Who Can We Trust About Trust Technology?

Seth Ward | CEO/Co-founder, Pynk.io

I always find it fascinating to watch new technologies emerge.

The way that people react to their development and introduction into business and everyday life encompasses the whole range of human emotions.

With any technology that has real impact, you will inevitably hear predictions from the extreme of human extinction at one end, to a new era of enlightenment or utopia at the other.

The most extreme negative reactions are generally based on fear, and you’ll see a split in the type of people on each side. And it’s somewhat influenced by age.

As Douglas Adams once said, “Anything that is in the world when you’re born is normal and ordinary and is just a natural part of the way the world works. Anything that’s invented between when you’re fifteen and thirty-five is new and exciting and revolutionary and you can probably get a career in it. Anything invented after you’re thirty-five is against the natural order of things.”

In that respect, I’ve enjoyed being involved in all kinds of new tech that changes the world. So far, anyway — now I’m over that bigger number I’m waiting to turn into a bit of a luddite.

From running a DIY arcade full of Pac-Man and Donkey Kong arcade machines to programming my first computers (BBC Micros and Commodore 64s) back in the 80s. Then launching one of the world’s first internet consultancies in the 90s and doing the same with mobile around the millennium. Then most recently getting more and more involved in blockchain, having played around with mining Bitcoin back in 2011.

Based on age and Mr Adams’ quote, I should be on the fence with Blockchain (although I’d been reading about the cypherpunks and their attempted development of cryptocurrencies in my early 30s, I was precisely 35 when it looked like Satoshi Nakamoto had finally made the breakthrough with his Bitcoin white paper).

But as I’ve said, the age factor may actually be more about fear.

We fear that which we don’t understand, and as we age, we are less likely to understand those technologies that are ‘against the natural order of things’.

The older generation tend to have a big stake in that order of things so they are even more likely to reject and fear the technology.

And if you have a big stake in that current natural order, you’re even more likely to reject and fear the technology.

Just look around today and you can indeed see all kinds of opinions around Bitcoin, crypto, blockchain.

And yes, this is what I’m talking about when I use the term ‘trust technology’.

Because that’s really what it’s all about.

Not just currencies, tokens or ICOs.

It’s technology that helps humans to work together, at scale, in all kinds of ways. Without having to worry so much about issues of trust.

It helps us reduce our dependence on small numbers of ‘gatekeepers’ who control money, contracts and financial decisions.

And as we know, when we do trust those people, corruption quickly follows.

Let’s take a look at a few of those opinions, consider where they’re coming from, and ask ourselves how much attention we should be paying to them.

NEGATIVES

A few examples of people who are dismissing the technology include…

Nouriel Roubini

He has a lot riding on his reputation, which he has built on his claims that he predicted the financial collapse in 2007/8.

Let’s ignore the fact that some people believe he was actually inaccurate in his reasoning for the crash (despite connecting it to the housing boom and bust) and his claims should, therefore, be viewed as suspicious and self-promoting.

He has repeatedly made bold pronouncements, such as that Bitcoin is a Ponzi and isn’t safe due to hacking.

Let’s look at the hacking claim made in his Tweet posted above — it had never been hacked in 2014 when he said that. And now, in 2019, it still hasn’t been hacked.

Clearly, incorrect.

He’s also claimed it will fail, and on every occasion that its value has sunk, he’s had his ‘told you so’ moments. Only for its value to reach new, unimagined heights.

Let’s see him go through this process again next time the crypto market reaches $1 trillion. And again, and again, at higher and higher amounts.

There’s always a place and a demand in the media for naysayers who don’t mince their words.

Nouriel is filling that gap.

But should you take him seriously?

Personally, I think that when someone is failing to engage with new ideas and facts — and shows signs that they are defending an entrenched position for egotistical reasons — that’s someone I tend to ignore.

If you look back on Mr Roubini’s public comments, you’ll struggle to find any acknowledgement of value being added by trust technology.

You won’t find much nuance.

You won’t even detect any indication that he understands what it’s all about.

He’s just focused on cryptocurrencies.

What you will find is a whole host of self-aggrandising, bombastic tweets defending his stake in the ground.

He’s too far gone now to admit he was even slightly wrong.

A perfect example of someone over that magic 35 number and with too much at stake in the ‘old order’ to embrace this new technology.

So, even if you give him credit for his economic predictions of the past, it’s hard to pay too much attention to him when it comes to trust tech.

Jamie Dimon

As the head of JPMorgan, one of the most renowned financial institutions on the planet, surely Jamie Dimon must have something to say?

