The Art of the Index — Handling Cryptocurrency Bubbles and Minimizing Volatility

A Need for Diversification

Ahhh yes, the good ol’ reliable index fund. Many of us who have been in the investment world for more than a few months can at least roughly comprehend and explain to our friends and family what the purpose of one is. Additionally, most of us can understand why they are so lucrative in the long-term scheme of investing and in their abilities to make people wealthy. In almost every asset class, index funds are immensely popular in today’s investing environment. There has to be a reason our uncles won’t shut up about how the rest of us need to be heavily invested in them.

So what is being done for cryptocurrency?

Above Image: Donald and Melania (in this totally real and not hypothetical or symbolic illustration) are taking notice of indexes changing the landscape of cryptocurrency as we know it.

Even in the relatively new cryptocurrency space, index funds and ETF’s are starting to gain traction and trust among traders looking for a safety net in arguably what will continue to be an asset class with the most volatile waters a trader can experience. Dr. Redouanie Elkamhi, who is the founder of BB Index, states,

“The potential cost savings from investing in an index is perhaps the most obvious benefit to investors of financial market indices. This is even more pronounced in the crypto market given the scarcity of transparent and investable indices so far.”

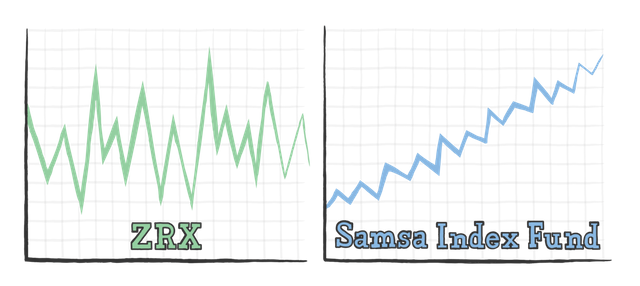

Index funds can be extremely beneficial to traders on new index sites like Samsa, not only to hedge their investments in a variety of coins they believe in, but also to reduce the volatility of their portfolios. Many research one or a small handful of coins, and do the crypto version of putting “all their eggs in one basket”. This can lead to massive swings that can overwhelm an investor’s risk tolerance and ultimately create a barrier for them to be in the heavily volatile asset class.But by grouping coins together and following a sound investment strategy, particularly one that is researched by analysts here at Samsa or by successful traders, one can decrease their volatility while increasing their portfolio’s sharpe ratio.

Above Image: A representation of what a trader’s balance may reflect during a short/medium timeframe investing solely in a highly volatile coin like 0x (ZRX) vs. a solid index fund with Samsa. There are much higher swings and lower sharpe ratio (on left) than what a portfolio would experience in a balanced group of coins (on right).

Chris Slaughter, the founder of Samsa, provides his take as to why actively monitoring and trading cryptocurrency is so difficult:

“Investors have to buy crypto assets on an on-ramp like Coinbase, learn about crypto wallets, and transfer their funds to an exchange. Next, the user has to research, price, place, and monitor trades every day to maintain diversification and beat the markets. Finally, they have to deal with the fact that crypto markets are ever-changing and open 24 hours a day, seven days a week, and why the popular Robinhood Crypto exchange launched with the phrase “Don’t Sleep.” All of this is way too difficult for most traders to keep up with — and as a result, most people just passively “HODL” their Bitcoin.”

Simply put, investing in index funds eliminate these problems. A group of well deserving coins all invested in an index is a smarter decision than throwing a dart at one coin, and hoping that it provides the best returns.

Internet Boom Similarities and Lessons We’ve Learned

Today’s cryptocurrency landscape has often been compared to the “dot-com boom” of the mid to late 1990’s. You know, that little tiny bubble at the end of the last millennium which saw the Nasdaq Composite stock market index rise a cool 400% between the years 1995 and 2000? Well, many have tossed around the idea that crypto is in the early stages of experiencing a similar phenomenon, albeit a much more rocky and perhaps uncertain one. Yes, the digital currency assets are far from the same investments as actual physical brick-and-mortar, company backed stocks that were emerging right and left 20 years ago. But Bitcoin, Ethereum, and other cryptoassets do have some similarities to the 1990’s versions of eBay and Amazon, at least in the patterns in which they are traded.

First off, cryptocurrencies are far, far more volatile than dot-com internet companies from the late 90’s ever were. And secondly, if we could accurately predict Bitcoin’s direction on the above chart just based on the similarities it has to the 20 year-old tech bubble, life would be a lot simpler. Third, the asset classes of tech companies vs. cryptocurrencies are simply far too different. There are no physical brick-and-mortar to invest in with crypto, meaning values are essentially purely speculative. Due to a theoretical value that is essentially crowdsourced, it makes future price direction far too difficult to predict for even the most well-accomplished analysts. Anything can happen moving forward as blockchain technology continues to make strides toward real-world application.

So how do we invest going forward? If you still strongly believe in the future of cryptocurrency, as we here at Samsa certainly do, then what strategic options are available to use in order to invest responsibly? How can we minimize our exposures to massive downswings and maximize on the upswings?

In an age where very few people can accurately and consistently predict what cryptocurrency coin, stock, or commodity is about to spike up or fall off a cliff next, index funds have become increasingly important in everyone’s quest to generate the best returns with the least amount of babysitting.

Investing should ultimately be about generating passive income, so there is a pretty nice advantage to jumping onboard an ETF or mutual fund where analysts do the research and portfolio adjustments for you in return for a typically small percentage-based fee.

