BitCoin 2018 forecasts: here are the 7 experts' predictions for the price of digital currency.

The soaring price of Bitcoin in 2017 sparked the enthusiasm of many observers - and some said they predicted the price that Bitcoin could reach in 2018.

It's a fact: many observers say that the price of Bitcoin is insane - some say up to $1 million by 2020.

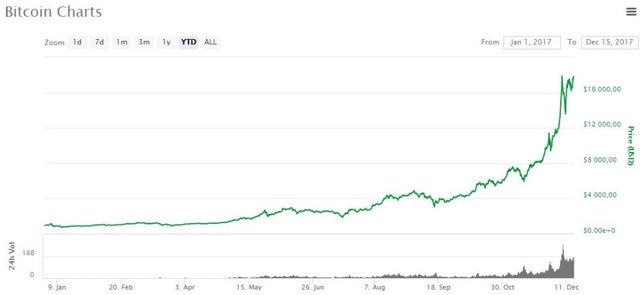

At the same time, however, new entrants to this market are caught in the crossfire. If they believe that the price of the digital money should increase in the coming years, they can't help but wonder if they didn't pay too much for it - they could have gotten 15 times more if they had done it a little earlier:

And some fear, in the short term, a sharp correction in the price of Bitcoin - while several financial analysts point to the existence of a speculative bubble, which threatens to burst at any time.

We remember that the Bitcoin course plunged last November, when the network was arguing over the miners'"hash rate" in front of one of its forks, Bitcoin Cash. The price of the digital currency thus dropped from more than 7,700 to nearly 5,500 dollars in less than 4 days, recording a drop of nearly 30%.

Since then, investors seem to be divided between the spectre of another similar decline and a feeling of "FOMO".

The problem is that it is very difficult to assess the price of crypto-currencies. Unlike stock market equities, they are not linked to income levels. Consequently, indicators commonly used in traditional markets, such as the price-earning ratio, cannot be used by "crypto-investors".

But some analysts have devised other methods that allow them to consider the price that the first digital currency could eventually reach. These include the adoption rate of the Bitcoin, valuation differentials with other asset classes, and imbalances between money supply and demand.

Growing demand in the face of limited supply

Some analysts have tried to predict the future price of crypto-currency against the background of the confrontation between supply and demand for Bitcoin.

In an interview with The Motley Fool, David Drake, founder of LDJ Capital, predicted that Bitcoin would reach $20,000 by 2018. This estimate is based mainly on Bitcoin's limited supply.

Indeed, only a limited number of BTCs are "mined" each year, at a rate known, approximately, in advance. Satoshi Nakamoto, the creator of this digital currency, has already made it impossible to emit more corners than what was planned over 9 years ago.

There is a limited supply for Bitcoin, but at the same time demand for digital money is increasing,"Drake said. "When such a phenomenon occurs, the price goes up."

The total number of Bitcoins that may be available in the future is limited to 21 million (16.74 million have already been issued). Moreover, the last Bitcoin should be mined in 2140, while the number of BTCs awarded to miners as a reward is halved about every 4 years.

It should also be made clear, even if Mr Drake does not mention it, that all the Bitcoins that have been broadcast since the network deployment are not accessible. Many homeowners have lost them, such as this man who inadvertently threw away a hard drive containing 7,500 BTC. According to a recent study, between 2.77 and 3.79 million Bitcoins would be lost forever - further reducing the supply of money that could be poured into markets.

Without a tool to estimate the "fair" value of digital money, analysts are often led to revise their predictions.

This is the case of Ronnie Moas, the founder of Standpoint Research, who recently raised his target price for 2018 from $7,500 to $11,000.

Less than a month later, he again revised his forecast upwards to $14,000 by 2018, before changing it again in early December, predicting a price of $20,000.

Moas is so optimistic because he estimates that the capitalization of the Bitcoin (now close to $300 billion) is relatively small compared to the $200,000 billion represented by major financial assets.

If 1% of the $200,000 billion worth of stocks, cash, gold and bonds (all overvalued) worldwide ended up in the Bitcoin, then the crypto-currency would be worth $125,000. On the other hand, the Bitcoin could eventually catch up with gold if it reached $250,000 to $500,000 per corner."

Moas believes that agents investing in Bitcoin can expect positive developments in the medium term. Among them, he cited the possibility of buying Bitcoins from the Square Cash application, as well as the imminent arrival of futures contracts backed by the Bitcoin on the Chicago Mercantile Exchange platform.

He expects these contracts to lead to higher trading volumes in the Bitcoin markets - even if institutional investors will not manipulate any cryptocurrency.

