Malta: Crypto Haven? A Realty Check (LXXXVI)

Last year, with much fanfare, Malta claimed to become the world’s first jurisdiction to regulate ICOs and Blockchain. A Forbes article hailed 4th, July, 2018, as a historical day for Malta, when Malta passed 3 bills presumably to make Malta the most favored Crypto destination. A closer look gives a completely different story. Here’s our reality check.

Malta’s Financial Instrument Test Guidelines. Latest version is available here

Let’s begin with decluttering the legal jargon that each of those three so-called blockchain-friendly Maltese acts enshrines in them. To make it simple we first review what is already established within the global blockchain industry.

Last year the SEC declared that Ethereum tokens are not securities by applying the Howey Test. The Howey test is derived from the United States Supreme Court case of SEC v Howey, which essentials asks investor four main questions to determine whether a token is a “utility token” or “a security token.”

As of April 3, 2019, Howey is still a good law, when SEC allowed Turnkey Jet, Inc. to proceed with the public sale (ICO) of their digital tokens within 24 hours of their request.

While the world is campaigning to further relax the Howey test for supporting innovation, Malta’s Virtual Financial Assets Act (VFAA) is stifling the innovation by completely abolishing the concept of “utility token” and eventually killing the Howey standard.

VFAA Basically Abolishes Utility Token & Howey Test

VFAA along with two other acts became crypto / blockchain regulating law in Malta on 1st November 2018. It defines the conventional cryptocurrency tokens, either as:

- Virtual Financial Asset (VFA), or

- Virtual Token(VT).

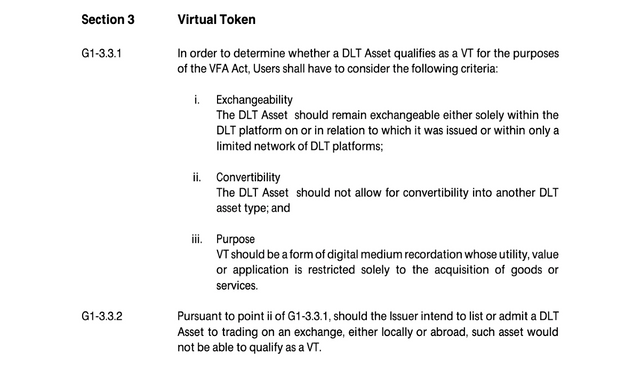

Under VFAA, VFAs are regulated, while VTs are not. If we look at the definition of VT, any further discussion on VFA or VFAA or the remaining 2 of the 3 acts will become redundant. VA is defined in Section 3 of the FAA as extracted herein:

G1-3.3.1 of the act leaves no ambiguity in concluding that if there is even an intent to list a token at any of the crypto exchanges it would be considered as a regulated token (a security token). In other words, each one of the 2000+ tokens listed on CoinMarketCap is rendered illegal under new Maltese law, although implicitly they are considered as utility tokens not warranting explicit regulatory mandate in any jurisdiction other than Malta.

The Binance / OKEx Marketing Farce

Image Credit: Logos of Binance and OKEx

There was a big media hype last year that Binance and OKEx are moving to Malta. But as of now, the LinkedIn profile of Binance discloses their location as Asia and particularly [Taiwan]( according to a recent report](https://www.vox.com/recode/2019/5/8/18537073/binance-hack-bitcoin-stolen-blockchain-security-safu), and OKEx website provides Kuala Lumpur, Malaysia, as company’s location. These exchanges list hundreds of tokens (verified as utility tokens per Howie test). They explicitly exclude security tokens.

Currently, there is no market for security tokens as only utility tokens can be traded on each of the 200+ crypto exchanges. One wonders how any of those exchanges would operate in Malta when Malta defines each and every exchange-tradable token as a regulated token (security token), making each of their listed tokens illegal in Malta.

Why would Binance or OKEx move to Malta if VFAA compels them to delist all of their utility tokens since those tokens will become regulated tokens under VFAA?

I guess all those stories of Binance, OKEx et al, migrating to Malta were a marketing farce that pre-date the promulgation of the VFAA. At the time they probably didn’t actually know how stifling VFAA would be when it comes into force.

IEOs Impossible In Malta

Image Credit

A brand new IEO (Initial Exchange Offering) industry has cropped up as ICOs had hard time in 2018. An IEO is very similar to an ICO, but with a slight twist — users can participate directly from their exchange of choice so that the utility tokens become available for trading on the exchange shortly after the sale completes.

IEOs for utility tokens are thriving with almost all the leading crypto exchanges jumping into the bandwagon. Binance’s latest IEO platform, Launchpad, targets launching at least one token every month. Following Binance OKEx also announced its own IEO platform joined by a bunch of other exchanges.

Arguendo even if Binance and OKEx actually shifted their operations to Malta, not only their collective $4.5+ billion daily trading volume will become illegal, but they will miss out on the potential of exploiting IEOs for utility tokens.

Without Tradability Security Tokens Are Worthless

The fact that no exchange will list a token unless a due diligence process establishes it as a utility token, makes VFA tokens totally worthless. The value of a token comes from its liquidity in exchanges. However, just because security token exchanges are virtually non-existent at the present time does not mean that they don’t have future potential. But the nature of cryptocurrency is such that it cannot survive more than a few months, or a year at best, without liquidity. Even if Malta creates its own security token exchange from the ground up, it is of no avail to the projects looking for fundraising today.

#Endnote

This study was commissioned by Trimark Technologies. The author’s opinion in this report is exclusively based on the VFAA’s definition of VT and VFA tokens, plus his experience as a provider of utility token due diligence services to cryptocurrency startups and exchanges. This review does not claim that there cannot be other provisions in VFAA and the other two related acts that may create exceptions that negate or dilute the stifling impact of those definitions. But it is highly unlikely any other provision, except a future amendment, can alter the conclusions of this review in any significant way that will make Malta any less repulsive to the blockchain economy.

This article was first published in Medium

The Prosperist Pledge-LXXXVI:

If you wish to pledge support to the Prosperism movement, the terms remain the same as previous posts, with the following pledge:

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

Thank you for your continued support.

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01

“I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01”.

Hii @sharonomics, funds transferred to @prosperist right now. so plz update your record.

I pledge to share my SBD+Steem reward from this post with @prosperist to earn Xteem tokens @ 1 Xteem token / $0.01