How many stocks of Nirlon Ltd one has to buy for 5000 Rs dividend per year?

To determine how many stocks of Nirlon Ltd one needs to buy to receive a dividend of Rs. 5,000 per year, we need to calculate the total dividend per share based on the provided data and then divide the desired dividend amount by the total dividend per share.

Given data:

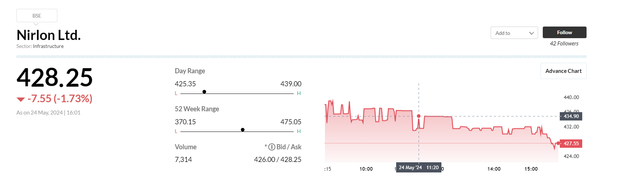

- Stock price: Rs. 428.25

- Desired annual dividend: Rs. 5,000

Dividend data:

Ex-Date,Type,Dividend (Rs)

23 Feb 2024,Interim,15.00

04 Sep 2023,Final,11.00

17 Feb 2023,Interim,15.00

07 Aug 2022,Final,11.00

17 Feb 2022,Interim,15.00

To calculate the total dividend per share, we need to sum up the dividends for the most recent year (assuming the trend continues).

Total dividend per share = Interim dividend (2024) + Final dividend (2023) + Interim dividend (2023)

= 15.00 + 11.00 + 15.00

= Rs. 41.00

Now, we can calculate the number of shares required to receive a dividend of Rs. 5,000 per year:

Number of shares required = Desired annual dividend / Total dividend per share

= 5,000 / 41.00

= 121.95 shares (rounded up to 122 shares)

Therefore, one needs to buy 122 stocks of Nirlon Ltd at a price of Rs. 428.25 per stock to receive a dividend of approximately Rs. 5,000 per year, based on the provided dividend data.

Note: This calculation assumes that the dividend trend remains consistent in the future. Additionally, it does not consider any potential capital gains or losses from the stock price fluctuations.

No le importa a nadie.