Coronavirus could have adverse effect on other forms of investment, but not on gold investment

"Gold is a method of going long on panic," prestigious financial specialist Warren Buffett once said.

The Berkshire Hathaway CEO clarified that if individuals "become increasingly apprehensive, you bring in cash, on the off chance that they become less apprehensive you lose cash, yet the gold itself doesn't deliver anything."

Financial specialists' dread levels are especially high at the present time, as the coronavirus pandemic transformed a worldwide wellbeing emergency into a monetary one. Furthermore, it's dubious when the world will recoup from both of these emergencies.

It is in such seasons of vulnerability that gold is touted as a "place of refuge" for those searching for cover from all the more customarily unpredictable ventures, similar to stocks.

"Contrasted with an interest in stocks, where even the greatest blue-chip organizations can (and have) fizzled, an interest in gold regularly appears to be less unsafe," said Adam Vettese, advertising expert at venture stage eToro.

Our advantage today is a stage called the Digital Gold Token, as cryptocurrencies, as their numbers surge, one of the things you should see is that the all-out market capitalization is diminishing.

Towards the finish of 2017, the market was nearly $900 billion dollars with under 2000 coins, quick forward to March 21, 2020, the market is under $300 billion dollars with in excess of 6000 coins.

The measurements show that the main 100 coins tumbled to 1-10% of their unique value, how about those that are not in top 100, how about the coins whose qualities are nearly at zero valuation.

James is a vendor and he sells things like apples, oranges and here comes Alice he gets a few apples today and he pays $4 in crypto and Bob comes to purchase oranges and he pays $5 in crypto.

Imagine a scenario in which following fourteen days of the purchase, Alice $4 has dropped in an incentive to $1 and Bob $5 to $1.5, if you are James, how would you adapt to such drop in value, would you reexamine tolerating crypto for installment.

Stablecoins mitigate this problem, they are digital forms of money whose worth are pegged on a 1:1 proportion with a fiat currency, some different cryptographic forms of money or true resource like gold, silver, precious metals and so on.

The computerized gold token is a stablecoin pegged to real gold, what this implies is that for each token stamped there is a relating physical gold for it in the organization's vault.

Furthermore, presumably, you are keen on putting resources into gold and perhaps you don't have the foggiest idea how to go about it?

There are reasons most likely why you are not putting resources into gold, one of them could be education(maybe you don't know enough), the issue of access(of the reasons why I like blockchain systems, growing up I wanted to make commendable ventures, however, didn't have the foggiest idea how to go about it, I made enquiries about bonds, mutual funds, treasury bills, stocks and one of the motivations behind why I like blockchain frameworks is that you can truly put resources into nearly anything in spite of the fact that this likewise accompanies its own dangers)

Another issue that could upset many individuals may likewise incorporate the difficulties of a few know your client requirements, privacy concerns, legal and limit limitations.

The computerized gold stage deals with all that, so once you need to purchase gold you should top off a form, now this structure means a keen contract, you enter the measure of gold token you wish to purchase and so forth, and that will start an exchange in the online commercial centre or you could essentially visit a trade like bitforex and purchase the tokens there.

For what reason should you consider to put resources into such a gem?

In such a case that these are coins and this is gold, coins dislike gold, coins are not bolstered by anything, there are affected by things like community, pumps and dumps, little to no regulation, few markets/crowd.

At the point when you talk about gold, you talk about the Federal Reserve Bank of New York that stores over 20% of all the gold in the presence and this is gold that has a place with a lot of governments, corporations, banks etc, there is a gigantic market for gold, also the gold market has been tried and tried, while the cryptographic money advertise is not exactly 10 years old, the gold market has been existing for a considerable length of time.

Likewise, there are more tight and entrenched guidelines around the trading, purchase, transfer and capacity of gold and furthermore not at all like cryptocurrencies, gold has value solidness.

So when you purchase the advanced gold token, as the cost of gold drops, so does the price, as the cost of gold increases, so does the token.

As more fiat money gets minted, it values drops yet dissimilar to fiat, gold is scant and not printed at the same rate as fiat so the worth is steady and expanding.

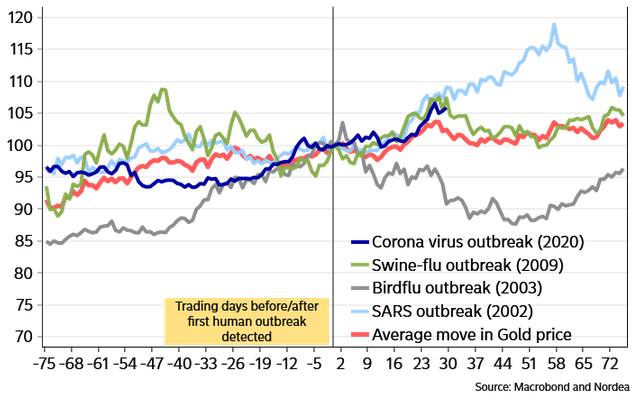

Below is a graph showing the movement of gold amidst coronavirus pandemic and other previous outbreaks:

I accept if the coronavirus pandemic isn't taken care of inside the following 6 months, it may set our reality on a worldwide recession, we see the impact already, schools, businesses, religious houses and so forth are been closed down, movements are been limited and amidst all these crises, a crash in the estimation of numerous things is certain, an insightful decision will be to put resources into some advantage like gold and the advanced gold token stage is a decent spot to begin.

Useful Resources:

Website: https://gold.storage/

Facebook: https://www.facebook.com/golderc20

Twitter: https://twitter.com/gold_erc20

Medium: https://medium.com/@digitalgoldcoin

Telegram: https://t.me/digitalgoldcoin

BTT USERNAME: Denreal

BTT PROFILE LINK: https://bitcointalk.org/index.php?action=profile;u=1946802

Reference:

My Original Article on Uptrennd and Publish0x:

https://www.uptrennd.com/post-detail/coronavirus-could-have-adverse-effect-on-other-forms-of-investment-but-not-on-gold-investment~NDk4MTE0

https://www.publish0x.com/blockchain-technology-and-cryptocurrency/coronavirus-could-have-adverse-effect-on-other-forms-of-inve-xqoewvw