Review Q Dao 2 - Process for CDP Operations - Roadmap

✅Hello everyone, today I will continue to introduce you to the Q DAO platform.

✅ As you all know, Any person can use Collateral Assets in order to create USDQ at Q DAO Platform. They do this by interacting with a special smart contract, identified as "Collateralized Debt Position". The Q DAO Governance, made up by holders of the Q DAO governance token, is charged with making decisions on Collateral Assets, allowed for the use. CDPs are simultaneously used to mint USDQ and accrue the debt. The user can withdraw the Collateral Assets at any time upon repayment of the USDQ amount, equal to the loan originally received. CDPs implement the "excessive collateralization" principle, assuring that the debt value never exceeds the value of the Collateral Assets. The technique enables CDPs to dampen a negative impact from sudden price movements for the Collateral Assets.

👉 In that Q DAO is a blockchain platform, integrated with Ethereum smart contracts. It provides a number of enablers for sustainability of the generated stablecoins, such as CDPs (collateralized debt positions), automated price adjustment processes with feedback mechanisms, as well as a system of incentives for external actors.

🧐 Blockchain is divided into 3 main types:

Public: This is a blockchain system that anyone can read and write data on. The process of authenticating transactions on Blockchain requires thousands or even thousands of nodes to participate. Therefore, it is impossible to attack this Blockchain system because of the high cost. Examples of public blockchain: Bitcoin, Ethereum ...

Private: This is a blockchain system that allows users to only read data, not write because this belongs to an absolutely trusted third party. This third party may or may not allow users to read data in some cases. The third party is free to decide all changes on Blockchain. Because this is a Private Blockchain, the transaction confirmation time is quite fast because only a small number of devices are required to authenticate transactions. For example, Ripple is a type of Private Blockchain, this system allows 20% of nodes to be fraudulent and only needs the remaining 80% to operate stably.

Permissioned: Also known as the Consortium, is a form of Private Blockchain but adds certain features, combining "belief" when joining Public and "absolute belief" when joining Private. For example: Banks or financial institutions will use their own Blockchain.

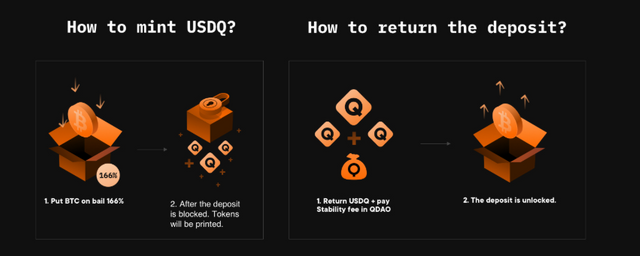

👉 Process for CDP Operations

- Stage 1: CDP Creation: The user registers at Q DAO Platform. The user needs to specify only the email, so that the ecosystem can furnish notifications on important events. In this way, we assure a high level of anonymity. The user receives the wallet and 3 private keys (private key to user's BTC wallet, private key to our network and private key to Ether network (with the last key provided optionally)), used to access various functions within the ecosystem.

- Stage 2: CDP Activation: The user transfers a required amount in BTC to their BTC wallet within the Q DAO Platform. Then, the user sets the desired parameters for the loan to be obtained.

- Stage 3: USDQ Generation: The ecosystem checks the availability of the required amount of the collateralized assets (for instance, Bitcoins, which the user has previously collateralized within the system). Upon a successful completion of the verification, the ecosystem mints the respective amount of USDQ and furnishes the same to the user's wallet. Now the user can utilize the received stablecoin as he wishes.

- Stage 4: Equilibrating Collateral: Subsequently, the user can adjust the collateral depending on the changes to the collateral price. Should the collateral's price go down, the user must add up the collateral or repay a portion of the USDQ-denominated loan. If the user fails to take any action, the ecosystem will perform the forced liquidation process. Should the collateral's price go up, the user can increase the USDQ-denominated loan amount, withdraw a portion of the collateral or avoid taking any action at all.

- Stage 5: Withdrawal: The user furnishes a request to the ecosystem for the funds withdrawal. The user should repay to the ecosystem the earlier received USDQ-denominated loan and the Stability Fee, which accrues throughout the loan term and payable in Q DAO token. The user utilizes the private key in order to sign the transaction, enabling the user to get the collateral assets back to his wallet.

👉 Single-Collateral USDQ vs Multi-Collateral USDQ Currently, the ecosystem allows to collateralize only one asset - Bitcoin. Subsequently, we plan to switch from Single-Collateral USDQ to Multi-Collateral USDQ, enabling users to leverage various Collateral Assets in order to generate the stablecoins.

✅ Q DAO Platform is effectively protected against any large-scale attacks on its infrastructure with the Emergency Shutdown being the measure of last resort. Upon activation, the Platform terminates all of its operations and subsequently redeems USDQ holders and CDP operators for the net value of assets they have a claim for. USDQ holders are entitled to receive the value in Collateral Assets, equal to the USD-denominated amount of USDQ units they held. During the Single-Collateral USDQ, the Emergency Oracles, elected by Q DAO holders community.

Below is a review of some website

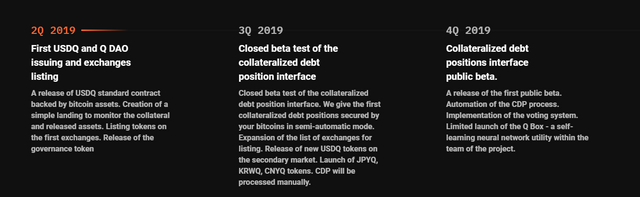

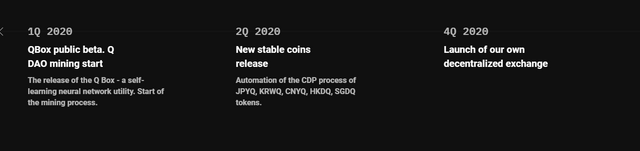

And this is the Roadmap that QDao has set out

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://usdq.platinum.fund/docs/whitepaper[v0.8].pdf