The Instability of Stablecoins

The Instability of Stablecoins

Three months ago we held a vigil for the death of the cryptocurrency bull market. Last month, my HodlBot portfolio went up by 50%. What a wild ride.

While this volatility doesn’t bother long-term HODLers like myself, price instability is a large barrier to mass-adoption of cryptocurrency.

It’s hard to use crypto to pay for stuff, when prices can fluctuate 20% day-to-day.

Stablecoins —the holy grail of cryptocurrency

Stablecoins claim to achieve price stability by pegging their own prices to stable assets like the USD.

The promise of stability has led many to call stablecoins the “holy grail of cryptocurrencies”.

Despite the praise, history has taught us over and over that currency pegs can break, and cause wide-spread catastrophe when they do.

To name a few:

- 1994 Mexican peso crisis

- 1997 Asian financial crisis

- 1998 Russian financial crisis

- Argentine great depression

Pegging cryptocurrencies is dangerous. And it is a great irony that we do not recognize the stability stablecoins offer is just as elusive as Chrétien de Troyes’s holy grail.

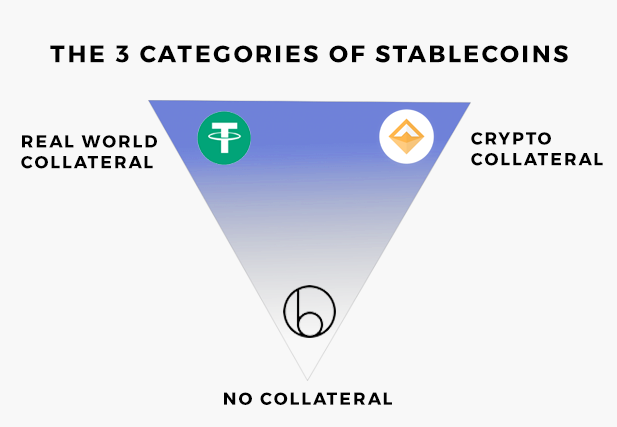

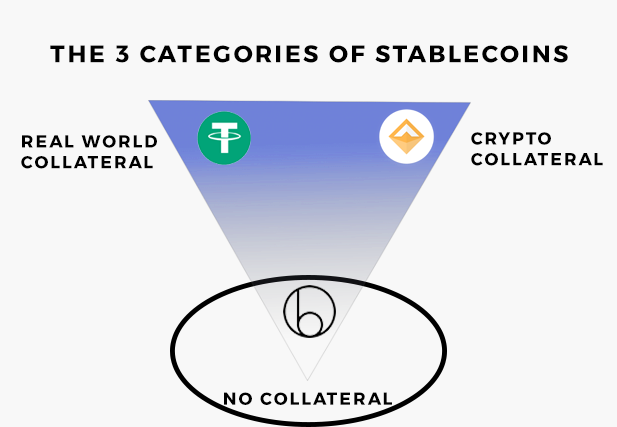

In this article, I will demonstrate the weaknesses and dangers of each of the 3 categories of stablecoins while providing poignant real life examples.

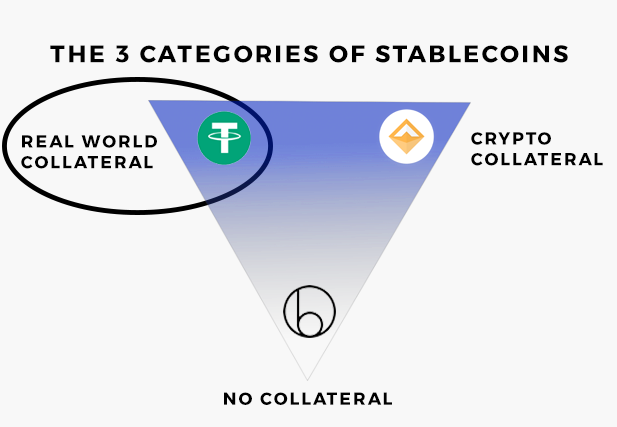

Stablecoins backed by Real World Collateral

Stablecoins backed by real world collateral are simply a digital representation of fiat currencies or valuable commodities like gold.

USD Tether (USDT) is an example of stablecoin backed by real-world collateral. It is owned and operated by Bitfinex, one of the world’s largest cryptocurrency exchanges. USDT claims to keep $1 USD on reserve for every unit of USD Tether issued. They also claim that Tethers are redeemable for USD on a 1:1 basis.

