The captian has a cryptocurrency for investors

INTRODUCTION:

For over 200 crypto-formdas of February 2018,while traditional trading houses continue to express interest in the increasement of exposure in the platform of blockchain assets,but here comes the world of crypto which lives continuously growing.There are a wealth of new exchanges and cryptocurrencies,the traditional investors asset managers and traders have the navigate resources,however tools individuals and institutions who could otherwise parttake in this growing economy,Caspian is full of stack of financial tools that integrates with major exchanges in order to offer users a single place to interact with the entire crypto-space.

The digital asset space has seen explosive growth over the past year,with average daily exchange trading volume across all crypto asset surpassing 18 billions USD equivalent and a Total of Estimate market lap for blockchain instrument showing a exceeding of 325 billions USD equivalent as of April 2018.

But cryto investors continue to lack a number of crucial tools tht will be necessary for the space to achieve its potential grase-trade Execution,Compliance risk management keys among the professional position also reporting functions.

The currently,crypto invest I on are forced to choose among many exchanges when executing various trades,which the large number of digital asset exchanges.the various challenge's are position and risk management are like wire made more challenging by the diversity of the platform that must frequently to be used to trade for a single portfololio ,due to difficulties to harmonize the output of different platforms,of meeting reporting and compliance requirements can present significant obstacles for crypto investors as well,moreover Caspian is a joint venture between Tora trading

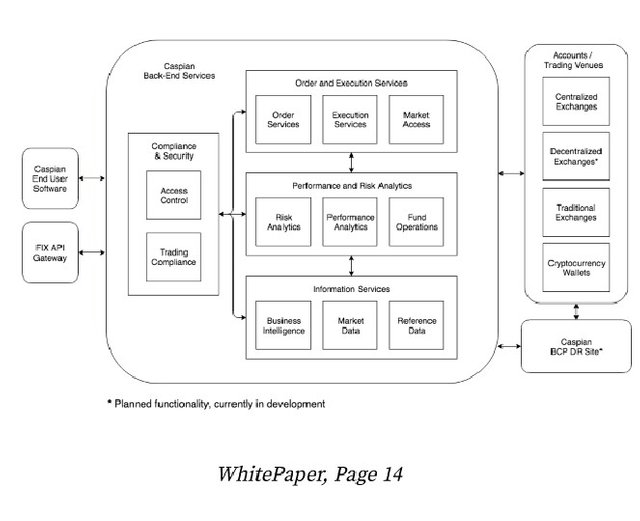

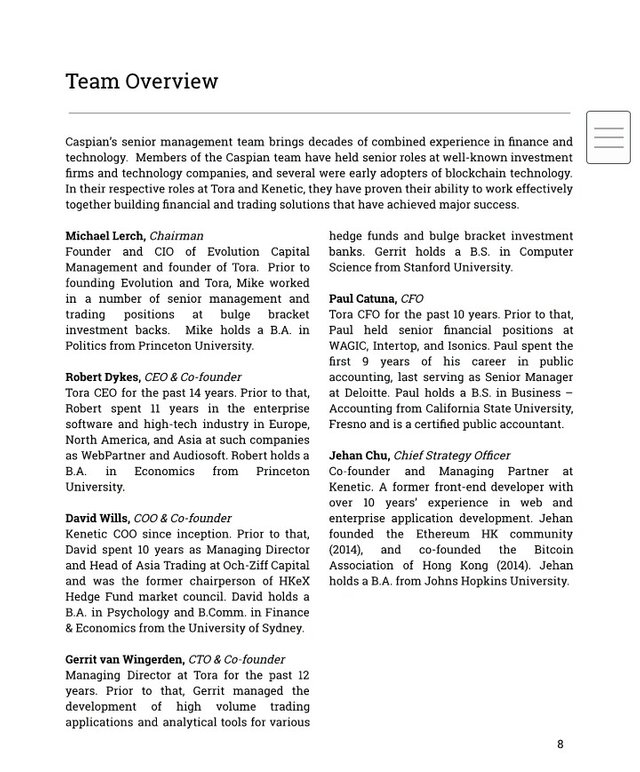

Service limited (and its affiliates ,"Tora"),global leading could base,front back technology providing to buy side institutions and kenetic trading system limited(together with its affiliates "kenetic")a leading blockchain and cryptocurrency investment firm.these provides institutional and experienced investors with a comprehensive order and Execution management system(OEMS),position management system (PMS) and Risk management system (RMS),backed by experienced Support team.