Above Image: Jeff Bezos, founder of Amazon, working diligently in his office circa 1999. Source: http://www.whiskeyriff.com/2018/01/02/amazon-founder-jeff-bezos-in-his-office-in-1999-is-all-the-motivation-you-need-for-2018/

History Repeating Itself Through Patterns and Bubbles

Another attribute that similarly links cryptocurrency to the dot-com boom is how the price of both industries had massive downward corrections following their surges in value. For internet companies, this correction occurred over a three-year stretch between 2000 and 2002, with tech-based Nasdaq dropping from $4069.31 to $1,335.51 (a 67.2% loss). In cryptocurrency, where things typically move on a much more rapid time scale thanks to higher volatility and 24-hour market trading, the price of Bitcoin dropped from its high on December 17, 2017 at $19,783 to a low of $6,048 on February 6, 2018 in a mere 51 days. Bitcoin’s price crashed an eerily similar 69.4% in about one-twentieth the time duration that it took Nasdaq to lose roughly the same proportion of gains.

Above Image: Bitcoin’s value in dollars (above) over a three-year span shows a striking resemblance to Nasdaq’s value (below) on a 15-year span. This reveals just how quickly markets move in cryptocurrency, and how similar bubbles can be even in entirely separate asset classes.

As so many altcoins, in this infancy of cryptocurrency, are linked to the success and stability of Bitcoin, an index fund likely would not have protected your portfolio from diverging too far from the pattern we see in Bitcoin’s chart above. However, this will not always be the case. Altcoins will continue to individualize and separate themselves from Bitcoin’s wrath, and that is when having an index will really pay off.

All this being said, the similarities in the above comparative charts simply infer that a bubble, in some capacity, did and may still exist in cryptocurrency. But what does this all mean? Can we expect Bitcoin to follow the same trajectory as tech stocks did 16–20 years ago post-crash? And can we even be certain we are in the recovery period of Bitcoin’s crash? I can say with almost certainty that the answer to both questions is a resounding “nope”.

To assume that Bitcoin’s value is on some sort of conspiracy-driven track to follow the same proportional trajectory as Nasdaq’s composite index did during its famous late 90’s bubble would be foolish. It is hard to find much relevance between the valuation of a still relatively new individual asset like Bitcoin to a massive technology stock market that has been around since 1971 and made up of over 3,000 companies. However, it does demonstrate the psychological similarities that investors demonstrate when they become overly excited about an investment during a massive rise, followed by overly panicked during a brutal fall. It is easy to forget that bubbles and prices in both Nasdaq’s and Bitcoin’s situations are driven by traders.

We can’t always avoid industry-wide bubbles or erratic, irrational fluctuations in prices. However, index funds do an excellent job of stabilizing and minimizing the effects of these kinds of bubbles.

Is the Soaring Popularity of Index Funds Justified? And What About Crypto?

According to Trevor Hunnicutt of Reuters,

“Stocks in actively managed hedge funds, mutual funds, and institutional accountings total $17.4 trillion, 25.6 percent of the global equity market cap…”

This is no small proportion, and it clearly is an indication that people want to feel a level of safety when investing (which would be obvious regardless). These numbers also point to the likelihood that investors are trusting their assets with expert analysts at an increasing rate. Many large firms have track records of success that speak for themselves.

Yes, in the stock world, over the past couple years, major corporations like Netflix and Amazon have individually out-earned your run of the mill S&P ETF by a pretty substantial margin. But most stocks are not Netflix and Amazon, and there are hundreds of American stocks alone that have fallen short of traditional ETF’s and mutual funds during this same period of time. There also have been more than a handful of stocks that have done significantly worse than these ETF’s. Since the dawn of their existence, indexes have proven to be quite lucrative in just about every profitable sector. Reliable and trustworthy stock indexes run by established companies like Vanguard, Fidelity, or TD Ameritrade have a proven track record of out-pacing most stocks over long timeframes.

So knowing what we know about traditional index funds, the question begs to be asked. Is there a need for crypto index funds? We at Samsa think this is a no-brainer, and not just because we provide users with the ability to invest in them. Coins move at varying rates, and there is nothing worse than watching a token you didn’t quite jump in on quick enough proceed to take off. And conversely, watching something you just began investing in drop unexpectedly. Cryptocurrency index funds will allow users to flatten out their exposures to individual coin risk. Worries of jumping in or out of one coin too late will always be a thing, but index funds will help minimize the amount of punishment one feels from a single coin’s volatility.

Our indexes in particular will allow for automatic reshuffling of your allocations any time you see the need. With so much price movement and volatility on a minute by minute basis, it is impossible to monitor prices without going at least slightly insane.

That is precisely why we have algorithms in place that will do that work for you and trade based on strategies you are in complete control of. In the end, most crypto investors would like to set their strategies and forget about them for substantial periods of time, all while minimizing their exposures to risk. We think using index funds are the future, and they are exactly the solution for users to make passive income without the need to constantly hit the refresh buttons and worry about stop-losses, FUD, and FOMO.

I write in depth cryptocurrency analysis at Samsa, the passive investing tool for crypto. See what we’re doing at Samsa.ai and see our other analysis at our magazine. If you love what you see, give this article 50 claps! If you hate it, show your displeasure with 49.

This article and related content is for informational purposes only. It should not be considered investment advice, and you should consult a financial advisor and do your own research and due diligence prior to making any investments. Where securities or commodities are referenced, it is only for illustrative purposes only, and does not imply any position on securities or commodities classification. To the extent that Samsa services are offered or discussed, those services are available only for Samsa whitelisted assets only.

Hi! I am a robot. I just upvoted you! I found similar content that readers might be interested in:

https://hackernoon.com/the-art-of-the-index-handling-cryptocurrency-bubbles-and-minimizing-volatility-371faddfa2dd