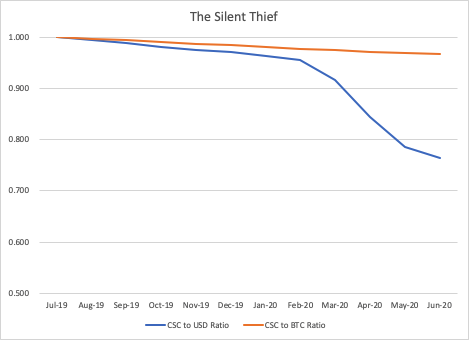

Control Stable Coin (Protect yourself from the silent thief in the night)

On July 1st, 2019 I created a new money. This new money is called the July 2019 control stable coin.

On July 1st, 2019 the CSC was worth 1 BTC and also worth $10,577 USD.

1 CSC = 1 BTC

1 CSC = 10,577 USD

1 CSC = 1 CSC and never changes. CSC does not have any inflation or deflation. There is only 1 CSC ever in existence and will never change.

I’m using this CSC as a base line to demonstrate to the world how both USD and BTC over this past year have silently stolen your value without you even knowing it. Everyone that has a bank account, or a crypto wallet have lost value. If you compare each money with itself, you can see this. The trick is to better understand how much value you have lost.

Since CSC never changes it can show what your current value today is worth in your bank account or crypto wallet.

Today is August 2nd, 2020. Let’s walk through the value of your CSC coin as compared to the USD.

On July 1st 2019 the USD had a money supply of 14.8 Trillion (also known as the M2 indicator). You have $10,577 USD in the bank. To see how rich, you are to the rest of the US you can figure out your ratio of your $10,577 to 14.8T. Your ratio to that 14.8T is 0.0000000712%.

Let’s say on that date you decided to buy 1 CSC with that $10,577 USD. You now own 1 CSC. Good for you!

However, your friend Sally decided to keep her $10,577 in the bank for the next year.

It is now June 1st, 2020 and now the USD money supply is 18.4 Trillion. That is a 3.4Tillion difference since July 1st, 2019. That is a 24% difference.

The silent thief attacks

Sally didn’t realize she lost 24% of her value. She still has $10,577 in her bank after all. But if you look at her ratio now it is 0.0000000576%.

After a year of thinking about it, Sally decided that she would like to own a CSC coin. Sally decided to buy your 1 CSC. However, on this date she could only buy .76 of the CSC with the same $10,577 in her bank account. You sell her .76 for $10,577 on June 1st, 2020.

You now have .24 CSC coin + $10,577 USD.

What people don’t realize, 1 year ago they were 24% richer than they are today. Or if you want to look at this in a negative way, you lost 24% of your value. Now let’s say you invested your USD wisely and made 24% this year. You may think Wow 24% in a year is really good. But you just broke even.

Is Bitcoin better?

Let’s walk through the value of CSC coin as compared to BTC

On July 1st, 2019 Bitcoin has a money supply of 17.8 Million (Total BTC). You have 1 BTC in your crypto hardware wallet. To see how rich, you are to the rest of the Bitcoin community you can figure out your ratio of your 1 BTC to 17.8 Million. Your ratio to that 17.8M is 0.0000056202%

Let’s say on that date you decided to buy 1 CSC with that 1 BTC. You now own 1 CSC. You rock!

However, your friend Jeff decided to keep his 1 BTC in his crypto wallet for the next year.

It is now June 1st, 2020 and now that BTC money supply is 18.4 Million. That’s a .6 Million difference since July 1st, 2019. That’s a 3% difference.

Jeff didn’t realize he lost 3% of his value. He still has 1 BTC in his wallet after all. But if you look at his ratio now it is 0.0000054371%

After a year of thinking about it, Jeff decided that he would like to own a CSC coin. Jeff decided to buy your 1 CSC. However, on this data he could only buy .97 for 1 BTC on June 1st, 2020.

You now have .03 CSC coin + 1 Bitcoin.

What people don’t realize is 1 year ago they were 3% richer than they are today. Or if you want to look at this in a negative way, you lost 3% of your value. Now it just so happens that BTC value on June 1st in USD was down to $10,203. But as of August 1st, it is up to 11,817. That’s about a 12% increase from the $10,577. But with the value of the USD losing 24% over the year you are still not in the plus.

In summary, one can see that determining where to put your value can be a very complicated calculation. There are so many variables to consider. I don’t have the answer and please do not take this article as a recommendation for anything. I just wanted to point out that there are external factors that need to be taken into consideration when determining your investment strategy. I hope this exercise has been educational and that you can use this information to your advantage.