Major Weaknesses

While this seems like a great way to achieve price stability, there are some major weaknesses to this approach.

- We need to trust that the issuer will act honestly and not under-collateralize the digital assets issued.

- We need frequent professional audits to prove that the collateral is there because real-world assets are not visible on the blockchain.

- Because collateral is not transparent, the stablecoin is weak to speculation and false rumours about how it is not sufficiently backed.

- There are many regulatory hoops to jump through when converting tokens for real-world assets. Barriers to convertibility makes the token less valuable.

The USDT Controversy

USDT is being accused by the cryptocurrency community of minting tethers not backed by USD, and critics have demanded independent audits to verify USDT’s integrity.

So far, the situation does not look great. USDT’s relations with their original auditor, Friedman LLP, deteriorated after Freidman asked for additional information that USDT was not willing to provide.

Recently, damning audio recordings have been released implicating USDT in fraud. Currently they are seeking another auditor to validate their records which Bitfinex’ed, a harsh critic of USDT, claims to be just a stalling tactic.

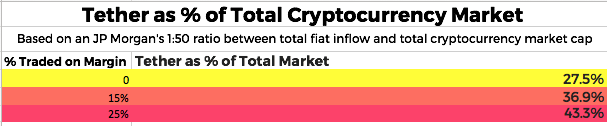

Impact of USDT Fraud on Cryptocurrency Market

Many think USDT fraud would only impact a small part of the total cryptocurrency market cap.

But JP Morgan estimates a 1:50 ratio between fiat-inflow and market cap. Given that USDT is effectively one method of fiat-inflow, every USDT used to purchase cryptocurrency increases the overall market cap by $50.

If fake USDT are issued, then worthless USDT is being used to artificially prop a significant portion of the entire cryptocurrency market. Once the fraud becomes clear, the market goes boom.

Here’s how /u/arsonbunny sees the collapse:

- Tether-enabled exchanges will see a massive spike in Bitcoin and cryptocurrency prices as everyone leaves Tether. Noobs in these exchanges will think they are now millionaires until they realize they are rich in tethers but poor in dollars.

- Exchanges that have not integrated Tether will experience large drops in Bitcoin and altcoins as experienced investors flee crypto into USD.

- There will be a flight of Bitcoin from Tether-integrated exchanges to non-Tether exchanges with fiat off-ramps. Exchanges running small fractional reserves will be exposed, further increasing calls for greater reserves requirements.

- The exchanges might slam the doors shut on withdrawals.

- Many exchanges that own large balances of Tether, especially Bitfinex, will likely become insolvent.

Scary right?

USDT is an example of what can happen when investors blindly place their trust in stablecoins to hold the correct amount of collateral. Let’s not forget the purpose of cryptocurrency is to move away from this kind of centralization.

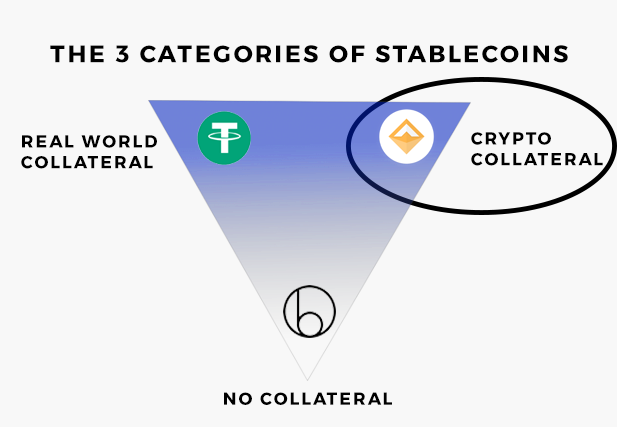

Stablecoins backed by Cryptocurrency Collateral

So now that we’ve seen how stablecoins backed by real world assets have trust issues, let’s turn our attention to stablecoins that use cryptocurrency as collateral.

How they work

This category of stablecoins claims to achieve price stability by over-collateralizing cryptocurrency against the issued tokens.

For example, if we wanted to create a stablecoin that is backed by Ethereum, we’d issue 1 stablecoin worth $1 that is in turn collateralized by $2 of Ethereum (as opposed to 1 USD) . If ETH falls by 50%, our stablecoin would absorb the shock and still be valued at $1.

