Long Term Yields As A Call Option

A long time ago, I played around with the idea that when yields are near zero, forward yields act more like call options on future interest rates than unbiased market expectations of future rates.

What this means is that there is an unreliable relationship between long term yields and uncertainty. That is because there could be uncertainty about the business cycle, or rising concern about a contraction, which would normally cause rates to decline. But, there could also be uncertainty about the various potential states of the future. For instance, let's say that the marginal expectation for 5 year forward rates is 0.5%, with a standard deviation of 0.5%. What if there is a change in uncertainty that, somehow, leaves the marginal expected rate the same, 0.5%, but increases the standard deviation of that expected rate. Since all of the expected future rates that were already below zero would still all just be truncated at zero, this would actually raise the market rate, because in those future scenarios where rates are higher, they wouldn't be truncated at zero.

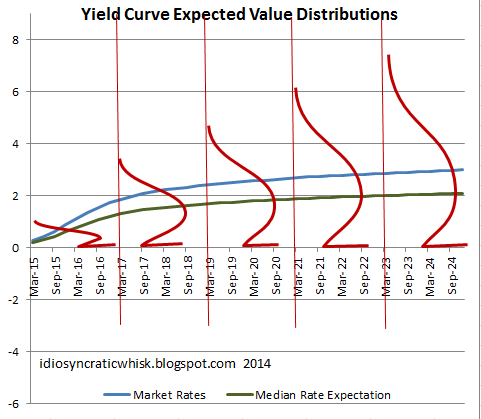

Yield Curve Expected Value Distributions

In the chart here, think of each forward rate as the expected value of a range of potential rates, shown here as normally distributed expectations. But, those distributions are truncated at zero. The expected value of all potential scenarios would be higher than the median value because every value below zero would only count as zero.

Basically, this is just like a call option. Call options can rise in value because, either (1) the expected future price of the underlying security increases or (2) the variance of expectations about the future price increases, making expected positive outcomes more valuable.

Yields have had some strange behavior this week, and I wonder if this could be part of it. In options speak, maybe long term expected rates have been falling but with higher implied volatility this week.

I have been wondering when the right time is to sell long bond positions. Earlier this week might have been the best time. But, I suspect, because of this effect, when there is a positive shock from a Fed announcement or something that signals optimism to the market, the initial effect may be that interest rates decline quite a bit because there will be more certainty about the future economy. I doubt that there will be a strong force pushing actual rate expectations much higher in the near term. The net effect may be that the first move in long term rates will be to settle at a lower level that is actually more in line with what expectations are now, but which market prices are now biased away from due to uncertainty.

Treasury markets seem a bit unable to perform price discovery this week, and I assert that that is evidence in favor of my hypothesis. If the Fed can get Treasury markets to calm down, long rates might decline.

One side effect of this would be that, if the Fed announces some big stimulus that calms markets, that should trigger declining long-term rates, and that will make it look like the Fed creates stimulus by lowering rates all along the yield curve. I think that is not a useful way to think about Fed policy. Stimulative Fed policy should cause the long end of the yield curve to rise. In this case, it could very well cause median expectations of future rates to rise from 0% to 0.4%, but simultaneously reduce uncertainty so that the market rate falls from 1% to 0.6%, or something. That would give a false statistical signal about how Fed policy affects the yield curve.

Congratulations @bondstrader! You have completed the following achievement on the Steem blockchain and have been rewarded with new badge(s) :

You can view your badges on your Steem Board and compare to others on the Steem Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPVote for @Steemitboard as a witness to get one more award and increased upvotes!