Liquidity-Solving The Impractibality Of Blockchain Today

Introduction

Many times, it's hard to pinpoint what industry the blockchain actually stems from, especially when one examines the multiplicity of functions that it offers. Smart Contract, being a prominent use case of blockchain, can be used in just about any sector.

But you should know that while novel and cutting-edge technologies are good, majority will always prefer something that requires zero stake and less burden of trust. Thankfully, this is one of the features of the blockchain technology, hence its growing adoption on the mainstream. Till date however, the architecture of many existing blockchains is anything but perfect. And, Lightning technology appears to be the core of most blockchains today. Its not as though there is anything inherently wrong with the former's architecture really, but its no rocket science that as the sphere continues to grow there will be need for improvements or better alternatives that can capacitate the dynamic operations.

As an illustration, till date Bitcoin network can barely perform 12 transactions per second. Considering the volume of transactions that lie in queue every second, it indeed is a deplorable matter.

The rest of this article profiles Liquidity; a novel cryptocurrency-based platform that is focused on improving the general outlook and performance of the sphere.

Liquidity Network & Exchange

Liquidity is a new financial intermediary setup that is targeted at enabling swifter payment processing and efficient peer-to-peer exchange. The exchange platform's uniqueness is borne from the fact that there is no point in time that the platform takes custody of the funds being transacted. It is absolutely decentralised.

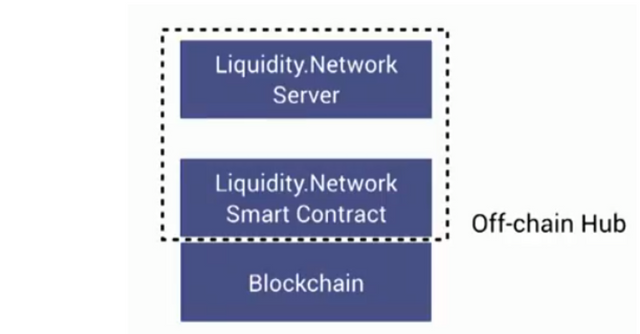

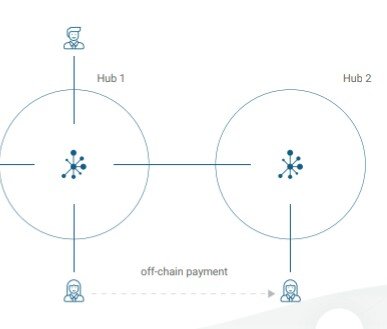

It would interest you to know that the setup is made of several interconnected offchain hubs, unlike the prevailent technology today.

And each hub is comprised of peered users. This invariably imposes decentralisation. Here are some explicit illustrations that justifies the bespoke assertion:

And each hub is comprised of peered users. This invariably imposes decentralisation. Here are some explicit illustrations that justifies the bespoke assertion:

- Liquidity is a non-custodial mediator.

- Every wallet has its designated private key and can only be accessed through same. Hence, its impossible for any hacker or central entity to usurp control.

Here are some notable features of the Liquidity Network and Exchange

Reduced Transaction Fees

Of a fact, many participants in the cryotocurrency sphere today are simply suffering and smiling. Especially during this bearish period, many traders are seriously struggling to make something decent. Upon examination of the kind of exhorbitant transaction fees that a handful of these exchanges charge, its amazing how that these guys(traders) still manage to break even. Liquidity is alive to this matter, which is why the fees will be very minimal compared to other existing exchanges.

Faster Payment Processing

One of major reasons blockchain hasn't quite witnessed the kind of large-scale adoption that the internet enjoyed upon arrival, is simply because it is not practical for use in the real world. Imagine waiting for 15-30minutes in order to confirm payments for groceries bought in a supermarket. It is absurd and does not measure up to the convenience that other conventional mobile payment options offer (e.g debit card).

In light of this knowledge, Liquidity's team has taken out time to avail a platform whose architecture allows it to exerts little stress on the core, thereby giving ample room for the network's performance to improve. This gives Liquidity an edge over the likes of Raiden and Lightning networks.

Absolute Decentralisation

Again, it is most worthy of note that Liquidity network is 100% decentralised. This is a feat that is hardly obtainable anywhere else today. As earlier mentioned, only the original wallet owners reserves the right to disburse or transfer his funds, however he pleases.

