Stratis in Numbers (Stratis Weekly #4)

Greetings and welcome to our fourth edition of the Stratis weekly newsletter.

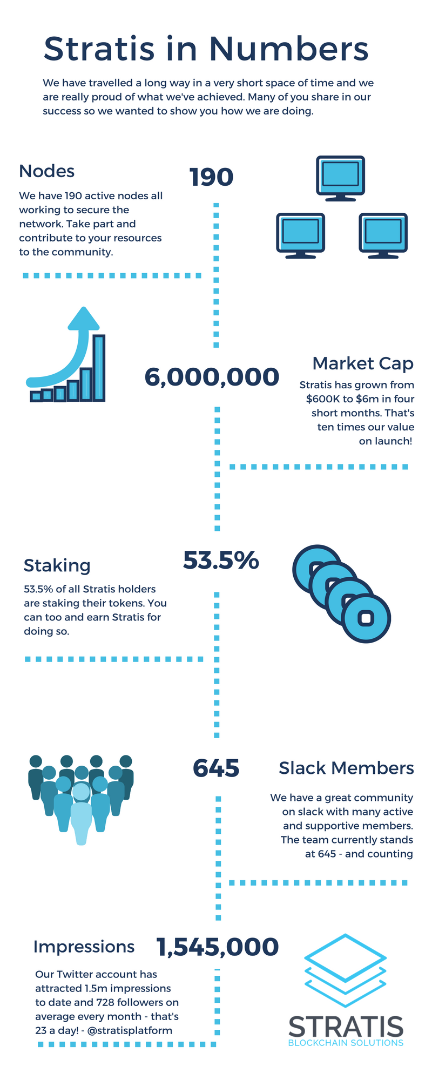

This week we have responded to a slack conversation in which some of our community members were discussing how to help with Twitter promotion. In response we have come up with a smart little infographic that we hoped would give you insight into some of our stats, whilst being something you can share within your social networks. That’s not all though – we are pleased to report that two of our core team members went along to the Blockchain Money Conference in London at the weekend – scroll down to read their highlights from the event.

Notes from the Blockchain Money Conference

Stratis were out and about at the Blockchain Money conference in London on Sunday 6th and Monday 7th November. The conference was held at Bishopsgate and Stratis Dev Dan Gershony was joined by PR and content manager Freya Stevens. The program included the likes of John McAfee, Roger Ver (Blockchain Ultimate) and Nic Cary (Blockchain.info)

Freya

The conference kicked off with Marieke Flament, Managing Director of Circle, describing internet has fundamentally changed many industries since it’s inception such as the travel and music industries, but for some reason banking still resists. The Bitcoin and Banking panel went into more detail about where the utility of blockchain technology could be within the finance industry but couldn’t agree on the extent of its potential. Professor Ferdinando Ametrano was of the opinion that blockchain was just another hype word and explained that smart contracts were not needed where nano-second trading was already taking place. ‘We don’t need the DAO – we have people’ he declared, and the subtleties of trade finance would not be solved with blockchain. Instead he argued for applied cryptography or ‘a database on steroids’.

Anthony Macey (Barclays) strongly disagreed arguing that blockchain technology had enabled him to reduce settlement flows down from 14 days to under 4 hours which represented a seismic shift for the industry. Chris Ballinger (Toyota) also took sides adding that at the moment ‘It’s probably faster to mail bills than to use the current attempts to digitise financial settlements’. He then returned the discussion back to where he saw the opportunity of blockchain technologies.

‘Cryptocurrencies turn every instrument into a ‘bearer’ instrument – whether financial, physical or intellectual property – all can become bearer instruments thus solving the trust problem – that is the real value in the system’

Dan

For me John McAfee’s talk was really interesting. He spoke about the spread of keylogger software used to spy on wallet keys during signup. He talked about the need to use harware wallets and of his conviction that there will never be a software wallet that is secure so long as mobile exists. Outside in the foyer I chatted to Paul Puey, CEO of Airbitz wallet who said they were working on delivering edge encryption to everything on their platform which is definitely a way forward!

Something else John McAfee said was intriguing – he has set up a mining business in the US on his conviction that ‘cryptocurrencies are here to stay for good or for bad, nothing can top that now, not even governments’. This sentiment was echoed by political representatives on the European Government and Blockchain panel. EU parliament member Eva Kaili said that there would be voting on a new raft of regulation within the next few months but since the technology is still in a state of development they will be cautious to take any tough measures, and they will certainly not be classing cryptocurrencies as money any time soon. Overall the message I got from the political establishment is one of gradual acceptance.

I also noticed the theme that blockchain is being applied to other use cases beyond finance. Michael Mainelli from Y/Zen took a quick tour of its use in Geostamping, Clinical Trials and Supply Chains – anywhere that a central 3rd party situation can be found. Blockchain he said, has the potential to reduce natural monopolies thereby reducing a raft of vulnerabilities like switching costs and sloth. All in all though, it’s exciting times for blockchain.

That’s all for now but look out for next weeks issue where we will dive into the C#.NET protocol.

Wishing you a Trumptastic day!