McKinsey sees blockchain technology reaching full potential in 5 years

McKinsey & Company, a global management consulting firm for governments and NGOs, recently submitted a blockchain Technology report to the US Federal Advisory Committee on Insurance. The firm analyzed how the technology may disrupt a range of industries, emphasizing banking and insurance, and predicts commercial deployment of blockchain technology at scale by the year 2021. The firm states that most people in the industry already believe that blockchain technology will “have a material impact” within three to five years.

Calling the period between 2009 and 2016 the "Dark Age," where all solutions are bitcoin-based, the company suggests that a new era of Blockchain technology began in 2016. More mature businesses using the technology have now entered the market, and over a hundred blockchain solutions have been explored. The firm expects 20 to 30 proof-of-concept use cases for blockchain technology to be tested in 2018, with 10 to 20 successful business cases surviving and deployed commercially by late 2020.

“Based on the current rate of evolution, we believe blockchain solutions could reach their full potential in the next 5 years.” - McKinsey & Company

McKinsey found 64 different use cases for blockchains in a survey of 200 companies. The report claims that the insurance industry has the largest non-bitcoin blockchain solutions, with 22 percent, followed by the payments industry, with 13 percent. Financial Services in general make up 50 percent of the total mix. In terms of dollars value, the biggest revenue generating sector is cross-border business to business payments, generating between $50-$60 billion, followed by trade finance with $14-$17 billion.

24 use cases focused on financial services applications. However, seven of them were referred to as “genuine use cases” that addressed “associated pain points” with today’s systems, indicating that they will generate the most revenue and be the most pursued. Between the seven use cases, McKinsey is expecting Blockchain to “generate ~$80B to 110B in impact.”

Trade Finance, where it can lower costs and speed up turnarounds to a revenue boost of between $14 and $17 billion.

Cross-border B2B payments, where lower costs and fees plus speedier delivery will save them around $50 - $60 billion.

Cross-border P2P payments, which like B2B payments can lower costs while adding speed, but do so for personal remittances, should add $3 - $5 billion to their bottom line.

Repurchase Agreement Transactions, where blockchains will lower operational costs and systematic risks, is worth around $2 to $5 billion.

Over The Counter Derivatives, where streamlined settlements lead to reduced operational costs and need for capital. $4 - $7 billion more saved here.

Know Your Customer / Anti Money Laundering Management, because it reduces duplicated effort and smooths the on-boarding process, worth between $4 and $8 billion.

Identity Fraud, where more security leads to fewer damage payouts and happier customers. $7 to $9 billion saved here as well.

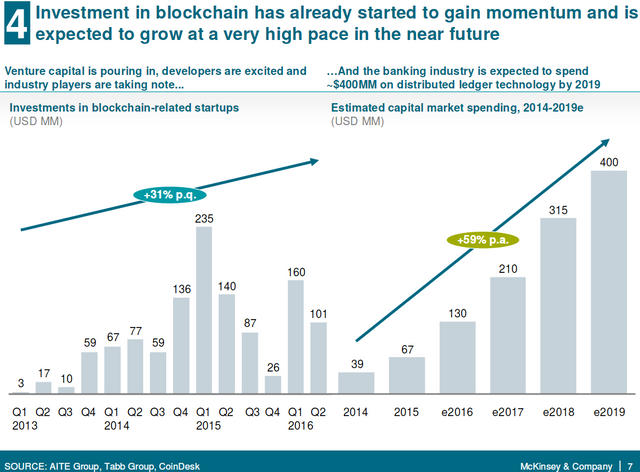

Noting that the Venture Capital investments for blockchain startups are now coming off their early 2015 highs, the report points out that the established banking industry is pouring money into blockchain technology far faster and more steadily, and a likely target of $$400 million during 2019.

The McKinsey report’s time estimate for full blockchain adoption is about half that of similar estimates. The World Economic Forum released a report in October 2015 about the tipping point of disruptive technologies, and included predictions about blockchain in it. Governments, the report claimes, would reach their tipping point for using blockchain technology by 2023, and people would reach their tipping point for using “bitcoin and the blockchain” in 2027.

Focusing on capital markets where stocks and bonds are traded, Euroclear and consulting firm Oliver Wyman predict that for "it is likely to take more than ten years to overhaul core parts of the system.” However, over the next one to two years startups and standards for the space will rise, as well as “niche applications that will define new markets that do not exist today.” In another three to five years, they predict that the majority of large players will use blockchain technology. Global business consulting firm Accenture has a similar timeline, with a two year shorter timeframe.

Top investment bank Morgan Stanley have released their own set of ideas that could harness blockchain technology, complete with a timeframe, but also spelled out a set of ten hurdles that are currently blocking financial institutions from adopting the technology. “While financial institutions are investing in research now, adoption will be iterative, asset-class by asset-class over the next five to ten years,” the firm said in May.

More recently, IBM released a pair of reports in September, based on two surveys. One surveyed 200 global banks, and the other 200 global financial market institutions. Both reports focused on blockchain adoption and the rate in which it is being adopted. “Fifteen percent of banks and 14 percent of financial market institutions interviewed by IBM intend to implement full-scale, commercial blockchain solutions in 2017,” the latter report states.

“Mass adoption isn’t that far behind with roughly 65 percent of banks expecting to have blockchain solutions in production in the next three years.” - IBM

Good blog @bravenewcoin , better for world to cross the last milestone as soon as possible ( mass adoption ) , i think blockchain have limitless solution for many problem and many option for better life .

I was convinced that if no financial crisis happened or any form of fiat system collapse it will take little more than that for large scale adoption like buying a loaf of bread with cryptocurrency , it toke Crypto 9 years to reach current progress , But your blog is backed with good statistic witch make me optimistic :)

Upvoted and tweeted. Great blog. Thanks for sharing. Stephen

https://twitter.com/StephenPKendal/status/819118196703817728

This post has been ranked within the top 80 most undervalued posts in the first half of Jan 11. We estimate that this post is undervalued by $4.33 as compared to a scenario in which every voter had an equal say.

See the full rankings and details in The Daily Tribune: Jan 11 - Part I. You can also read about some of our methodology, data analysis and technical details in our initial post.

If you are the author and would prefer not to receive these comments, simply reply "Stop" to this comment.

Full potential? I doubt it. The potential of this technology almost seems limitless.

Thanks for the king comments, we appreciate the support