Yes, in fact he’s renowned for talking it down at any opportunity.

He’s called Bitcoin a ‘fraud’ that is ‘not a real thing, eventually it will be closed’.

He stated that he would ‘fire in a second’ any of his traders caught investing in it.

Many in the industry raised their eyebrows at this, as it was clear that at this point in time, his company JPMorgan would have to be utterly incompetent to not at least be considering investing.

Further than that, it was hard to believe that they weren’t already doing so and suspected he was trying to talk down prices.

And sure enough, at the very time of the above takedown, it quickly emerged that JPMorgan were talking positively to clients about cryptocurrency and blockchain technology — for example, Catherine Clifford was an invited speaker at just such an event.

It has now announced its own crypto coin, the JPM Coin, something it surely must have been working on when Dimon was making his comments.

Plus this isn’t a one-off — many, many other large financial institutions are doing the same thing and launching blockchain-based projects.

So in the case of Jamie Dimon, his contemporaries at the head of financial institutions and government regulators who have been relentless in their criticism, I’d say — look for conflicts of interest.

Take what they say with a pinch of salt and try to uncover what they’re actually doing behind the scenes.

When somebody has a great deal to lose if a new technology succeeds — because it’s very purpose is to reduce our dependence on them — then obviously you have to apply a healthy dose of scepticism to any criticisms they make.

Particularly when they say one thing and do another.

Clearly Mr Dimon is from the old order, fears what’s coming, and is doing what he can to protect his company and clients, regardless of the impact on the rest of the world.

That’s his job, and you can’t really blame him for it.

Warren Buffett

He’s the CEO of the Berkshire Hathaway investment fund.

And surely the most famous investor our planet has ever had — and certainly one who is right up there in terms of sustained success, along with his partner Charlie Munger.

Plus he’s heavily invested into ‘old’ finance.

So many people will want to hear his opinion on any new tech, particularly FinTech ones such as blockchain.

Well, back in 2014 he made his first public pronouncement…

“It’s a mirage, basically”

He says that it’s not investing, because there’s no intrinsic value. Unlike a farm, nothing is being produced. There are no returns. You’re simply relying on other people paying more than you did.

Now, it’s hard to argue with this guy.

He understands investing better than almost anyone who’s ever lived. But, he’s not infallible — just look to his admissions of mistakes when it came to both Google and Amazon. Pretty gigantic mistakes, those! In particular it seems he has something of a blindspot when it comes to game-changing technology.

I’d argue that this has led him to the same mistake many critics make, and it’s one that can largely be put down to the language most used in this industry — the word ‘cryptocurrency’.

This word leads people down the wrong path. Most criticism has come from people missing the point. Blockchain / crypto is about so much more than just currency.

The coin that started the whole thing — Bitcoin — can be used as a currency, sure. And for some use cases a very good one. But, that’s probably not its main use case. That’s as a store of value. And as far as I see it, it’s a superior store of value to anything we’ve ever seen. It should be compared to gold. A form of gold that is more scarce, almost infinitely divisible and able to be stored and transported around the planet with ease.

It does this through a total transformation and revolution in the idea of ‘trust’ when it comes to storing and moving money.

The other forms of ‘crypto’ do include currencies — many are way superior to Bitcoin in terms of potential environmental impact, speed of transfer, scalability and ease of use.

But there’s so much more!

The technology can be applied anywhere that there are issues of trust between people and entities.

Have any of Warren Buffet’s comments shown any signs that he understands this and is still dismissing it?

Not that I’ve seen.

So in this case, I’d simply say: wait and see.

I have tons of respect for Mr Buffett and Mr Munger.

They’ve admitted mistakes before, and I expect they’ll do it again with trust tech — once they realise just what it is, why it exists and how much it’s going to change things.

Summary of the Negatives

To summarise the position of these guys, we see a mix of:

Lack of understanding

Fear of the new and of having missed an important new development

Prospects of being made redundant and antiquated

Delaying the inevitable

Misinformation (investing while talking it down)

Protecting entrenched public positions

Let’s remember that the entire raison d’être of Bitcoin and of many cryptocurrencies and blockchain projects is to remove our dependence on a small elite of financial experts and institutions when it comes to money, trading, investment and finance generally.

So, you should always be cautious of reactionary statements from those with the most to lose.

What’s more interesting is when people like that embrace the technology.

As we’ve seen above in the case of JPMorgan, we should be watching what they do more than what they say.

