Debrief: Inaugural Blockchain Case Competition Put on by Blockchain and Cryptoasset Association at the University of Alberta

The Blockchain and Cryptoasset Association held its first official, open event: a blockchain themed case competition. Over 20 teams of 1-3 members registered to compete, and 6 finalists were chosen to present their proposals at the windup.

Over 25 people attended the windup event on April 7, 2018, where finalists pitched their solutions to a panel of judges. Originally it was intended for there to be a single winner, but due to the high quality of proposals, a 1st and 2nd place prize was awarded.

The case is summarized below, in addition to summaries of the finalists’ solutions and links to their full proposals.

Option 1:

Research and identify challenges, shortcomings, and inefficiencies of current carbon-pricing regimes – you can choose to focus on one specific mandate (Western Climate Initiative, Alberta Climate Leadership Plan, or any other international model of your choosing), or you can take a general macro-approach and analyze industry shortcomings as a whole. Some examples could include, but are not limited to:

Illiquidity in the trading of carbon offset credits

Segmented and fractured policy mandates

Carbon accounting issues – additionality, auditing, double-accounting, etc.

Develop a conceptual construct (no coding) focused on introducing a blockchain-based solution to your chosen issue.

Summarize your findings and solution in a written proposal document (1,000 words)

Option 2:

Try tackling the following problem: Develop a protocol that will allow for human verification of transactions, accounting, and audits to occur in a decentralized network of industry experts, from offset origination to retirement. Once an audit occurs and is broadcasted to the network, how is it validated to ensure its accuracy without the oversight of a central authority? What does the incentive system that maintains the blockchain integrity look like? Public or private ledger? Permission-based or open source? How does the reward system work (and what is the reward)? How does data mining occur? These could all be questions to think about if going this route.

Carbon audits aren’t an exact science – they often rely on statistical assumptions and extrapolations, approximations, and best guesses. Due to this, 2 qualified, professional auditors may evaluate the same project, yet calculate different offset originations based on their interpretation of the data. In order to implement a decentralized blockchain protocol to store data and originate carbon credits, there must be a consensus protocol that involves elements of manual human verification.

View the full case here: https://goo.gl/xWxvV6

WINNERS:

1st Place ($500) Winner:

Carbon Coin

Team: Martha Han, Hylann Ma, Henry Su

Summary: Currently, companies self-enter carbon emissions into an online system, with audits periodically conducted. To improve transparency and accountability, instead companies will upload their carbon-auditable records to IPFS. The government will issue Carbon Coins, proportional to obligated emissions targets. Companies will hire 2 independent auditors, granted access to the records on IPFS. Smart contract will issue a reward to both auditors if their audits agree within tolerance, but if not, a special auditor will be contracted. The system proposed would function as a private, permissioned ledger. Read the full proposal

2nd Place ($200) Winner:

Distributed Carbon Chain and Audit Protocol

Team: Mihai Esanu, Peter Atrazhev, and Nathan Doraty

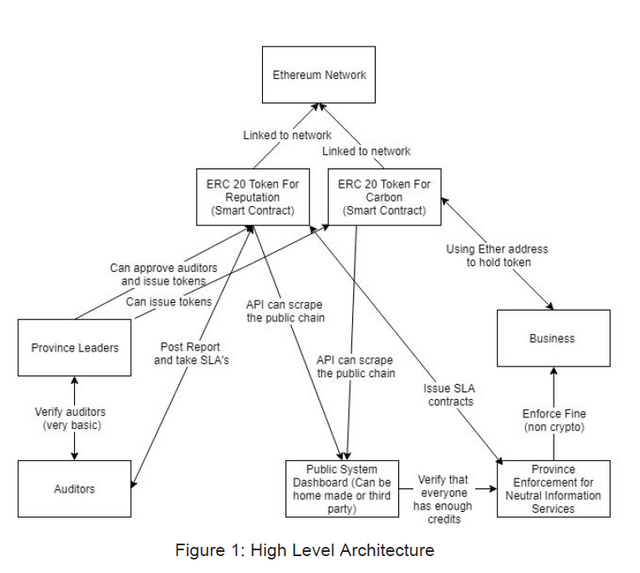

Summary: Blockchains suffer from the ‘oracle problem’, in that they do not have a built in way to access external information. In carbon credits, this applies to the specialized auditing information. To solve the oracle problem, we propose the reputation of information sources in this system be represented by an ERC-20 token, and the Chainlink architecture. Statisticians stake their reputational token, and if their audit report is not in line with overall consensus (ie. inaccurate), they will be punished through reputation deduction (automatic smart contract). Read the full proposal

FINALISTS (in no particular order):

Blockchain Solution to Carbon-Offsets

Team: Taleana Huff

Full proposal

Emissions Reductions and Distributed Ledger Technology

Team: Dragos Cocosila, Christine Lam, & Olivia Wang

Full proposal

A Wager-Based Blockchain Protocol for Tracking International Carbon Offset Credits

Team: Ashley Herman & Rooshan Aslam

Full proposal

The Potential for Blockchain Technology in Alberta’s Carbon Offset Mechanisms Pertaining to Large Emitters

Team: Kabir Nadkarni & Jason R Wang

Full proposal

Feedback and areas for improvement:

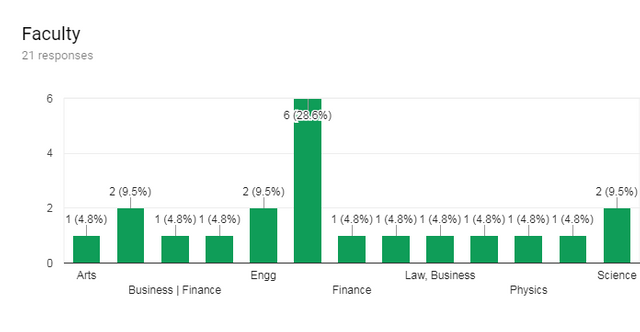

Overall, our organization is pleased with our first event. We melded blockchain into a business format in a way that hasn't really been done before, inclusive of students of pretty much any faculty (science, math, CS, engineering, business). You can see the demographic of the participants in the chart below.

We had a great turnout at the presentation and windup event as well. The audience's engagement was excellent, with many excellent and informed questions being asked. Participants stuck around for hours afterwards to mingle with each other and network with industry professionals who were present from Calgary.

We also received feedback from participants (likert scores presented in the chart below), and from our own observations and those of our organizers.

At our next case competition, we hope to have smoother transitions between presenters, have more judges, and more explicit judging criteria and quantitative scoring. We also intend to increase the proposal word limit to 1500, and the presentation time from 7 minutes to 10 minutes.

Stay tuned for more events from the Blockchain and Cryptoasset Association!