In addition, the hub architecture is such that it effects transparency, making the details of the off-chain transactions publicly available, unlike conventional technology, which is strictly between the two parties involved. However, the fund is neither accessible to the public nor Liquidity as an entity.

Another interesting feature about this platform is the fact that it is flexible in operation. The fate of the funds are neither tied to the cooperation of the other party nor locked on-chain. At any point in time, the fund-releasing party can choose to recall his or her money and have the balance restored.

Benefits of Liquidity Solution

Liquidity portents a host of benefits for the sphere and the world at large, here are some.

Scalability

Here's a platform whose architecture was built from the standpoint that as events unfold and the world continues to adopt, the population of users will increase.

Hence, the team took it upon itself to avail an architecture that can capacitate that possibility. Liquidity users will continue to enjoy the experience because of this visionary act.

Promotion of Mass Adoption

Blockchain has remained in the shadows for too long. To make matters worse, in some quarters, the technology is still very alien. Personally, its high time this immutable technology is brought to the mainstream. Thankfully, Liquidity is doing a good job on making this possible. Hopefully, mass adoption on the mainstream will become a reality through this.

Zero Trust

Liquidity's architecture makes live very easy and offers a more convenient option for the cryptocurrency sphere. From the ensuing, it clearly requires absolutely zero trust level on the part of the user.

Use Case

Thomas is new to the crypto sphere. His friend had been trying to convince him to join for one year now. Eventually, he decided to take the bull by the horn last month. Initially he was thrilled by the modus operandi of the blockchain, that he immediately wanted to be part of the sphere. But, once he learnt of how the fate of his funds would be tied to the willingness of the counterparty to see the transaction through, he soon became sceptical. And when he further realised that in the eventuality that the counterparty reneges, the funds on the chain will remain locked, he immediately called it quit.

As fate would have it, one day,he stumbled on Liquidity and since then he hasn't stopped trading.

Conclusion

Taking a cue from the popular saying that, Rome was not built in one day , it's only wise to first appraise the efforts of existing blockchain networks today. The likes of lightning technology, comti and co. The ignominable truth is that there will always be a need for improvements that can cater for the dynamic crypto sphere. Liquidity is no doubt, rightly positioned for this and I sincerely hope that it supersedes public expectation.

Kindly find my video presentation here:

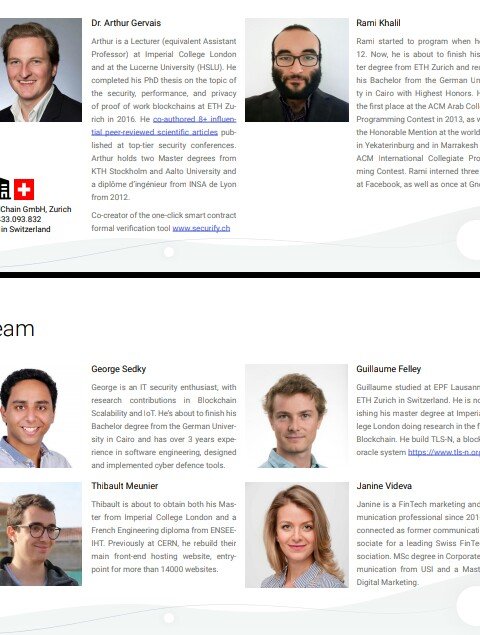

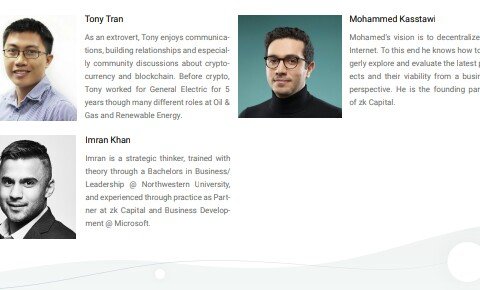

Team

Roadmap

For more information:

Liquidity Network Website

Liquidity Network Wallet

Liquidity Network WhitePaper

Liquidity Network NOCUST Paper

Liquidity Network REVIVE Paper

Liquidity Network Google Play Store (Android)

Liquidity Network Apple App Store (IOS)

Liquidity Network Telegram Group

Liquidity Network Telegram Announcement

Liquidity Network Twitter

To participate follow this link:

https://steemit.com/crypto/@originalworks/2500-steem-sponsored-writing-contest-liquidity-network

lqd2019

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!