Planning for the future: Possible targets for BTC (and a bit on ALTs)

Hi, everyone. Here are some of my projections for Bitcoin. In my opinion, we are in a ranged, unpredictable market for Bitcoin short-term. The analysis below offers an explanation why I think so and my rationale for a few hypothetical price targets in case BTC breaks out of this formation either upwards or downwards.

Most likely a ranged, unpredictable market

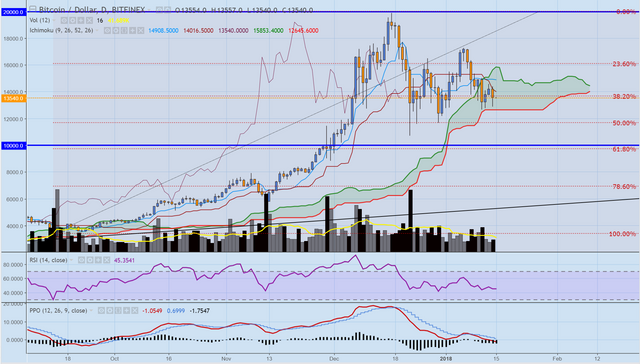

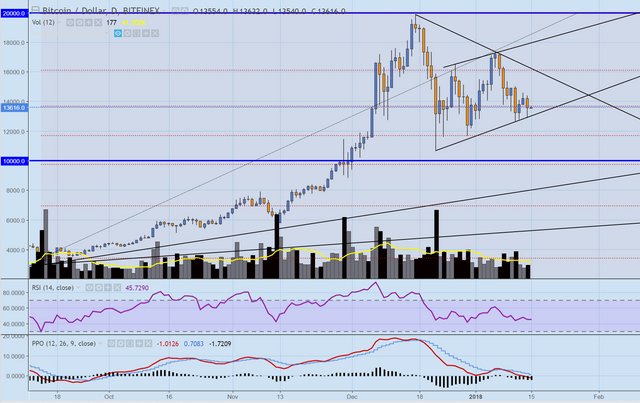

After a Christmas sell-off, the price has been moving within the 12000$ and 17000$ range, not considering the wicks going as low as 10500$. After a somewhat climatic selling on December 22, with 178K bitcoins sold on Bitfinex, the volume has been decreasing with each subsequent low being higher and each subsequent high being lower than the previous one.

From December 22, RSI is also indicating a balance of buyers and sellers. In yet more support of the ranged market is the entrance of the price within the Ichimoku cloud. While the cloud itself suggests a continued uptrend, the decreasing line on PPO shows the buyers momentum is gone, which last happened during September (China banning BTC exchanges and ICOs) and July. In fact, it is currently right at 0, and who steps in and takes control - buyers or sellers - remains unknown. If history repeats itself, I would expect more selling for the next few days.

If we look at the chart patterns, then a case can be made for a symmetrical triangle, albeit not a very useful case as those tend to follow the market trend which is currently unknown. The second case can be made for a rising channel, or a flag, which shaped a flag pole on high volume as the price plummeted in December and is continuing its formation on decreasing volume. It is generally a bearish sign resulting in a downward movement. This can only be confirmed, however, if the lower resistance line of the flag breaks on higher than preceding it volume. Overall, I take these conflicting observations as another sign of a ranged market.

Bearish case

Now, what if BTC decides to go down? I would expect there to be a catalyst for it of some sort for the following scenario to play out. I see more and more people estimating that BTC may touch 8000 or even 6000$ some time this year. These estimations are, of course, not random and are likely based on a similar analysis of mine. If we take a trend-based Fib extension of the Christmas sell-off, then, following an AB=CD pattern, it takes us down to the level of 8000-9000$. In case of a stronger catalyst (Japan, the Bitcoin haven, suddenly making a 180 on it?) we may see an extended CD leg all the way down to 5000$ or, in the most extreme case, 2500$. The 7000-9000$ range also overlaps with the .61 and .78 Fib retracement levels (as measured from the middle of July, 2017), giving more credibility to these levels as possible support lines.

Most likely, if the pattern plays out, BTC will touch one of those levels with a wick and rebound quickly. This may provide 3 targets for those leaving orders at extremely low buy prices hoping for momentary dips/crashes.

Bullish case

A move upwards is even more speculative. My estimation is based on the following. December 15th was the end of the 5th, highly extended, Elliott wave that started on November, 11th. The major sell-off of December 22 marked the first point of an ABC retracement. I speculate that the end of that retracement will be the same or similar low of A assuming that A and B seem to be shaping a flat 3-3-5 formation. In that case, I can use point A to estimate the upward move which results into the following three targets of 24000$, 28000$ and 33000$, depending on how strong and excited buyers will be. One of these levels may shape the next point of profit-taking and another ABC retracement like the one hypothesized here.

What does it mean for ALTs?

In December, the market showed a continued exuberance following the gains on BTC in the previous months. BTC only needed to cool off a little to let ALTs run. Later, when it became evident that BTC did not just cool off but entered a choppy market, investors seemed to become more careful. Overall, an indecisive market for BTC does not bode well for ALTs.

Since there is no evidence ALTs managed to free themselves from BTC dependence, the next big move in BTC, either upwards or downwards, will most likely result in depreciation of ALTs against it and, on a smaller scale, against fiat. Personally, I am very careful taking positions in ALTs against BTC. Long-term, however, and as long as fiat value is concerned, ALTs are positioned well, especially the bigger, better-known and established names in the top 20-30 on CoinMarketCap.

Conclusion

If you are a fundamental investor, you may have noticed I am missing any fundamental analysis here. Please share if you know something I don't in the comments. If you are a professional or experienced chartist, I would like to hear your thoughts on my analysis and point out any weaknesses or misinterpretations of what I see.

Thank you for reading and commenting.

Disclaimer

This is neither financial advice nor a forecast. This post is my personal opinion, is for informational purposes only and is of speculative nature. Do not invest more than you can afford to lose. Do not invest at all when in doubt.

This post has received a 1.88 % upvote from @booster thanks to: @humbledumbell.

You got a 0.49% upvote from @upme requested by: @humbledumbell.

Send at least 2.5 SBD to @upme with a post link in the memo field to receive upvote next round.

To support our activity, please vote for my master @suggeelson, as a STEEM Witness

You got a 1.42% upvote from @postpromoter courtesy of @humbledumbell! Want to promote your posts too? Check out the Steem Bot Tracker website for more info. If you would like to support development of @postpromoter and the bot tracker please vote for @yabapmatt for witness!

Thank you @humbledumbell for making a transfer to me for an upvote of 1.21% on this post! Half of your bid goes to @budgets which funds growth projects for Steem like our top 25 posts on Steem! The other half helps holders of Steem power earn about 60% APR on a delegation to me! For help, will you please visit https://jerrybanfield.com/contact/ because I check my discord server daily? To learn more about Steem, will you please use http://steem.guide/ because this URL forwards to my most recently updated complete Steem tutorial?

This post has received gratitude of 0.78 % from @appreciator thanks to: @humbledumbell.