Bitcoin Price Eyes $4000 as Combined Market Tops $135 Billion

Earlier today, on September 27, the bitcoin price recorded a five percent gain within a 24-hour period, increasing from $3,930

Tuur Demeester, another prominent bitcoin trader and investor, also noted that the bitcoin price is breaking its resistance level and if trading volume in South Korea, Japan, Europe and the US hold up, a strong rally in the near future could be expected.

Having successfully defended the key rising trend line support over the last few days, the bitcoin-US dollar (BTC/USD) exchange rate is well bid above the $4,000 mark today.

At press time, the cryptocurrency that powers the world's largest blockchain is trading at $4,070, up 3% on the day. On a monthly basis, though, it is still nursing 6% loss.

The total crypto market cap began the day at $131.5 billion, having risen past the $130 billion mark the day before. Monday afternoon, it quickly shot up to $135 billion and eventually rose to a present value of $137.2 billion–its highest point since September 20.

Key Points

Bitcoin price has started a recovery from the $2965 low against the US Dollar and already moved above $3500.

There is a monster bearish trend line with resistance near $3850 on the 4-hours chart of BTC/USD (data feed from SimpleFX).

The pair has to break the 43850-4000 resistance to gain momentum in the near term.

Bitcoin price is recovering above $3500 against the US Dollar. However, the BTC/USD pair is now facing a major hurdle near $3850 for further gains.

Bitcoin Price Resistance

This past week, Bitcoin price managed to recover above the $4000 level once against the US Dollar. The price traded as high as $4106 where it faced sellers and declined once again. The pair traded below the 38.2% Fib retracement level of the last wave from the $2965 low to $4106 high. However, the downside move found support near $3500 and the price is now back moving north.

It was a perfect test of the 50% Fib retracement level of the last wave from the $2965 low to $4106 high. Buyers are now facing a crucial test near $3800-3850. There is a monster bearish trend line with resistance near $3850 on the 4-hours chart of BTC/USD. The trend line resistance is also near the 100 simple moving average (H4) at $3900. Therefore, a break and close of the $3850-3900 resistance won’t be easy. We can already see the price is losing momentum below $3850.

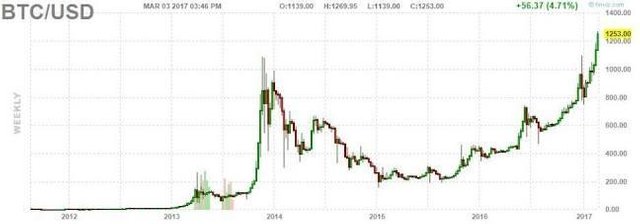

Bitcoin Price Weekly Analysis BTC USD

If the price fails to move above the $3850 level, there can be another downside wave. On the downside, a few key supports are $3600 and $3500. Below $3500, the price could even retest the $3200 level in the near term. On the upside, a close above $4000 would be a great bullish sign.

Bitcoin’s price has been reacting to news coming in from China since the beginning of the month. However, as the dust settled, investors and traders looked beyond the warnings and announcements by Chinese regulators, and two broader trends emerged. The first being that this isn’t the first time China has intervened with Bitcoin’s existence in the country. Time and time again there have been issues, and each time the cryptocurrency has managed to circumvent them. The second being the decreasing reliance on China to propel Bitcoin trade.

The overall cryptocurrency market capitalization is $135.55 billion with Bitcoin dominating 47.6%. Eleven cryptocurrencies have a market cap in billions with Bitcoin (BTC), Ethereum (ETH), Bitcoin Cash (BCH), Ripple (XRP) and Litecoin (LTC) being the top five.

Wall Street “bear” Tom Lee doubled down on his prediction that the bitcoin price will reach $25,000 by 2022, shrugging off concerns about the recent market downturn.

Lee, a managing partner at Fundstrat, reaffirmed this long-term price target in an interview with CNBC’s “Fast Money.” He bases his prediction on the increasing trend to view bitcoin as a store of value and a hedge against inflation, forecasting that it will capture some of gold’s market share. He also stated that younger investors–particularly those under age 30–believe that bitcoin makes “perfect sense” as an investment vehicle.

Hi, sandysaini! I just resteemed your post!

I am a new, simple to use and cheap resteeming bot.

If you want to know more about me, read my introduction post.

Good Luck!

https://steemit.com/@nahid197

follow, upvote & replay on my post.