Robert Kiyosaki and Bitcoin: Anticipating Growth and Investment Potential

The author of Rich Dad, Poor Dad, Robert Kiyosaki, has expressed alarm about investing in gold, silver and oil, while emphasizing that there is no problem with bitcoin. He usually displays increased alarmism towards the US dollar, but this time he drew attention to new problems within the system outside of the dollar.

"Rich Dad, Poor Dad," co-written with Sharon Lechter in 1997, has been a New York Times bestseller for more than six years. The book has been translated into more than 51 languages and released in more than 109 countries, totaling more than 32 million copies.

Kiyosaki shared on his X account his love for gold, silver and oil and his ownership of gold, silver mines and oil wells. However, he emphasized that the problem with these commodities is that "the higher the prices go, the more they are found."

Kiyosaki noted that the situation is different with bitcoin, as regardless of the increase in its price, there will always be only 21 million coins. "That's why I prefer bitcoin," he emphasized.

The recent spike in the bitcoin price, driven by massive demand for bitcoin-ETFs, has emphasized the limited supply of bitcoin. Currently, miners are only mining about 900 new BTC daily, and that supply will be cut in half after the halving in April. While nine new spot bitcoin-ETFs are rapidly accumulating bitcoins, far exceeding daily mining capacity.

Many expect the bitcoin price to rise significantly due to supply and demand dynamics. Bernstein analysts are now more confident that the price of BTC will reach $150,000 by mid-2025.

Scott Melker, also known as "The Wolf of All Streets," sees the beginning of a major rise in bitcoin and the crypto market as a whole. Galaxy Digital's CEO, Mike Novogratz, echoes this view, emphasizing the "unbridled momentum" in spot bitcoin ETFs.

Bitwise's Matt Hougan foresees a potential rise above $200,000 this year, citing "too much demand and not enough supply." Hougan expects a "season of everything." Even billionaire investor Mark Cuban recognizes bitcoin's scarcity as a key factor in its value proposition.

Kiyosaki, a passionate bitcoin maximalist, has consistently made bold predictions about BTC prices. Last week, he stated that bitcoin is "on fire" and heading towards the $300,000 mark.

He urges investors to act quickly, noting that even a $500 investment could be a good start. He previously predicted a price of $100,000 by June, viewing any dips as buying opportunities.

El Salvador's president, Naib Bukele, an even more ardent bitcoin maximalist, announced that El Salvador has been buying one bitcoin every day since November 18, 2021, and has no intention of stopping the practice until bitcoin is no longer available for purchase with fiat money.

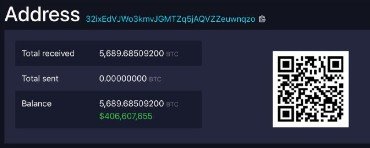

To prove his openness, Bukele published the address of the El Salvador cold wallet. He thinks it's a good strategy to buy one BTC every day after breakfast, regardless of the price. In time, most of the world will probably regret not taking advantage of this opportunity.

Translated with DeepL.com (free version)