic crypto projects. This platform is very active, and the infographics are good for sharing on social media. There are currently already 93 podcasts recorded and 1 or 2 are added each week.

Judging by these 2 websites, we can see that there’s a lot of activity in this space. Nevertheless, if we look deeper, then the contribution to sustainability becomes questionable. Let’s take Moss.earth as an example. Moss is a carbon offset platform, with a token called MCO2. 1 MCO2 token equals 1 ton of CO2. By buying the tokens, Moss claims that users are combating climate change. The proceeds would go to reputable environmental projects. But in reality, the CEO Luis Adaime called himself the Wolf of the Amazon and sold tokens for up to nearly eight times what it had originally paid to developers, making a stellar profit for themselves. At best, this project had good intentions, but at worst, it was never designed to combat climate change at all. It’s likely that crypto firms like Moss are chasing quick returns to pay back investors and puts the credibility of the market at stake.

Moss.earth is dealing in carbon credits. The question is: Is it done in good faith?

In order not to fall for scams, there are a few red flags to remember. To make a real sustainability contribution, someone in the project needs to have subject matter expertise. If the team consists of people with only a finance or a technology background – this is most likely not a good start. Other indicators are an aggressive focus on immediate buying, extreme bluffing (also called virtue signalling), and little explanation of the operational process. A practical tip for investors: It often helps to join some of a project’s social media channels and ask some detailed questions.

A new technology: blockchain

A public blockchain is a global decentralized ledger that records transactions or processes with a predefined consensus. It works similar to a database but has no central point of attack and is therefore incorruptible. The data recorded in public blockchains is visible to everybody with an internet connection through blockchain explorers. Some blockchains use a lot of energy, but most of them don’t. For example, Ethereum has recently upgraded to the less energy-intensive proof of stake consensus.

In a nutshell, public blockchains provide a global, incorruptible, transparent database. It puts pressure on centralized processes, because if they don’t perform well because of transparency or corruption, then people have a working alternative. This doesn’t mean that the decentralized option is by definition better, but it provides a plan B in case plan A leads to a dead end.

Time for alternative organizations

With the numerous great projects that are started to promote a more sustainable future, are we maybe treating the symptoms, but not the disease? It’s unlikely that ESG problems will be solved within the current organizational structures (government or private) because of the following reasons

- Lobbyists and corruption

- Politicians are used to negotiation and concessions, whereas the framework of global environmental stability is non-negotiable.

- Law enforcement for many illegal activities is not taking place

- Legal prosecution comes after non-reversible facts have already taken place.

- Legal action takes years

- Differences between jurisdictions

- Space without jurisdiction (like the oceans)

- If legal constraints become uncomfortable in a jurisdiction, then it will move to other jurisdictions.

Powerful leaders can organize meetings to agree on good intentions, but execution counts, and it seems to be unsuccessful. The Paris Agreement nor the COP26 Climate deal are likely going to make the difference we need to prevent 1,5 degrees or even 2 degrees by 2050. Also, Sustainable Finance is not likely to make a real difference, because, within the current frameworks, it’s too easy to escape from uncomfortable truths. By 2030 we will conclude that the implied regulations were too free in form.

The current problem we face

The problems that we face with ESG implementation looks like a prisoner’s dilemma on the individual, company, and country level. If participants all cooperate, then they will all equally benefit, but if participant 1 cooperates where participant 2 refuses, then participant 2 will benefit from participant 1 without making any sacrifice.

If we look at the SDGs as defined by the UN, then there are numerous items that any company can contribute. For example, to contribute to SDG13, country A could charge a heavy carbon tax to limit the number of carbon emissions of that country. But if country B doesn’t implement the same strategy, then the products of country A will have a competitive disadvantage compared to country B because it doesn’t have to pay the tax. This prevents any participant to be a first mover and opposes fair play. Similar dilemmas can be imagined for other SDGs on the company and individual level.

The Sustainable development goals defined by the United Nations

A fair system would charge equal global taxation with traceable contributions. To avoid confusion, this would only apply to taxes related to sustainability, every country can apply its own additional layers of taxes. This kind of organization for global taxation needs to be incorruptible, there should be no single representatives that can be influenced or extorted. This needs to be an organization that enforces rules immediately and doesn’t make concessions. An organization where individuals, companies, and countries can commit to solutions without the risk of being exploited.

