PayBlok: Bridging the Gap for SMB

In order to solve the cash flow problems faced by SMB’s, InstaSupply aims to introduce PayBlok in its ecosystem in order to solve small and mid sized businesses cash flow problems.

WHAT PLAGUES THE EXISTING INDUSTRY

Formal SMB’s (Small and Medium Businesses) contribute upto 60% of total employment and upto 40% of national income in the total economy of USA. Small firms having less than 25 employees tend to develop more patents per employee when compared to their counterparts in the big firms. Even after all these developments Small and Medium sized businesses (SMB’S) have to face working capital restraint that makes them financially prone to the fluctuations of the market. The buyer is recorded as a liability while the supplier is an asset. About 30% of SMB’s state that around 47% of business payments are paid late. The delay is generally an intentional delay cused by customers or elongated processing methods.In the American region about 48% of B2B invoices are not paid on time. Late payments being highest in United States. In Asian pacific about 44.6% of domestic invoices are paid late. India being the most affected country where 56.4% invoices are unpaid at the due date. Considering the case of Europe average payment duration being 59 days 41.9% of domestic invoices are unpaid. This hinders the workflow of any business and hampers their ability to expand their operations.

Highlights of Instaflow Technology:

Instaflow provides a portal for buyers and sellers to manage their payments and collections. This portal creates a network between buyers and sellers collecting data from both ends. It helps users to create and place orders, track deliveries and enables the buyers to manage, control their spend and track their orders.The development of single platform for payment facilities will enable more benefits to buyers as well as sellers. Since its a single platform its free from any external frauds and manual activities such as exports and reconciliations.This portal will enable account payable department the ability to settle an unlimited numbers of invoices. Wallet security involves Protection and security of funds which is indeed the most important factor within instasupply. The ‘virtualised’ model doesn’t enables the physical wallet addresses and thus blockchain gets no access of the wallet. A virtualised wallet is accessible only with in the instasupply application. The cryptocurrencies will be stored across a number of wallets internal to instasupply so that private keys are inaccessible to humans. The Steps involved in easy and fraud free buying process :

- Purchase order

- Delivery or service

- Invoice

- Payment

Supply chain financing can help in resolving the issue to a large extent as it involves simple and bureaucracy free financing portal. It enables suppliers to receive funds, net of fees within 24 hours added with the transparency that blockchain offers. Sales and marketing team seeks to grow instasupply users via a three fold approach as Inbound marketing, Partnership and Integrations. Automated approval is an essential part of the project as it helps in financing the project at the righ time. Automation tends to reduce the chances of human error by a percentage of 90 resulting in quicker payments and thus increasing chances of accuracy. Payblok also aims to expand geographically the main target of the company is to focus on the US and UK markets thus increasing growth and profit. Geographic expansion is driven by following factors:

- Market size

- Market average interest rate

- Collection Complexity

- Average B2B Payment Default Rate

- Participation of Credit on overall B2B transactions

- Other markets of interest in the advanced stages are Brazil, Mexico and Australia.

The PayBlok Solution

PayBlok token system will leverage the Instasupply ecosystem by creating a business network between buyers and suppliers. Once an invoice is received by a customers on the platform, they will be able to review the invoice, and accept or reject it.

The PayBlok solution will comprise of:

- PayBlok Tokens: The creation of the PayBlok token enables InstaSupply to offer a range of products solving the problems faced by SMBs. The products are Integrated Payment Solution, Supply Chain Financing and Asset-Based Lending

- Decentralized Community: The community comprises of buyers, Sellers, Investors and Validators who will share the profit among themselves

- Automated Approval and the Window of Opportunity: The entire procedure of approvals on the Instasupply platform will be automated which will be guided by “Automation Policies” of the platform

- The Integrated Payment Solution: Payment facilities will benefit both buyers and suppliers. Developing the payment portal within the platform ensures that the complete procurement cycle will go through InstaSupply, creating security while also eliminating any risks associated

- Supply Chain Financing: Supply hain financing is stated as the most interesting use case of PayBlok and will provide the SMB's with much needed financing power to procure their supplies

- Asset-Based Lending: This feature will use PayBlok tokens as a guarantee. If a loan is not repaid, that Payblok collateral will be taken by InstaSupply.

- PayBlok Lifecycle: The PayBlok network will have two kinds of life cycles namely, Buyers Subscription for using InstaSupply and Supply Chain Finance

- Value Exchange and The Network Growth: The company will be engaging with customers to get more users onboard, incentivizing them using various marketing techniques

Apart from the above mentioned products, the PayBlok ecosystem also other short term cash flow problems problems faced by SMB such as :

- Factorising:

It is a process that enables companies to borrow money on sales invoices. this involves working with finance company in order to get short term loans. - Bank loans:

These can help in solving immediate cash flow constraints and provide emergency cash. Bank loans can be secured or unsecured based on involvement of collateral. - Dynamic discounting:

This process involves use of excess cash. If the buyer has extra cash he /she may use this cash to make an early payment to the supplier. - Marketplaces:

Most of the market places limit themselves to institutional investors and require substantial initial deposits just to gain access of the marketplaces.

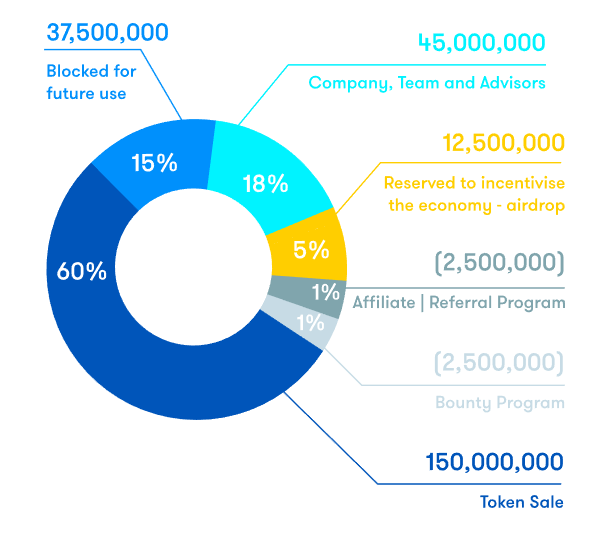

PayBlok Token Metrics

Thus, InstaSupply has introduced in the modern business scenario the most user friendly, fraud free and efficient transaction portal to resolve the problems of SMB’S that being payblok.

LINKS FOR MORE INFORMATION

- Website: https://payblok.instasupply.com

- Twitter: https://twitter.com/instasupply

- Facebook: https://www.facebook.com/instasupply

- Whitepaper: http://assets.ctfassets.net/5vuk877t9hxd/2GZxu4Bf2g684Kq8c8wk0Q/f15cf1e6867a131f215772a9859f2f3b/payblok_whitepaper.pdf

- Youtube: https://www.youtube.com/watch?v=1AQEXlJk1uI

- Slack: https://payblok.slack.com/join/shared_invite/enQtMzU1NjczMTA2OTc2LTcyZmRlNzcxN2U1ODExNTdjMzc2ZWQyYjc1NzExZThmYjljOGRiZmU5YTI4YWM3MWI3NWY4OGVhYWNiMGUzZmY

- LinkedIn: https://www.linkedin.com/company/instasupply/

- Bounty0x Username: atinaditya

**This article was created in exchange for a potential token reward through Bounty0x**