POSITIVES

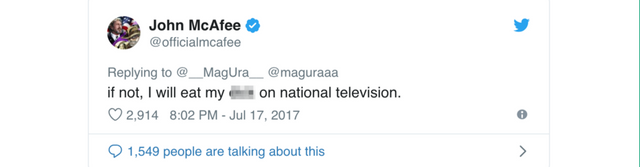

John McAfee

This guy is so seemingly crazy and controversy-laden that his inclusion in the ‘positives’ column may not reassure anyone other than fans of entertainment.

He’s most famous for being the creator of the ‘McAfee’ antivirus suite of products, so does have some kudos when it comes to cybersecurity.

He’s also well known for being accused of killing his neighbour and, most pertinently, stating that he will eat a certain part of his anatomy if Bitcoin doesn’t reach $1million by the end of 2020.

So it’s safe to say that he’s on the more positive side of pronouncements when it comes to Bitcoin specifically.

But he’s also a big player in the larger scene, with many investments and startups in the space.

And he’s been repeatedly accused of ‘shilling’ for any project that sends him enough of their tokens.

He also seems to be perpetually on the run from one country’s law enforcement agency or another.

He has a lot at stake and is pretty much motivated by anything that can make him money, fast.

There’s also an extreme anti-authoritarian stance that would make the average investor wince.

Despite his former fortune, he may not exactly be the ‘old order’.

There’s a possibility that his penchant for the wild life has led to him spending insane amounts of money and needing to make a quick buck. Everything he’s done in the space could have been shaped by that.

So it’s pretty safe to say that this guy is biased and — even if he understands the industry more than many — we shouldn’t necessarily be hanging on his every word.

The Winklevoss Twins

"Money is the oldest social network and arguably the strongest. #Crypto is potentially the strongest networks of value ever in the world and will continue to be so" - Our Founders, Cameron @winklevoss and @tylerwinklevoss, with @CNN at #SXSW2019 https://t.co/b28r4Qu6AS pic.twitter.com/927xfc9Ykl

— Gemini (@Gemini) March 11, 2019

Tyler and Cameron are interesting because they’re also pretty famous outside of the crypto space.

Most people have heard of the Winklevoss twins through their ill-fated involvement with Facebook, as covered in David Fincher’s movie ‘A Social Network’. They successfully sued Mark Zuckerberg, claiming he stole the idea for Facebook from their ConnectU project.

They won $65 million and subsequently invested a large sum (reportedly $11m) into Bitcoin, which subsequently led to them becoming the first Bitcoin billionaires.

You could argue that in this case, you should pay serious attention to these guys.

Turning $11m into over $1bn in around 5 years could be seen as incredibly smart, even when taking account of luck in terms of timing.

Has Warren Buffett ever demonstrated a return that good?

So what is their current stance?

Well they’ve backed and created other startups in the space, including the Gemini crypto exchange, and the GUSD which is a cryptocurrency backed 1:1 by the US dollar.

And they don’t seem to be coming out with any statements as outrageously positive as John McAfee.

They think Bitcoin is going to remain the number 1 in the space in terms of overall value or market cap.

If we go back to 2014, they predicted a price of $40,000 which is double its peak at the heady heights of speculation late 2017, and 8 times its current price.

Ultimately, they think Bitcoin is a better ‘gold’ than gold.

That means it will surpass the 7 trillion market cap of gold.

Let’s do some maths on that…

There are only ever going to be 21 million Bitcoins.

7 trillion / 21 million = $333,333.333

That’s a price per coin of one third of a million dollars.

So actually they’re not that far from McAfee’s prediction. However they also don’t give a timeline, so they’re not suggesting we’re going to see anything like that in the next 20 months or so.

Overall, very positive.

Some would say it’s a crazy prediction, but at least they give reasoning and they weren’t far off with their 2014 prediction when you consider what the price was back then (around the $500 mark).

So, should we listen?

Well, yes, I’d say their opinions are worth taking into account, even if they have so much ‘skin in the game’ that you have to be cynical when it comes to them talking prices up.

To discount their Bitcoin prediction, you’d need to do some deep dives into that one specific use case for Bitcoin — a store of value. And understand why so many people, these guys included, think Bitcoin is superior in that respect to gold.

I think their prescience — combined with putting their money where their identical mouths are — means you should give them some credit when it comes to their all-round positivity around crypto and trust tech generally, even if that doesn’t necessarily transfer over to other tech.