These stablecoins don’t have the same trust issues because they can prove that the assets in reserve are locked up in smart contracts on the blockchain.

However, they are much more vulnerable to price shocks than their fiat-commodity counterparts. If the backed collateral were to crash hard enough, which is very possible in a volatile cryptocurrency market, price-stability would shatter.

Major Weaknesses

- Not capital efficient. Requires a ratio of collateral to stablecoin >1:1

- Only stable when cryptocurrency prices move in a neutral or positive direction

- Fragile to major price shocks that causes sell-offs and a broken peg

- While transparent in the assets that are being held, they are opaque how they actually work and are affected by the market.

- Their short-comings are disguised by technical white-papers. They are wolves in sheep’s clothing.

BitUSD — A Cautionary Tale

BitUSD, a stablecoin created in 2013, exemplifies the weaknesses found in this model.

Pegs, like promises, are meant to be broken

Pegs, like promises, are meant to be broken Warning: this model is pretty complex and its shortcomings are disguised by fancy jargon. We’ll need to make an effort if we want to uncover the wolf in sheep’s clothing.

Rather than making myself sick explaining how BitUSD works, I’m going to let Christopher Georgen take this one. He does a good job explaining it in plain English:

- Suppose that Alice wishes to create $1.00 worth of bitUSD (1 bitUSD).

- To do so, she must lock away $1.00 worth of Bitshares (the company’s own issued cryptocurrency) plus some excess collateral amount to ensure that she has enough Bitshares locked away even if the price relative to USD drops.

- Once she has locked away this total amount, she receives 1 bitUSD from the BitShares network.

- Alice now sells this 1 bitUSD to Bob for $1.05 worth of Bitshares. Alice insists on charging Bob more than $1.00 because her collateral is at risk should the bitUSD/Bitshares price shift.

- Bob can redeem the 1 bitUSD he holds by submitting this request to the BitShares network. In such an event, an open market position with the least-collateral is forced to accept Bob’s bitUSD in exchange for an amount of Bitshares determined by the current price.

Do you see the glaring problem?

If the price of Bitshares always rises, then everything is fine. The collateral gains in value relative to issued token so it can always cover what is owed.

But when prices start moving downwards fast enough, the excess, but now devalued collateral held by the least-collateralized position is not enough to cover what is owed.

What happens thereafter:

- The collateral evaporates faster than gasoline

- Maintaining the peg is impossible. It’s going to break.

- A massive sell-off is triggered and the entire speculative bubble around BTSX goes poof.

meirl trying to explain BitUSD — It’s a Fugazi

MakerDAO Dai — Not so Stable Either

Christopher Georgen did such a good job explaining BitUSD I’ll let him explain Dai too.

- Suppose that Alice wishes to create $1.00 worth of Dai (1 Dai).

- To do so, she must lock away $1.00 worth of ether, plus a specified amount of excess collateral, determined so that the position is collateralized above the liquidation ratio.

- Once she has locked away her collateral, she receives 1 Dai from the Dai system.

- Alice now sells this 1 Dai to Bob for $1.05 worth of ether. Alice insists on charging Bob more than $1.00 because her collateral is at risk and she must also pay a mandatory stability fee.

Like with BitUSD, everything is kosher when prices go up.

But when ETH prices go down, MakerDAO starts liquidating ETH collateral in anticipation so the value of Ether backing Dai doesn’t go below 1:1.

In mild price downturns this is fine. But black swan crashes happen fast and they don’t give you time to recover. In market meltdowns, selling ETH to liquidate Dai would actually contribute to driving the price down faster.

MakerDAO has a contingency plan for this. The community of MakerDAO MKR token holders will bailout DAI as a buyer of last resort.

Not to underestimate the MakerDAO community, but I really doubt any such community can stand against a torrent of sell-orders in a market crash.

Trying to maintain the peg during a market sell-off

Stablecoins Without Collateral

Now that we’ve already examined the 2 categories of stablecoins that require collateral, maybe you’re thinking: “what if we don’t need any collateral for a stablecoin?”.

What if people just believe that the price should always go to $1, so they resolves discrepancies in the market through arbitrage? After all, fiat currencies are not backed by anything and they work.

Well my friend, we’ve made it to the final category of stablecoins and perhaps the most misunderstood: stablecoins without collateral.