Finally, he had recently stated in an interview:"It is likely that this good news is not yet reflected in the current price.

Bullish sentiment

Tom Lee, Managing Partner of Fundstrat Global Advisors, had revised his forecast for mid-2018 from $6,000 to $11,500 - a price level that Bitcoin had far exceeded in the weeks that followed.

As Business Insider had indicated, Lee believed that the price of Bitcoin would undergo a sharp correction in the short term, adding that "the technical long-term trend[was] positive.

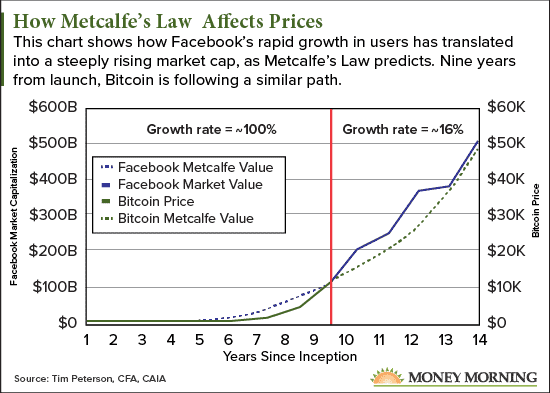

His optimism was reinforced by the valuation model he created. This is based on Metcalfe's law (which we referred to in this article), which provides that the utility of a product or service increases exponentially when the number of people using it increases.

Therefore, if this law actually applied to the value of Bitcoin, its price could rise much faster than the number of people using it:

Mike Novogratz is another famous "bitcoin-enthusiast". As part of the "Fast Money" program broadcast on the American channel CNBC, he said:"The Bitcoin could reach $40,000 by the end of 2018. He could easily."

He believed that the Bitcoin would emerge as a real currency more than ever before, thanks in particular to its arrival on the futures markets.

However, like Mr. Lee, however, he expects a potentially challenging path for the first crypto-currency, with possible corrections - corrections that could take the form of price cuts of up to 50%.

At the end of November, he explained to the Cryptovest site:"There will be major' crashes', since we will reach much higher levels than the current state of technology. This makes the investment very, very exciting, but complex."

And it was John McAfee's turn.

This is perhaps the most bullish observer: John McAfee, who founded the software of the same name in 1988.

The former U. S. presidential candidate had previously indicated that the price of Bitcoin would rise to $5,000 in 2017 and then hit the $500,000 mark in 2020.

Following the sharp rise in the crypto-monnaise price observed in recent weeks, the whimsical entrepreneur had revised his forecast upwards, estimating that a single Bitcoin could be worth $1 million by 2020.

As a decentralized currency that is not supported by a government, Bitcoin has aroused a certain enthusiasm among libertarian circles. For many, it is the ideal asset to free themselves from the constraints imposed by governments and traditional financial markets. There are also indications that the Bitcoin could benefit from a new financial crisis, establishing itself as a safe haven for savers.

Tom Price, a financial analyst with Morgan Stanley, explained that Bitcoin has similar characteristics to gold: it is fungible (a Bitcoin is equivalent to another Bitcoin), durable (it doesn't wear out over time), portable, divisible (a BTC can be divided into 100 million Satoshis) and finally, the number of Bitcoins in circulation is limited.

An imminent correction?

Other analysts, although bullish against the Bitcoin, nevertheless evoke the possibility of a sharp drop in the coming weeks.

At the end of last November, when the Bitcoin was trading at $9,000, Shane Chanel, an investment advisor for ASR Wealth Advisers, had indicated that crypto money could reach $15,000 by the end of 2018. He explained, however, that bad news could cause "a drastic fall in the short term."

A few days later, he had said that a major correction "could bring the Bitcoin back to its previous levels of support, around $7,500." He had explained that it would be "a 20% drop from its current price".

While the Bitcoin price predictions are generally bullish, some analysts now seem to be adding warnings about a possible correction to their forecasts.

On the other hand, however, some observers are frequently forced to revise their estimates upwards - and some of the prices mentioned in this article for 2018 have already been largely exceeded, only a few weeks after being presented.

These two antagonistic phenomena seem to reinforce the speculative nature of crypto-currency, when it is difficult to define its "fair value" - even if it can be compared to assets with similar characteristics, such as gold.

Regardless of the views expressed, however, it would appear that there are fewer and fewer observers questioning the long-term impact of crypto money on financial markets or the global economy.

To finish this article, here is a computer graphics produced by CoinTelegraph that provides a summary of most of these forecasts on the price of Bitcoin in 2018:

References: 99 Bitcoins, CoinTelegraph, MoneyMorning, Cryptovest