Changes in the bitcoin world: Lower fees, hash prices and the outlook for mining

The era of huge commissions in the bitcoin network is gradually coming to an end. Only a couple days ago, the average transaction fee on the bitcoin blockchain reached $260.

After the peak of commissions, miners have seen a sharp decline in hashrate prices, falling from $114 per petahesh on Sunday to $79 per petahesh by Tuesday. While the network's hashrate has dropped slightly, it's not that significant.

Bitcoin miners now receive fewer dollars per mined block compared to the week before the halving. According to Luxor's hashrateindex.com, the hash price remained above $105 per petahesh per day for the week before the 840,000 block. Four days before the halving, on April 15, the hash price was $108 per petahesh.

During a period of historically high collections on April 20, the hash price reached $182 per petahesh. However, it fell to $114 by the end of the next day and continues to decline, sitting just above $79, a drop of 30%. On Sunday, miners were receiving an average of 5.105 BTC per block, but that amount has now decreased.

As of today, April 23, 2024, the hash price is hovering around $79 per petahesh after a low of $74 per petahesh. Between blocks 840,179 and 840,417, miners have collected an average of 4.95 BTC per block.

The decrease in hash price and slight drop in hash rate does not affect the resilience of the bitcoin network. This is a test of efficiency and resilience for miners, who are forced to adapt to lower revenues and optimize operations.

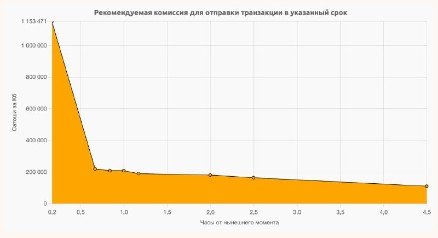

For regular users, it means that commissions may soon return to normal levels. Currently, the average transaction fee is around $43.83.

Most users are willing to wait a few hours, paying $5 instead of $70 for a rush shipment. Bitcoin doesn't need super speed or fixed low fees. It operates on the principle of democracy, where self-regulation mechanisms work like transportation logistics: those who need speed pay more, and the rest can wait but pay less.