From Securitization To Tokenization (LXXIX)

In the beginning .....

man created money and assets. And, for centuries, the assets were without liquidity. Then man said, “let there be liquidity,” and there was liquidity. Man saw liquidity was good. He called liquidity “asset-backed securities” (ABS), and securitization was born…..

… That was 1985.

In 2019, not counting other assets, US mortgage backed securities alone are reported to be $3.1 trillion of the $15.4 trillion total outstanding mortgage debt.

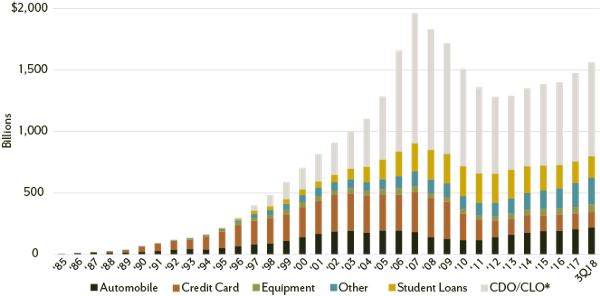

Established in the US in mid 80s with $1.2 billion in asset-based securities, ABS market in the US has grown exponentially over the decades approaching $2 trillion mark in 2007. The 2008 real estate slump not only arrested the ABS growth, but registered significant drop until the market gradually started picking up again in 2013–14.

Securitization is the process by which assets with generally predictable cash flows and similar features are packaged into interest-bearing securities with marketable investment characteristics. ABS is the transformation of an illiquid asset into a tradable security, such as bonds or notes, and therefore more liquid than the underlying loan or receivables. Securitization of assets can lower risk, add liquidity, and improve economic efficiency.

The securitization process redistributes a bank’s traditional role into several specialized functions such as:

-issuer,

-underwriter,

-rating agency,

-servicer, and,

-trustee.

The issuer (sometimes referred to as sponsor or originator) brings together the collateral assets for the asset-backed security. Issuers are often the loan originators of the portfolio of securitized assets because structured finance offers a convenient outlet for financial firms like banks, finance, and mortgage companies to sell their assets.

As this process can encompass any type of financial asset and promotes liquidity in the marketplace, ABS market continues to evolve into new securitization deals ranging from diamonds, to agricultural crops, to venture capital, etc, that have emerged over the past few years. Investors expect even more innovative offerings in the future.

Tokenization is the next quantum leap in asset-based securitization.

The Advent Of Blockchain & Tokenization

Blockchain and token or cryptocurrency are inseparably linked. As much as a decentralized form of token simply cannot exist without the security provided to it by blockchain, a blockchain cannot be created without giving people incentives to create it. Decentralized token / crypto is that incentive. Token serves as a digital wrapper that gives us the power to create, configure, and trade any imaginable asset frictionlessly, peer to peer. In short, tokenization can streamline our current financial markets, and allow us to create a world filled with seamless value transfer. This could potentially have massive implications on our future economy..

Tokenization not only allows us to create a digital wrapper around any physical, digital or intangible asset imaginable, but the tiny bytes of code can digitally enable the performance of valuable contractual deliverables without human engagement, helping automate the trustless transfer of digital assets. This means the trusted intermediaries in traditional centralized securitization, such as rating agency, servicer, and, trustee, etc are done away with, thereby saving a fortune in terms of time, manpower and financial resources.

Current Use Cases & The Buzz

A number of use cases for asset tokenization already exist today.

- Commercial real estate: Fluidity Factora’s FACTOR-805 successfully structured and tokenized the debt and equity in a 37-unit Brooklyn residential condo and retail space.

- Venture capital: Blockchain Capital — a venture capital firm — successfully raised its third fund, partly by issuing its own security tokens called BCAP.

- Startup fundraising: Provenance.io successfully raised $20 million in a Security Token Offering (STO) by selling tokenized equity in its startup.

- Tokenizing Art: Monart is a startup that’s bringing tokenization into the contemporary art space.

Earlier this week, a startup called 20|30 raised £3 million to start offering tokenized assets on the London Stock Exchange. And, Arca, an investment management firm filed with the SEC to start issuing tokenized bond based products.

This is just the beginning. The possibilities are endless.

It isn’t difficult to imagine a future, where all types of assets are issued natively on a blockchain and represented in tokenized format, all of the trillions, that humanity can claim as asset, eventually moving over to the blockchain.

The Future: Monetizing Influence Via Tokenization

Decentralized Ledger Technology (DLT), such as blockchain, goes beyond just tokenizing assets belonging to any of the known asset classes. It can help us create a new super asset class of Influence Capital. We are using blockchain to tokenize influence for creating quantifiable capital assets that can be profitably utilized to fund projects, particularly those that make our planet and our lives sustainable.

Even if we are able to tokenize the influence of just a fraction of the idling trillions sitting on the sidelines globally, the world would indeed be a much better place.

The Prosperist Pledge-LXXIX:

If you wish to pledge support to the Prosperism movement, the terms remain the same as previous posts, with the following pledge:

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

Thank you for your continued support.

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

Hii @sharonomics, Funds transferred to @prosperist now, So kindly update your record. Thnks

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01