Imagine when people understand

That crypto currency can be more secure than money in the bank.

So some people will be charged with negative interest rates. The cost of having money in the bank therefore is going to be significant.

In addition there is risk of having money in the bank (bank could go broke etc).

Now think about these folks could simply convert their fiat into a stable coin, use a defi platform and earn interest.

The thing is, a stablecoin like DAI has none of the problem money in the bank has.

- As long as ETH does not go to 0, it works and will have a stable price.

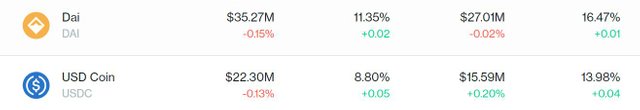

- Instead of paying interest one can earn interest (currently north of 10%)

- You always have full control over it. (unlike a bank where you simply own a liability or "I OWE YOU" from the bank to you.

- If inflation is a problem the index could be changed to something more stable and protect your value more than the fiat even

- it is entirely non confiscatable and cannot be taken away from you without consent (except stolen of course)

- it is very easy & cheap to secure

- it can be moved in seconds

Just imagine what this could do. I cannot wait for people and companies to realize this.

No-one seems to get this, otherwise the interest rates would not be this outrageous. But I am sure this is simply a matter of time to propagate.

Negative interest rate is simply kicking the can down the road. With Swiss interest rate standing at -0.75%, banks have to punish depositors for putting their money in the bank. It's going to encourage unnecessary risk taking and when recession comes, people are going to get hurt more

Hopefully more people will come to see the benefits of DeFi and what it really means to the world

This is very true but not well known. People think that when they deposit money in the bank, the money is still theirs. They are wrong. When the money is deposited in the bank, the money then belongs to the bank. The depositor is an unsecured lender to the bank. If the bank runs into financial trouble, the depositor can be left holding the bag. We saw this in Cyprus a few years ago, after which the laws were changed in the EU and US to make it easier for bail-ins to occur to rescue banks. In the US, there is FDIC insurance of up to $250,000, but even if a depositor has coverage, recovering on an insurance claim is time-consuming.

Crypto assets remain in the owner's hands at all times, as long as the owner holds his private keys. When more people truly understand the advantages of bitcoin and other cryptocurrencies, there will be a tidal wave of new investors. Sadly, some people may need to learn a hard lesson before this knowledge becomes widely known.

I use Celsius to get % at My usd-c. What do you use?

The thing is that money is always "safe" in the bank in the sense that the government (and I can only speak for the US) will never allow for people to lose their bank deposits. That's what happened during the great depression and the govt has learned from that. They will make sure (via insurance, bailouts, etc) that no matter what the banks do that people won't lose their deposited funds, otherwise it would collapse the banking system which they will avoid at any cost. Plus, it's very easy for them, they just print more money to cover any losses (like what they did in the 2008 bailouts).

This will lead to higher inflation, of course, but the genius of inflation is that's it's typically relatively slow and the general public doesn't notice. So people will lose their money but it will be a slow process and they won't realize it's happening, or what exactly is going on.

This is one main reason why it's so hard to get people to stop trusting the banks. On top of that, crypto is still WAY too hard for most people, so good luck trying to convince most anyone to take their money out of the bank, which they consider extremely safe and convenient, for something they have no idea how to use and adding a huge responsibility on them to secure.

People don't want to have "full control over their money" because that's a lot of responsibility. They want someone to manage it for them. They don't really care if their money is "non-confiscatable", they want it to be secured/insured, because it's a million times more likely that they will get stuff stolen than confiscated (again, speaking currently in the US). Lastly, they don't care about inflation because they don't even realize it's happening.

At the end of the day, crypto is solving problems that very few people have or care about right now while the economy is doing "well" and the system is "working". Unfortunately, I think it will really take a great depression type of event before any significant amount of people around the world will really start to understand the benefits of all the things you've mentioned in this post.

Great thoughts Matt! I think you are hitting the nail on the head.

Hi, @knircky!

You just got a 4.84% upvote from SteemPlus!

To get higher upvotes, earn more SteemPlus Points (SPP). On your Steemit wallet, check your SPP balance and click on "How to earn SPP?" to find out all the ways to earn.

If you're not using SteemPlus yet, please check our last posts in here to see the many ways in which SteemPlus can improve your Steem experience on Steemit and Busy.

Totally agree! I have started buying monthly lots of DAI and moving to hardware wallets to start taking more control over it. I think it will become more important as banks and governments start to limit even more so what we can do with our money. If it isn’t inflation, it will be fees and taxes for sure!

Posted using Partiko iOS

Good strategy!