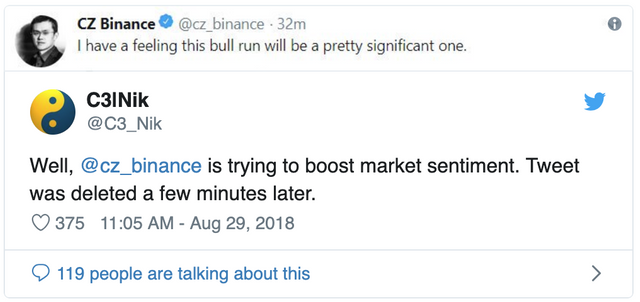

Changpeng Zhao

Changpeng Zhao, the Chinese-Canadian businessman, has created one of the most incredible businesses in the shortest amount of time that we’ve ever seen.

Binance, the leading crypto exchange, didn’t exist 3 years ago. Yet in 2018 it reportedly made $446million in profits.

You could say it’s the Amazon of crypto (although that’s ignoring the fact that Amazon have chosen not to make any profits for most of their existence)

He has said ‘Everyone will be in crypto. Don’t get left behind!’

This was pretty recently — April 2nd 2019, in response to increasing levels of confidence in the market.

He’s also said the industry needs more entrepreneurs to build real projects.

Another interesting comment is that he thinks crypto’s ‘killer app’ is already here and proven — raising money.

He tempered this by recognising that ICOs became a problem, with projects being way overvalued and there being too much freedom in the space.

This is essentially a call for caution and regulation.

While CZ is a true believer, and another person who has committed to the space professionally, this is a bit more balanced.

This, perhaps, reflects where his money is coming from — he earns money from people trading in almost any crypto project.

So he has less money involved in any one project (such as Bitcoin) and more interest generally in gradually increasing adoption.

On that note — and just to give some consistency — let’s look at his Bitcoin prediction.

Actually, he hasn’t publicly committed to one but has rather vaguely referred to $4,000 as a ‘bad day’ and $300,000 as a ‘good day’.

Some people argue this is the closest to a Bitcoin prediction as we’ll see from CZ.

It’s along a similar scale to the twins and McAfee.

It’s yet to be seen whether he can replicate the long-term success of someone like Jeff Bezos, or whether it’s a flash in the pan success.

But again, it’s hard to dismiss someone who has built such phenomenal success in the space in such a short time period.

Summary of the Positives

These four (yep, the twins are two people) seem to all be predicting similar ultimate prices for Bitcoin — in the six or seven figures per coin range.

They’ve all already made huge sums in the space.

They seem to believe that blockchain is a truly world-changing technology and that within the industry, Bitcoin is and will remain number 1.

But we have to remain cynical about their motives.

Each of them could make huge amounts of money from a succession of speculative cycles, even if the eventual worth of the industry went to zero.

But unlike the naysayers, if we’re looking at what they DO as much as what they SAY, we can gain some confidence.

Their motivations, actions and pronouncements would seem to be fully aligned.

CHANGED

Let’s now take a look at people who recognise the positive and negative side of the industry, and especially at people who have changed their stance.

It takes a certain amount of courage to recognise and publicly admit you were wrong.

By definition, it almost eliminates the possibility that someone is acting emotionally and defending an original position to protect their ego.

And it makes it more likely that we’re dealing with a person coming from a ‘perpetual beta’ mindset who is continually testing their understanding and challenging their prior beliefs.

These are the types of people I listen to.

Niall Ferguson

Niall is the Milbank Family Senior Fellow at the Hoover Institution, Stanford University, and a senior fellow of the Center for European Studies, Harvard.

His son originally told him to buy Bitcoin in 2014.

His understanding of currencies and technology at the time, however, stopped him from investing.

In December 2017, he said that Bitcoin reminded him of the ‘early eighteenth century South Sea bubble’.

He predicted it would burst and people would head to the exits, and that the ICO bubble would crash.

He was certainly right in that respect.

In March 2019, however, he admitted he had made a mistake — and this was at a time when Bitcoin had crashed from $20,000 to under $4,000.

He has now joined a blockchain project and of Bitcoin says that…

It is an option on digital gold. By this, I mean that bitcoin’s role in the foreseeable future is as a liquid asset that is hard to confiscate, and thus serves as a type of insurance. You might hold your private keys the same way the European wealthy used to hold gold jewelry and precious stones. However, the experiment launched by Satoshi Nakamoto in 2008 is not yet finished. To own bitcoin today is to have an option on Satoshi’s experiment succeeding.

This is interesting because — although he wasn’t an out and out non-believer, refusing to compare Bitcoin’s bubble to that of Tulip Mania, he was making quite accurate negative predictions regarding the short-term value of the market.

And he had avoided getting involved.

Now, however, he has very much joined the industry.

JPMorgan

I’ve actually decided to include JPMorgan here despite already including Jamie Dimon above.

