How many Canara Bank Stocks one need to buy for 5000 Rs Dividend per year?

To determine how many Canara Bank stocks one needs to buy to receive a dividend of Rs. 5,000 per year, The CSV data only contains information about the dividend percentage announced on various dates.

To calculate the required number of stocks, I'll need to make an assumption about the stock price. Let's assume the current stock price of Canara Bank is Rs. 200.

Given:

- Desired annual dividend = Rs. 5,000

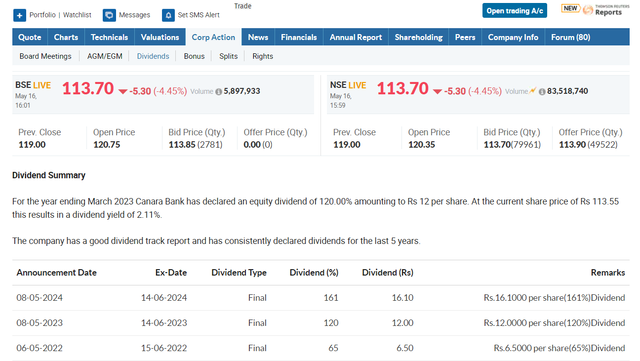

- Most recent dividend percentage (FY 2023-24) = 16.10%

- Assumed stock price = Rs. 200

Step 1: Calculate the dividend amount per stock

Dividend amount per stock = Stock price × Dividend percentage

Dividend amount per stock = Rs. 200 × 0.161 = Rs. 32.20

Step 2: Calculate the number of stocks required

Number of stocks required = Desired annual dividend / Dividend amount per stock

Number of stocks required = Rs. 5,000 / Rs. 32.20 = 155.28 (rounded up to 156 stocks)

Therefore, to receive a dividend of Rs. 5,000 per year from Canara Bank, assuming a stock price of Rs. 200 and a dividend percentage of 16.10%, one would need to buy approximately 156 stocks.

Please note that this calculation is based on the assumed stock price and the most recent dividend percentage from the provided CSV data. The actual number of stocks required may vary depending on the current stock price and the dividend announced for the respective financial year.