The PayBlok Token; Cryptoasset that incentivizes B2B payments within the InstaSupply platform

Small and Mid-sized Businesses (SMB) are cripplingly affected by the effect of prolonged credit terms upon sale, with customary financial products failing to cater to them. This leaves SMBs with little options when looking to lessen cash-flow problems. Normally, SMBs do not have the resources to run best practice administrative tasks dedicated to payment and collection. Additionally, they are in a weaker position to negotiate payment terms with their suppliers. SMBs depend on credit to survive as a result of these two factors; a dependence that is aggravated by the fact that half of all sales on credit failed to be paid on their due date, generating demand for even more credit. In spite of this, banks have failed to offer any accessible solution for SMBs. Having acknowledged this problem, InstaSupply is introducing PayBlok, a token aimed at solving SMB cash-flow problems.

Understanding B2B Payments

Before addressing the pain of payments faced by small businesses, it is important to first understand the business-to-business (B2B) payment process and how that differentiates from other payment processes. Business-to-business (B2B) payments represent a huge market of opportunity, worth an estimated $18.5 trillion in the US in 2016 alone; enormously above the value of business-to-consumer (B2C) and consumer-to-consumer (C2C) transactions. Digitizing B2B payments is being seen as the next great frontier for payments firms, based on the size of the market. Although multiple firms have been partnering, building and buying into the technology needed to digitize B2B payments, big strides won’t be seen until all the pieces of the puzzle — from transferring funds to invoicing — can take place on a single platform: a full-circle digital solution.

Problems Facing Small and Mid-sized Businesses

- The Payment Process - When a consumer pays a business, one entity is the sender and the other the receiver. In B2B payments businesses constantly manage both the send and receive sides of the equation. This back-and-forth series is usually referred to as the purchase-to-pay process for a buyer, and the order-to-cash process for the supplier. This procedure spans days, sometimes months before it is completed. The effectiveness of these processes has a direct influence on a company’s cash position. In general accounting, the balance of this interaction is that one company’s payable is always another company’s receivable.

- Late Payment Problem - 30% of SMB businesses quote late payment processing times as a main problem, and around 47% of businesses are paid late. Payment delays result from either an intentional delay in payment by customers, elongated processing methods, or both. Late payments are not the only problem, but large banks have brutally truncated their small business lending following onset of the financial crisis.

The PayBlok Solution

The problems faced by SMBs would be tackled by payBlok through the following;

PayBlok Tokens - PayBlok is a crypto-asset (token) that offers its owners/ holders exclusive benefits on the InstaSupply platform. It will be developed under the ERC20 Token Standard. As an asset, the initial sale of tokens will be subject to sales taxes according to each market. Following this, a token belongs to its owner and can be traded without restriction or the need for consent or participation from InstaSupply. The creation of the PayBlok token enables InstaSupply to offer a range of products solving the problems faced by SMBs

Decentralized Community - One significant element of the PayBlok solution is the formation of a community of participants that can contribute and get rewarded for their work. Every group that is part of the community has a key role to play in the overall success of the network.

Automated Approval and the Window of Opportunity - Automated approval is an integral part of this project because it creates the opportunity to provide financing. Formerly, without technology and automation rules, approving invoices was a very manual process. Automation reduces human input by 90%, causing suppliers to be paid quicker and more accurately.

The Integrated Payment Solution - The development of payment platform will profit both buyers and suppliers, with the complete buying cycle continuing on a single platform; safe from external manual activities such as exports and reconciliations

Asset-Based Lending - This type of lending is based on using Payblok Tokens as a guarantee. If a loan is not repaid, that Payblok collateral will be taken by InstaSupply. To release funds in this way, the applicant business can request a maximum of 60% of the value worth of PayBlok tokens in custody.

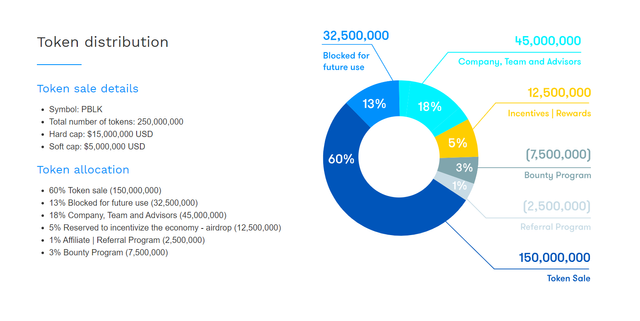

Token Sale

Payblok token supply will fixed at 250,000,000 with no further token issuance. The tokens will be assigned to a variety of uses as described below:

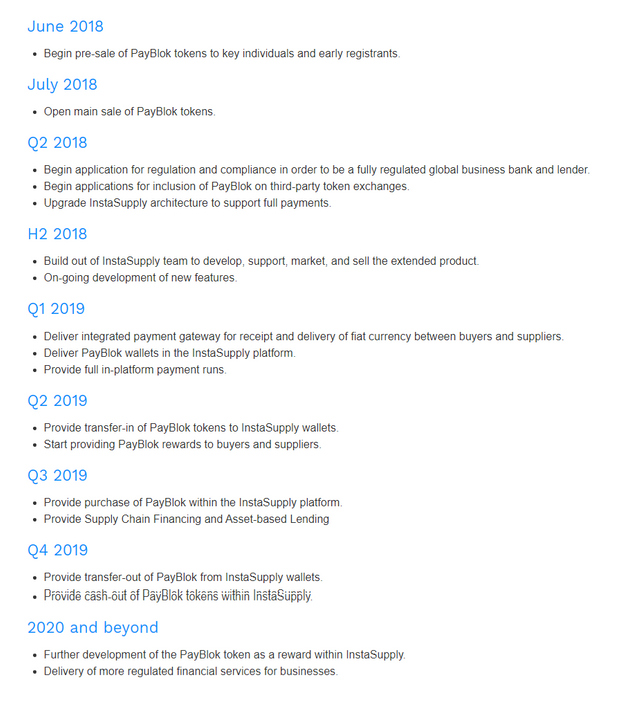

Roadmap

.png)

With all this in mind, InstaSupply is looking to further increase their support for SMBs by offering an early payment function on top of their existing platform— which connects buyers and suppliers matching purchase orders, deliveries, and invoices. This will enable provision of de-risked financial products to SMBs.

For more info, check out their website and Whitepaper.

Bounty0x username: ifeakinola