This is because the actions of the business contrast with his statements.

Their main representative has repeatedly denounced Bitcoin and the industry generally.

Yet, they’ve been frantically recruiting blockchain experts.

They’ve launched their own blockchain businesses and their own cryptocurrency.

They have been trading in the space and making investments on behalf of clients.

You could hardly give a more extreme example of a change of opinion than these guys.

It would be irresponsible of them to stay out of the space as it poses such a big threat to the established order in finance, of which they’re one of the biggest.

So, again, we should pay particular heed to this change of opinion.

Soros, Rothschilds, Rockefellers

And then there are these big hitters.

All of them had previously stayed away from the market.

In January 2018, Soros had come out against cryptocurrencies, writing the entire class off as a speculative bubble and Bitcoin specifically in its ability to be a solid currency.

And then around a year ago, in April 2018, it was reported that they had all started trading.

Adam Fisher — the head of macro investing at Soros’ $26bn Soros Fund Management in New York said that he’d become authorised to trade in the prior few months. It’s not known what investments they’ve made and when, although they did obtain 8.99% holding in Overstock.com which is itself heavily involved in crypto through its evangelist owner Patrick Byrne and the connected tZero security tokens exchange

The Rockefellers’ venture capital arm Venrock has signed a partnership with the cryptocurrency investment fund Coinfund

The Rothschilds had reportedly invested in Bitcoin for the first time in December 2017 via the Grayscale Bitcoin Trust

That last one is fairly remarkable as it would indicate they had bought in at the very peak of the speculative bubble!

Nevertheless, it’s interesting to see the changes in position — even if we should be suspicious about the timing of their announcements.

Soros was certainly right that Bitcoin was in a bubble.

As soon as it had popped, it appears that he jumped into it.

The most successful investors are those that see the market precisely as it is.

And while their investments don’t necessarily mean they are in the game for 20 years — they could easily make a killing from pumping the market back up again before cashing out — it does mean that they foresee at least short-term profits from the sector.

CONCLUSION

Actually, it makes sense to listen to all types of opinions before forming your own.

That does mean hearing what the naysayers and evangelists have to say in addition to those who are open to nuance and in particular those who have significantly changed their position.

It’s very easy to dismiss new technologies and new ways of doing things, particularly if they’re different from the way to which you’re accustomed.

Even more so if they pose a risk to your wealth, power and privilege, and run counter to everything you’ve learned that has brought you success.

If you’re not careful, you end up defending your position, looking for confirmation everywhere and ignoring news that challenges those beliefs.

Obviously you shouldn’t pay too much opinion to one person or institution.

The more you can learn, the better.

And unless you’re lucky enough to have unlimited time on your hands, then you’re going to benefit from thousands of hours of third-party research and lifetime experience if you just take a little time to listen to the opinions of others.

Remember to apply the appropriate dose of cynicism to those public opinions, because they may not necessarily match their privately-held opinions.

If you can understand where their biases are coming from — positive or negative — and what they have to gain from making others believe what they say, then you’re at a good starting point.

We’ve only looked at a few extreme examples above to illustrate this.

Takeaways:

When it comes to understanding the impact any technology — not just trust tech — can make, I’d recommend:

- Seeking out negative evaluations, while appreciating who is making them and why they may be biased that way

- Seeking out the most positive alternatives and doing the same

- Then spend a little more time hunting down people who have switched from one side to the other or at least moderated their earlier positions. You’re highly likely to find more advanced insights here

- Looking for people with real technological expertise — both in the space itself and in related areas where understanding can more easily transfer over

- Looking into regulations and likely negative impacts on individuals from the technology being misused

- Researching which companies are moving into the space

- Looking at which previously successful entrepreneurs and engineers are moving into the area

- Understanding the societal forces that are creating the need for the technology in the first place.

The ‘one big thing’

On that last point, are you able to pinpoint the ‘one big thing’ that’s driving the growth in blockchain?

The problem it helps solve.

I’ll give you a clue — it begins with ’t’.

You can’t have missed it after reading this article, even if some of the naysayer ‘experts’ above seem to have managed to.

If you can’t do that for a particular technology, then it means you don’t really understand it and should either dive deeper or stay clear.

When you understand something to that level it gives you the ability to very quickly ascertain whether someone else ‘gets it’ and to accord them the appropriate amount of attention.

And even more than that, it helps you to truly understand the impact it can make on the world at large without getting stuck in the weeds of short-term issues such as speed, scammers or mass adoption.

This is a well thought out post, and I thank you for taking the time to grab appropriate references and putting them together with some nuance. Kudos to you!