Bitcoin Cash forks successfully, but investors have little access

Bitcoin survived a forking event on Tuesday, with a muted reaction from the market. Anyone who held bitcoin at the time of the fork are automatically holding an equivalent amount of the new alternative, Bitcoin Cash (BCH), which they control with their Bitcoin private keys.

After a bumpy start and rapid appreciation the price of the new asset has mostly risen, briefly touching 0.485789 BTC, worth US$1,327 at the time, on the Bittrex asset exchange. At press time, one Bitcoin Cash is worth 0.232 BTC (US$629), although other exchanges offer a wide range of prices down to 0.0482 BTC (US$222).

While customers who previously held a Bitcoin balance at many of these exchanges were given their initial BCH balance at the time of the split, and could start trading straight away, most Bitcoin holders were warned to keep their assets off of exchanges during Tuesday’s forking event.

“In case you're wondering why the BCH price seems high: It's because no one can deposit BCH to exchanges. Once this changes, expect a crash.” - Henry Brade, Prasos CEO

The majority of BCH owners now need to deposit their assets on an exchange where they can trade them, an option that is currently hard to find. The original source of the Bitcoin Cash fork, ViaBTC has been trading the asset, as has the European exchange HitBTC. Current pricing on HitBTC is hovering below 0.1 BTC, and has been negatively affected by the mining of each new block recently.

Most blocks that have been mined recently have coincided with an immediate sell-off on both exchanges, suggesting that a large amount of the content of those blocks were transactions sent to exchanges to sell their BCH coins

The lack of deposit options has also kept global trade volumes extremely low. “No one can move coins so the price is totally out of whack,” claimed Lightning Developer and Stanford professor Elizabeth Stark in a tweet Wednesday morning.

Tuesday’s blockchain fork occurred 12 hours after the initiation of the UASF BIP 148 soft fork, as promised in Bitmain’s UAHF contingency plan announced on June 14. Monday night’s soft fork went smoothly, as core developer Luke-Jr tweeted an hour before Midnight, New York Time. "As expected, the #BIP148 #UASF was a complete success and did not split the chain. Be sure you're upgraded to be safe, though!"

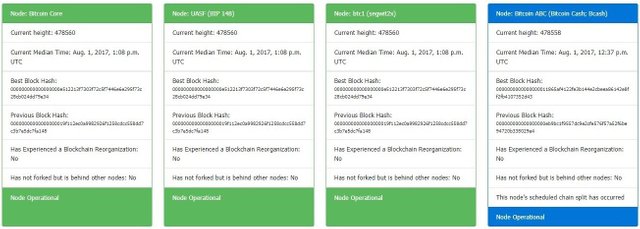

Bitcoiners spent Tuesday morning with their eyes fixed on a website called BTC Fork Monitor, which displays the status of different types of Bitcoin nodes, such as Bitcoin Core, UASF BIP 148, Segwit2x, and the recently added Bitcoin Cash. At 12:37 UTC, just 17 minutes after the scheduled start time for the fork, Bitcoin and Bitcoin Cash miners mined the final block shared by both of their chains, block #478,558.

Nodes running the Bitcoin ABC client then rejected all other blocks from the Bitcoin network. At 1:07 PM UTC, all other clients move on to create block 478,559 and those following. It wasn’t until almost 6 hours later, at 6:12 UTC, that the Bitcoin Cash blockchain produced its first, forked block.

The massive block, mined by ViaBTC’s own pool, was 1.915 MB in size, proving that their blockchain could handle larger blocks than the Bitcoin Core clients would. While the fork also avoided cross-chain transaction problems, better known as replay attacks, Litecoin admin Charlie Lee speculated that exchanges are vulnerable to double-spending attacks, and most exchanges “won't open deposits for BCH until the difficulty drops to a level where it's profitable to mine BCH.”

Lightning Developer and Stanford professor Elizabeth Stark later pointed out that a block hadn't been mined in over 12 hours, a result of how little mining power was working on the new blockchain. While the pace of mining has picked up since then, the new blockchain has to adjust to the difference in mining power since forking from Bitcoin.

ViaBTC's pool stats show that their Bitcoin Cash mining pool began with around 75 petahashes in mining power. During the creation of that first block, however, the hashrate inflated to match that of the company’s existing BTC mining pool, around 300 Petahashes. This was accomplished without their BTC pool losing any hashrate.

While exact mining power figures are impossible to know at this stage, rumours on twitter suggest that it is not yet profitable to mine Bitcoin Cash, and that switching mining operations from Bitcoin to the new blockchain would cause a 99.6% revenue loss. Meanwhile, the Bitcoin hashrate pool has shown no sign of reduction, currently hashing away at 6.5 Exahashes.

I am holding both chains. Very exiting to see how both camps in Bitcoin can implement their own vision and we can see the results in real life. Hope the two camps stop bothering each other and they didn't create this fork to give false signals to the market via manipulation. Here my reasons to keep both chains written before the fork, and it looks like I was right:

https://steemit.com/bitcoin/@michiel/six-reasons-why-i-will-keep-my-bcc-after-the-fork-on-the-first-of-august-even-when-i-am-heavily-against-it

What do you guys think will happen with bit coin cash, rise past 1500 or plummet to 180?

iam still holding my bitcoin..

ViaBTC is not the original source of the Bitcoin Cash fork. Where are you getting your facts? Bitcoin Cash was started years ago with the subreddit /r/btcfork. Only the name 'Bitcoin Cash' is relatively new, and ViaBTC was simply the first pool to support it.