HOW TO FORECAST BITCOIN PRICES, REGRESSION!

Let's continue where we left. In this post you can find a comprehensive explanation on the topics of Simple Linear regression (SLR). Remember that in the previous post we briefly pointed that in order to be able to run a regression and understand a regression there are 7 steps you must know.

1 What are dependent and independent variables?

The most basic procedure of a regression is defining what's your dependent variable and what's your independent variable. Well in order to understand what a independent variable and a dependent variable you first have to know the basic SLR model which is the following y ̂_i=b_0+b_1 x_i

Your "y"axis is your dependent variable and your "x " axis is your independent variable. So how do you know which of your variables is the dependent and independent variable? well it's really simple. In order to know which on is which. Just remember this trick. Your dependent variable is the outcome variable, which in all the cases is the variable you are trying to predict. Since, we want to predict bitcoin prices, then the dependent variable, also known as the y variable is the bitcoin prices. Once you have your dependent variable, the other variables are your independent variables. The X axis AKA the independent variables are the variables that have some influence on your dependent variable. So if your independent variable changes then this will cause that your dependent variable changes.

After knowing which are your dependent and independent variable, just plot your graph and make a scatter plot, to visualize your data.

2 What is a "Time series"

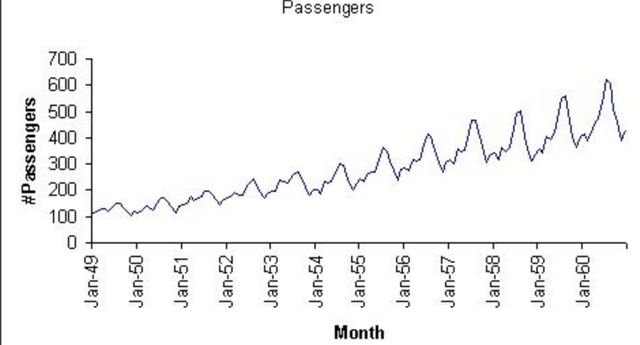

SLR can be done on different topics and are use in many different fields. The way on uses SLR relies on the type of data one is working with. Since, we are focussing on making a SLR for bitcoin prices you have to know that the only two things you get from looking at a graph on coinmarketcap.com are the prices and time. These type of graphs where a certain outcome variables is plotted against time are called time series.

3 What is seasonality?

The first two concepts are relatively easy. Now we get into the more challenging parts of a SLR. When we are looking at a time series we have to talk about the seasonality. In some cases seasonality places a role. Seasonality is basically a pattern every year that seems to be present. Seasonality can be either multiplicative or summative. Its important to know whether the re is seasonality in your time series. If there's seasonality, we have to adjust for seasonality, otherwise our model will be missing important information that one can find in the seasonality. There are many different ways to adjust for seasonality, one of the easiest ways to adjust for seasonality is to use dummy variables. If you have a question regarding on how to do this then ask and we will explain it in a different post. Because the process has a few steps that will just make this post too long.

4 What's a trend?

good question, we will discuss this tomorrow. You can start having a look on what the difference is between stochastic and deterministic trends.

5 What are residuals?

To be continued...

6 What's a random walk? or what is a white noise?

To be continued...

7 What's cyclicaltity?

To be continued..

Got questions?