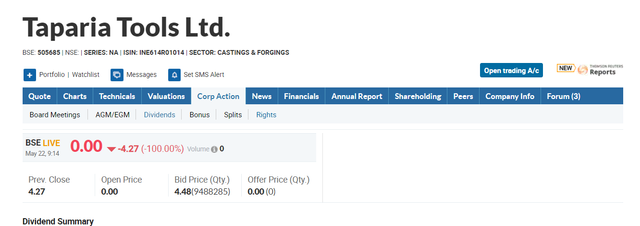

How many taparia tools stock one has to buy in order for the dividend of 5000 Rs per year?

To determine how many Taparia Tools stock shares you need to buy to receive a dividend of Rs. 5000 per year, I will use the dividend data provided in the CSV format.

From the data, we can see that the company paid the following dividends in the past:

- Rs. 200 per share as an interim dividend announced on 12-02-2024

- Rs. 775 per share as a final dividend announced on 30-05-2023

- Rs. 775 per share as an interim dividend announced on 24-02-2023

- Rs. 525 per share as a final dividend announced on 31-05-2022

- Rs. 500 per share as an interim dividend announced on 14-02-2022

- Rs. 700 per share as an interim dividend announced on 20-12-2021

To estimate the annual dividend, we need to consider the most recent dividends paid. Let's assume that the company will continue with a similar dividend pattern in the future.

The most recent annual dividend can be calculated as:

Interim dividend (12-02-2024): Rs. 200

Final dividend (30-05-2023): Rs. 775

Total annual dividend = Rs. 200 + Rs. 775 = Rs. 975 per share

To receive a dividend of Rs. 5000 per year, you would need to buy:

Number of shares required = Target annual dividend / Annual dividend per share

Number of shares required = Rs. 5000 / Rs. 975 ≈ 5.13 shares

Since you cannot buy fractional shares, you would need to round up to the nearest whole number.

Therefore, to receive a dividend of approximately Rs. 5000 per year from Taparia Tools, you would need to buy at least 6 shares of the company's stock at the current price of Rs. 4 per share.

The total investment required would be:

6 shares × Rs. 4 per share = Rs. 24

Please note that this calculation is based on the assumption that the company maintains a similar dividend pattern in the future. Actual dividends may vary.