We must go deeper

How does it work

- We issue a currency that has only one mandate: it should trade at $1.

- We ensure the $1 trading price by controlling the monetary supply.

- If the price goes to $2, we increase the monetary supply by minting new tokens to reduce the price back to $1.

- If the price goes to $0.5, we reduce the monetary supply by buying back tokens to bring the price back to $1.

It is always possible to mint new tokens and increase the monetary supply. But, there is a limit to how many tokens we can buy back because we don’t have infinite money.

For this reason when prices go below $1, non-collateralized stablecoins typically issue a bond that can be purchased for 1 coin. This bond is then redeemable in the future for $1 when the price of the coin goes back up.

Although it sounds like a fair solution, participants are only incentivized to purchase the bonds if they believe that the price of the coin will go up in the future. And in order to do that, there must be new entrants and net new inflow to subsidize the profit-taking of bond holders. Like we’ve seen before, stablecoins that only work when the market goes in a positive direction, tend to be not very stable at all.

Weaknesses

- Participants are only properly incentivized when the price goes up

- Requires inflows > outflows and a continuous stream of new buyers to maintain its peg

- Extremely vulnerable to crash — no collateral to back anything up

- Opaque system that is weaker to speculation because it is difficult to ascertain its true stability

- Shortcomings disguised by fancy whitepapers

Basecoin — A Proposed Solution to Stablecoins Without Collateral

Basecoin attempts to peg its price to 1 USD without the use of any collateral by controlling the money supply.

In order to do so, they issue two different kinds of tokens

- Base Bonds

- Base Shares

Base Shares are issued to early-adopters of Basecoin. When the price of Basecoin is above $1, new Basecoins are paid to Base Share holders as dividends. Newly minted Basecoins are then sold on the open market, increasing total money supply and bringing the price back down to $1.

When the price is below $1, Base Bonds are sold on the market for Basecoin. The bonds cost 1 Base Coin each and come with the promise to repay the bond holder $1 when the price of Basecoin goes back to the peg. The Basecoins used to buy these bonds are taken out of circulation and reduce the money supply, bringing the price back up to $1.

While this sounds fine and dandy, both Base Share and Base Bond holders are only properly incentivized when the demand and price of Basecoin goes up. After all who would want Base Shares if new coins are never minted? Who would want Base Bonds if they are never repaid with $1 Basecoins?

Token holders need to be able to take profits, or at least believe that they can. Otherwise, they don’t have a reason to want Base Shares and Base Bonds. For this to happen, they need to be able to sell their assets to new entrants. The new entrants then need to find even more noobs, and on and on it goes.

No wonder that critics say Basecoin looks like a pyramid scheme.

Like DAI and Bitshares, everything works when the market goes up, but going downwards is a precarious fall.

When prices slip under $1 and there are too few bonds being purchased and not enough new entrants, the only way to keep the peg is to for insiders to feign demand by making large artificial buys.

But at some point, it becomes too expensive to subsidize the difference what Basecoin think the price should be vs. what the market thinks the price should be. And as a result, the peg breaks.

My prediction for Basecoin -- a broken peg

Parting Thoughts — The Antifragility of Complex Systems

Although I appreciate the sentiment towards building a price-stable cryptocurrency, I’m just dubious about forcing volatile markets to be stable through man-made efforts.

Markets are complex systems that thrive on volatility. When we try to artificially repress natural movements, we are mistaking a complex system that does not respond linearly to inputs, for a simple one that does.

The Cat and the Washing Machine from the book Antifragile illustrates the difference between complex systems vs. simple man-made systems.

In the short-term, we are able to achieve some artificial stability as long as market participants play along. But stablecoins claim to be stable, forever. And that is a promise that cannot be kept. If the history of markets has taught us anything it is that: the market will always decide what the price of something should be, rather than the other way around.

Maybe the answer to price-stability is one we don’t want to hear. And that is price stability can only come with time when more real-life uses emerge for cryptocurrency. Rather than stablecoins, perhaps that is the holy grail we should all be searching for instead.

About the Author

I’m the founder of HodlBot

We automatically diversify and rebalance your cryptocurrency portfolio into the top 20 coins by market cap. You can read more about our methodology here.

We ignore all stablecoins even if they are within the top 20 coins by market cap because we believe they are not a worthwhile long-term investment . The short-term stability they offer, comes with the risks as I have aforementioned.