The required kind of alternative organization can be implemented on a public blockchain. It doesn’t belong to any nation, but the rules can be defined in global cooperation and the code can be open source so that the rules are provably fair. It will become immediately visible which contributors are defecting and there will be no excuses. All participants are encouraged to contribute, and the biggest contributors will have a competitive advantage because of this visibility.

Sustainability-enabled tracking system

We have reached the point where consumption cannot grow much further. At least not on a global scale. The most successful companies have aggressive strategies to continue growth, whereas this goes at the cost of natural resources that are needed for the next generations to survive.

The problem of resources is global, but we are organized by nation. That has logical historical reasons. The only way to get organized before we had computers, was to cooperate with groups of people and appoint representatives. Eventually, those groups became countries with their own laws and currencies. That makes sense, but now we have the internet and the possibility to create global systems, so why don’t we?

- In order to make the right decisions, we need to visualize and compensate on a global scale.

- Below is a set of minimum requirements for such a sustainability-enabled tracking system:

- Rules and systems must be globally implemented to prevent leakage at any point in the world, also on the oceans

- Rules and systems must be equally applied to all people on the planet to prevent the consequences of the prisoner’s dilemma

- The result must be measurable and visualized so that we have an immediate feedback loop to take measures

A solution for a sustainable planet has to tick all three minimum requirements in order to succeed. Blockchain technology is in a unique position to fill this gap because a public blockchain cannot be controlled by any government. It cannot be manipulated or corrupted and is updated in real-time. Everybody with internet can access this global system and see the transactions of the system.

The sustainability-enabled tracking system can be used to keep track of commodities including oil, precious metals, and crops. But we can also track clothes, meat, and electronics with little effort. The benefit of immediate visibility is that we can respond much quicker to deficits and surpluses. It may sound impossible to implement, but the same was said about a live overview of COVID infections and we got pretty close in a short timeframe.

Tokenized carbon credits as a UBI

UBI stands for universal basic income which is completely unconditional. In his book Utopia for Realists, Rutger Bregman carefully explains the benefits of UBI. There have been numerous blockchain projects experimenting with UBI, but most of them fail because there are many people on the sell side, but few on the buy side. What if the proceeds of carbon taxes would be used to distribute a UBI in crypto tokens?

In practice, every human that would like to receive a UBI would need to register in a Sybil proof list of humans, similar to proofofhumanity.id. They need to have a wallet address to receive the tokens and education on the actual workings. Non-profit organizations can help to subscribe to carbon credits in poor areas, to prevent them from doing harmful things (like child labor, clearing forests, or overfishing) to earn money to survive.

Do we have a blockchain that can accommodate a UBI on such a scale? Public permissionless blockchains based on proof of stake are most likely the best option for mass distribution of tokens. Stablecoins could be used to prevent wild fluctuations. As Ethereum has recently moved to proof of stake, it doesn’t have the energy use of Bitcoin, while maintaining a good level of security. Once sharding has been implemented, Ethereum probably has the best scalability options. There are also a few other blockchains with the capacity and low transaction fees to accommodate such monthly transfers, but none of them is as credible as Ethereum.

Five ways that crypto can contribute to UBI

Of course, not everybody participates at once, but if there’s free money, then it’s likely that people will be interested. If it’s working well, then the network effect will do the rest. A blockchain-based UBI financed by carbon taxes fulfils all three criteria. It’s a global system, it’s equal to humans in all countries. The result is measurable because carbon taxes and UBI paid are tracked in real-time.

Once the basic structure has been built, small initiatives can start everywhere. There will be a market gap for small companies in western countries that contribute to the initiative because individuals have the feeling that they pay a fair price for carbon taxes, while contributing to the reduction of poverty (SDG1) and reduced inequality (SDG10).

If there is a reliable carbon taxing system, then countries can draft local laws and policies that obligate to pay carbon taxes. Countries with these laws only do business with other countries that pay for their carbon emissions and the system will snowball from individuals to companies to countries.

Conclusion

There are numerous blockchain projects with a focus on sustainability. Blockchain has the properties to solve some fundamental problems of ESG-related aspects, but we do need to be careful about cases of greenwashing. While this article explained three use cases that might make a difference one day, there are numerous other options. There is still hope that blockchain can actually be a sustainability enabler and we should not dismiss it as a wasteful trend.