Niirlon ltd is it worth buying this stock for dividend value of 5000 Rs per year?

To evaluate whether it's worth buying Niirlon Ltd stock for a dividend value of ₹5,000 per year, we need to analyze the historical dividend data and make a projection for future dividends.

Given:

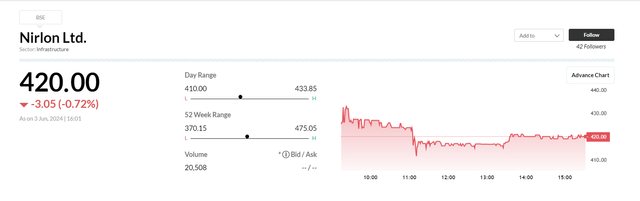

- Current stock price: ₹420

- Expected annual dividend value: ₹5,000

From the provided dividend history, we can observe the following:

- The company has been paying an interim dividend of ₹15 and a final dividend of ₹11 consistently for the past few years.

- The total dividend per share for the most recent year (2023-2024) is ₹15 (interim) + ₹11 (final) = ₹26.

To earn a dividend of ₹5,000 per year, you would need to hold:

Number of shares required = ₹5,000 / ₹26 = 192.31 shares (approximately)

The cost of buying 192.31 shares at the current price of ₹420 would be:

Cost of investment = 192.31 × ₹420 = ₹80,770.20

Now, let's evaluate if this investment is worth it:

Pros:

- The company has a consistent dividend payment history.

- The dividend yield (₹26 / ₹420 × 100%) is around 6.19%, which is relatively attractive.

Cons:

- The upfront investment of ₹80,770.20 is substantial.

- Future dividend payments are not guaranteed and may change based on the company's performance.

Overall, if you have the capital available and believe in the company's long-term prospects, investing in Niirlon Ltd for a dividend value of ₹5,000 per year could be a viable option. However, it's essential to consider your risk tolerance, investment goals, and diversification strategies before making any investment decision.