How many PEL stocks you need to buy for the 5000 Rs dividend per year?

To determine how many PEL stocks you need to buy to receive a dividend of Rs 5,000 per year, we need to calculate the annual dividend yield based on the provided dividend data and the current stock price.

Given information:

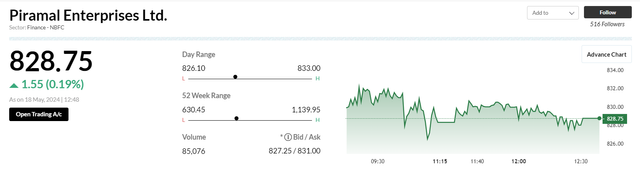

- Current stock price: Rs 828.75

- Dividend data (last 5 years):

- 16 Jun, 2023: Final dividend of Rs 31.00

- 14 Jul, 2022: Final dividend of Rs 33.00

- 06 Jul, 2021: Final dividend of Rs 33.00

- 16 Jul, 2020: Final dividend of Rs 14.00

- 18 Jul, 2019: Final dividend of Rs 28.00

Step 1: Calculate the average annual dividend per share.

Average annual dividend = (31.00 + 33.00 + 33.00 + 14.00 + 28.00) / 5 years = Rs 27.80

Step 2: Calculate the dividend yield.

Dividend yield = (Average annual dividend / Current stock price) × 100%

Dividend yield = (27.80 / 828.75) × 100% = 3.35%

Step 3: Calculate the number of shares needed to receive Rs 5,000 in dividends.

Number of shares = (Desired annual dividend / Dividend yield) × 100

Number of shares = (5,000 / 3.35) × 100 = 149,253.73

Therefore, you would need to buy approximately 150 PEL stocks at the current stock price of Rs 828.75 to receive a dividend of Rs 5,000 per year, assuming the dividend payout remains consistent with the historical data.

Note: This calculation is based on the assumption that the company maintains a similar dividend payout in the future. Additionally, the actual dividend received may vary due to factors such as changes in the company's financial performance or dividend policies.