How ICO works / Mechanics of working with ICO

Not so long ago the Sandcoin Project, which planned sand quarry mine working in Moscow Region, announced the date of ICO issue — 18th of September. We would like to mention that on prior trading session the company sold 230 000 SND just within 6 days. And 3 170 000 coins more are planned to be realized on primary sales.

ICO (Initial Coin Offering) concept itself has not been a virtual reality for a long time. In 2017 only the lazy one didn’t try to make money out of cryptocash. Value growth of bitcoins and ethereums really excite, while increasingly frequent examples of business, collecting million investments on trades, simply tease with hundredfold profits. At the same time, high percentage of cheating scares, as well as the absence of legislative base with a complete company’s virtuality when it comes to launching applications, estate funds or crypto currency exchange.

Another situation is when money on ICO are raised for business in a real sector. For now, in Russia there are only one-time examples — kolions of “Kolionovo” farm in Moscow region, Zircoins from a refractory zirconium of the same name and those Sandcoins from sand quarry creators.

So what is a product coin and why is it so attractive? Let’s start from a beginning.

ICO and IPO

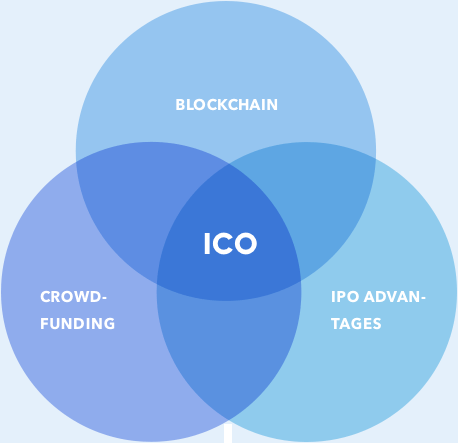

ICO (Initial Coin Offering) for a business is a method of crowd funding. In fact, it is a virtual analogue of IPO with a few substantial differences.

Firstly, company puts up tokens on the ICO, not shares. This is crypto currency itself, or virtual money. Number and cost of tokens are given by the company’s owner. In a pre-sale 1 SND is out up for $ 0,95 and on ICO it will cost $ 1.25–1.35.

Secondly, tokens purchase, unlike stocks purchase, does not give any legal rights to business. If the share grants the right for the company capital, and therefore caneasily influence on company’s decisions, the situation with token is not the same — it could be sold for a market price or exchanged to a product from a fixed date, which has been given in the project essentially.

Thirdly, acquirement of crypto currency does not require any legal acts on behalf of the buyer. Purchase and sale of tokens are not under legal adjustment, they are regulated with a blockchain-technology mechanism. As a matter of fact, above mentioned is the main preference of the ICO. It’s not everyone who could afford project stocks in the first sale, but absolutely everyone can anonymously buy any number of tokens of the company which put them up on sales.

How do tokens work?

Tokens are issued under certain purchases and implementations conditions which are fixed by smart-contracts on special crypto currency platforms. Nowadays two of them — the Ethereum and Waves platforms are most popular.

Smart-contracts function based ona blockchain technology or a distributed database. The essence of this mechanism comes down to the fact that all computers of payment service, being placed in different network nodes, are completely equal. Data between them is distributed independently of storage environment that provides complete transparency of system, along with its complete decentralization. A sufficient condition for access to the system is an open source client-program. All transactions made in payment service provider register in a blockchain and can be monitored by any user of the system. Thus, the smart- contract cannot be neither deceived, nor to forged.

Original tokens sale is practically secured only with businessman reputation and perspectives of project development. The token cost depends on demand for it and, respectively, on the company cost at exchange. In a real sector, coins are tied not only to the company itself, but to the value of its real product, therefore their investment attractiveness is higher.

Conditions and order of sale and repurchase of tokens and also the business plan of the project are stated in the document of White Paper which is always available on the startup website.

Why is it attractive in the real sector?

The main difference of ICO technology in industry is that the token cost is tied to a real product and its selling is carried out as electronic option. So in case of Sandcoin, 1 SND will be redeemed by the company since July 2018 at market value of 1 cbm of construction sand (today is USD5.30). At the same time cost of sand coin on ICO ($1.25–1.35) will be equal only to a costs of development of this cubic meter, what is nearly 4 times less. Thus, upon purchase of tokens of Sandcoin investors will be able to feel profit still before the quarry is developed.

At the same time the market price of sand will continue to grow further with high probability. At the moment the Sandcoin company owns a land of 109 hectares, which has GIN license for development from Federal Agency of Subsoil Management of the Russian Federation. After quarrying the total amount of the extracted sand will be 14 400 000 cubic meters. The site is located in 10 km from construction of an interchange of the Central Ring Road. Along the new highway a railway service is also projected. Besides, in the territory of the Moscow region, the active residential building in place of demolition of the emergency housing is planned, which has an area of 60 billion m2.

We glad to remind you, that SandCoin’s team announced ICO date — 18/09/2017.

Also you can participate in our bounty programme: https://medium.com/sandcoin/sand-coin-bounty-campaign-e1925a8721d5

You can join us on Telegram, we will give an answer to all your questions: https://t.me/sandcoin

Here is our project: https://en.sandcoin.io/

Also you can find us on Facebook - https://www.facebook.com/SandCoinICO and on Twitter - https://twitter.com/ruslanyocto .