This platform which has the potential to drive future participation in crypto-trading provides sophisticated conductivity and interoperability across various Digital asset exchanges also offers unified compliance and reporting functionality that enables users to analyze all their trades in one place,regardless of which exchange they take place on.

Problems:

Current Market Challenges

This are some preview about current market challenges,As of April 2018,average daily trading volume across all digital asset exchanges exceeded 18billion USD equivalent with total Estimate market cap for blockchain instruments surpassing 25billion USD equivalent by 2033 whole size of the crypto space remains small compared to traditional asset classes,the growth in this sector is unparalleled.Moreover, here is more than 200 exchanges are currently active.out of these five exceed a billion USD equivalent in daily trading volume and 19 have more than 100 million USD equivalent daily trading volume,it has been almost impossible to attempt to list all of the token that have been issued to date.This has market caps of over a billion USD equivalent and among those four conis see a daily volume of more than a billion USD equivalent.

Unreliable Trade Execution

Executing trades in the crypto-market currently poses a number of challenges of varying complexity to investor.At a basic level,the current fragmentation of digital asset exchanges,coupled with relatively low trading volumes compared to traditional markets often creates problems around liquidity and slippage.At also comparatively small order sizes have the potential to consume avaible liquidity ,causing significant slippage from,the current market prince.This has leading to high trading costs for market participants.Due to most existing digital asset exchanges be gain as small ventures and have grown organically as the market had surged,that often cannot handle large orders in particular, this has being a potential to undermine investment strategies if it causes delays in executing trades.Moreover ,due to grassroots origins of most incumbent exchanges,outages often occur as a result of the stresses of high trading volumes.

Beyond periodic performance failures ,trading,particularly across both traditional and digital asset venues ,presents a number of other difficulties. Regulated exchanges now list instruments such as crypto futures,and we expect this trend to accelerate as publicly traded companies increase their exposure to crypto and additional derivatives arise.

Inadequate security

Overtime digital asset traders are aware of the security risks that currently exist in purchasing digital assets.Exchanges are Vulnerable to hackers,a risk that has been out in a series of thefts resulting in the loss of over 4billions USD equivalent since 2011.

The recent exchanges lack many of the customer protections offered by trading platform in traditional markets,these include effective customer protections offered by trading platforms in traditional markets.these include effective customer support and risk management capabilities.

Risk management is a crucial element of trading in any asset class,and it takes added dimensions for the digital asset space.These including the counterparty risk that is present when transacting on any individual exchange

Traders must make contingencies to initigate the Live whood that an exchange will suddenly fail,taking investors funds with it.

Market participants must also account for liquidity risk the fragmentation of he market Leads to situations in which there is insufficient liquidity on a given exchange to fully exit position.

Lack of Reporting compliance crypto funds are no exception but the fragmentation that exists among the various exchanges can make satisfying that needs difficult.

Solution:

Platform An institutional Care crypto Trading

Caspian has an ecosystem solving the problems facing crypto investors using a single,user-friendly interface.

It help achieving this by providing sophisticated connectivity and interoperability across various digital asset exchanges.

Caspian is expected to drive futher growth in digital asset participation on the part of institutional and experienced investors.

Features/Benefits

This section outlines the caspian model as currently envisaged and designed but is subject to modification Caspian effectively aggregates princes,bid and ask information,orders,positions,accounts and executions from multiple crypto exchanges and other sources,presenting the information on a single platform .It allows users to act on this information by sending orders to exchanges individually or using a smart order Router based on existing Tora technology

<# Technical summary

Use case :

•Caspian has world crypto,bring about a wealth of new exchanges and stcryptocurriencies.

•This caters to wide range of users.

•Unknowingly, many crypto holders are traders and their own personal fund managers.

More Information & Resources

Caspian Website

Caspian WhitePaper

Caspian Steemit

Caspian YouTube

Caspian Telegram

Caspian Videos

Caspian Blog

Caspian Events

Caspian News

Caspian Linkedin

Caspian Management

Capian2018

This post has been submitted for the @OriginalWorks Sponsored Writing Contest!

You can also follow @contestbot to be notified of future contests!